Utah Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

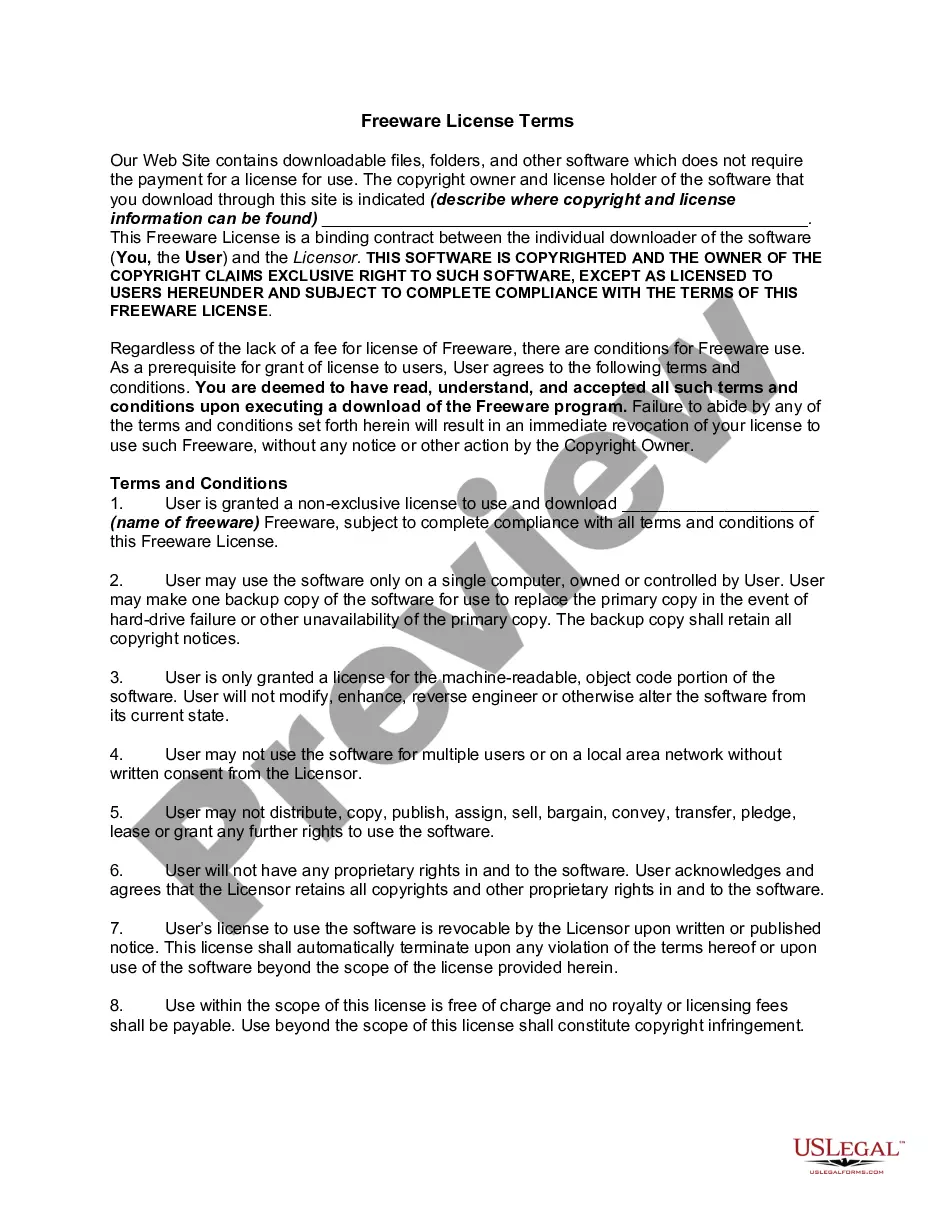

US Legal Forms - one of the largest collections of legitimate documents in America - offers a vast selection of legal record templates that you can either download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current forms like the Utah Startup Costs Worksheet in moments.

If you already have a membership, Log In and download the Utah Startup Costs Worksheet from the US Legal Forms library. The Download button will appear for every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Fill out, modify, and print and sign the downloaded Utah Startup Costs Worksheet.

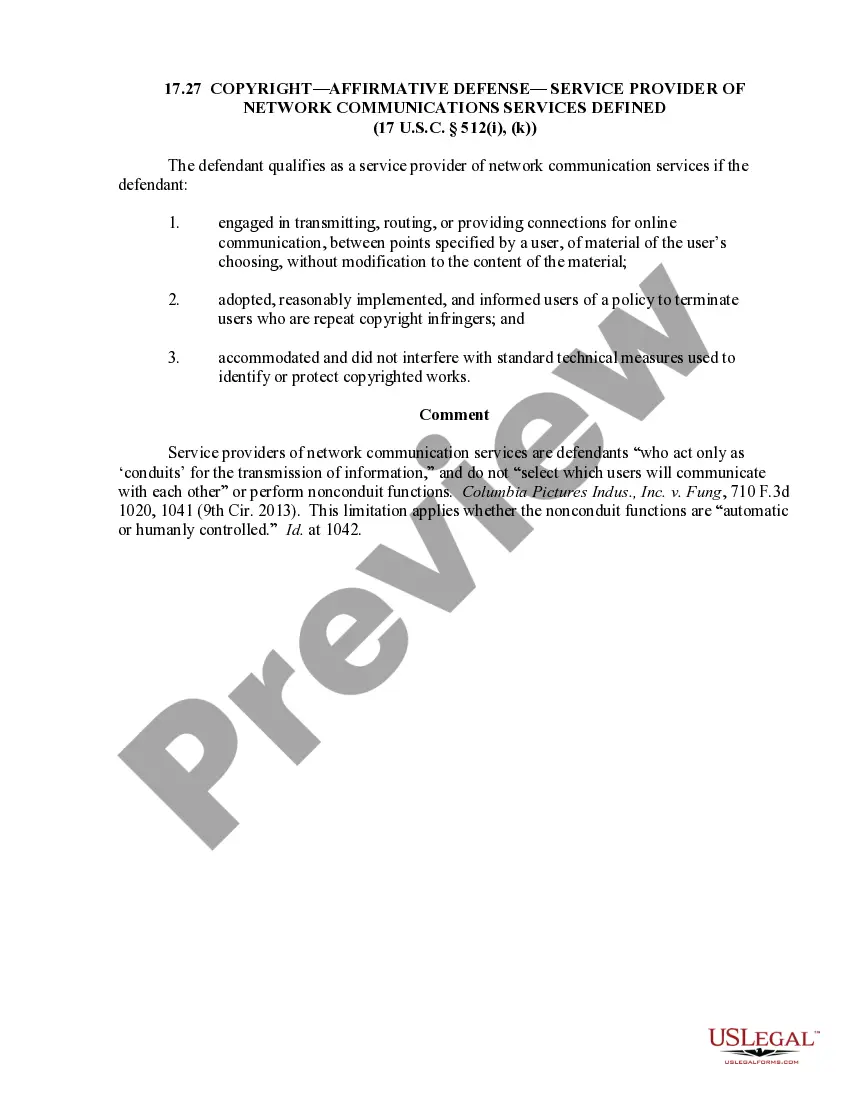

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview button to review the form's content.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

For those companies reporting under US GAAP, Financial Accounting Standards Codification 720 states that start up/organization costs should be expensed as incurred.

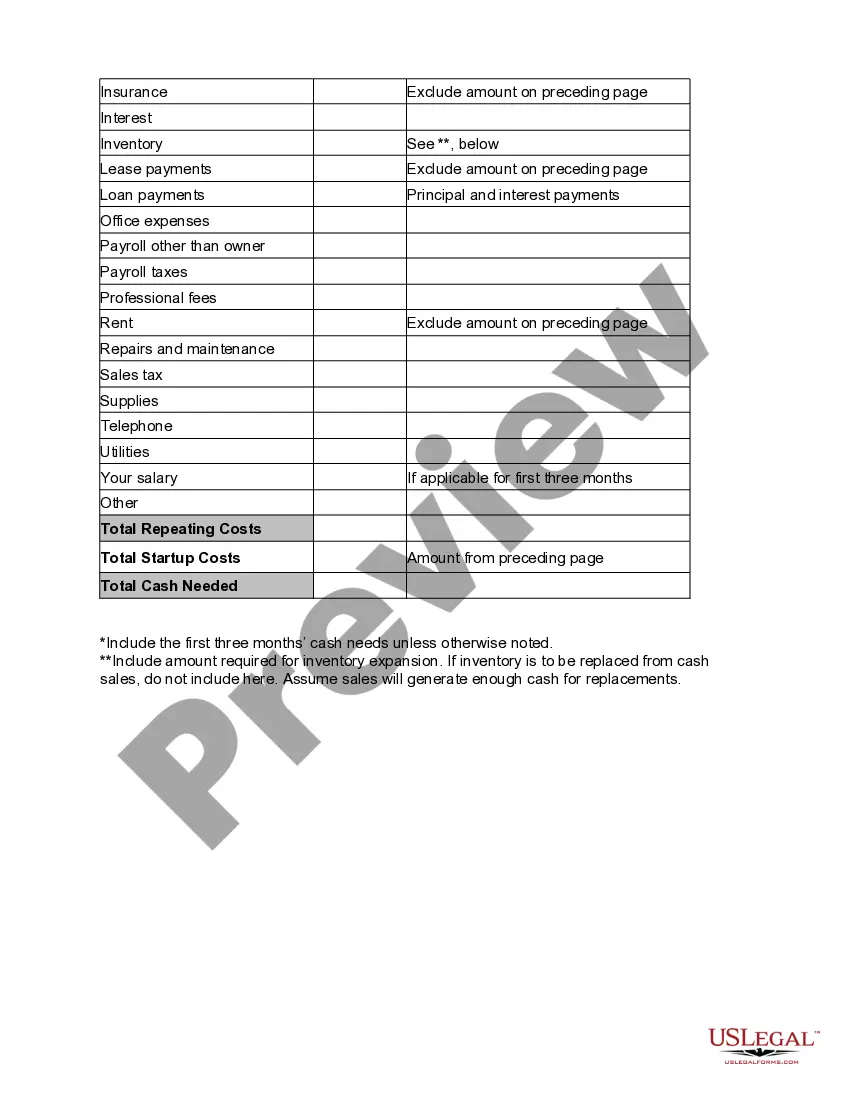

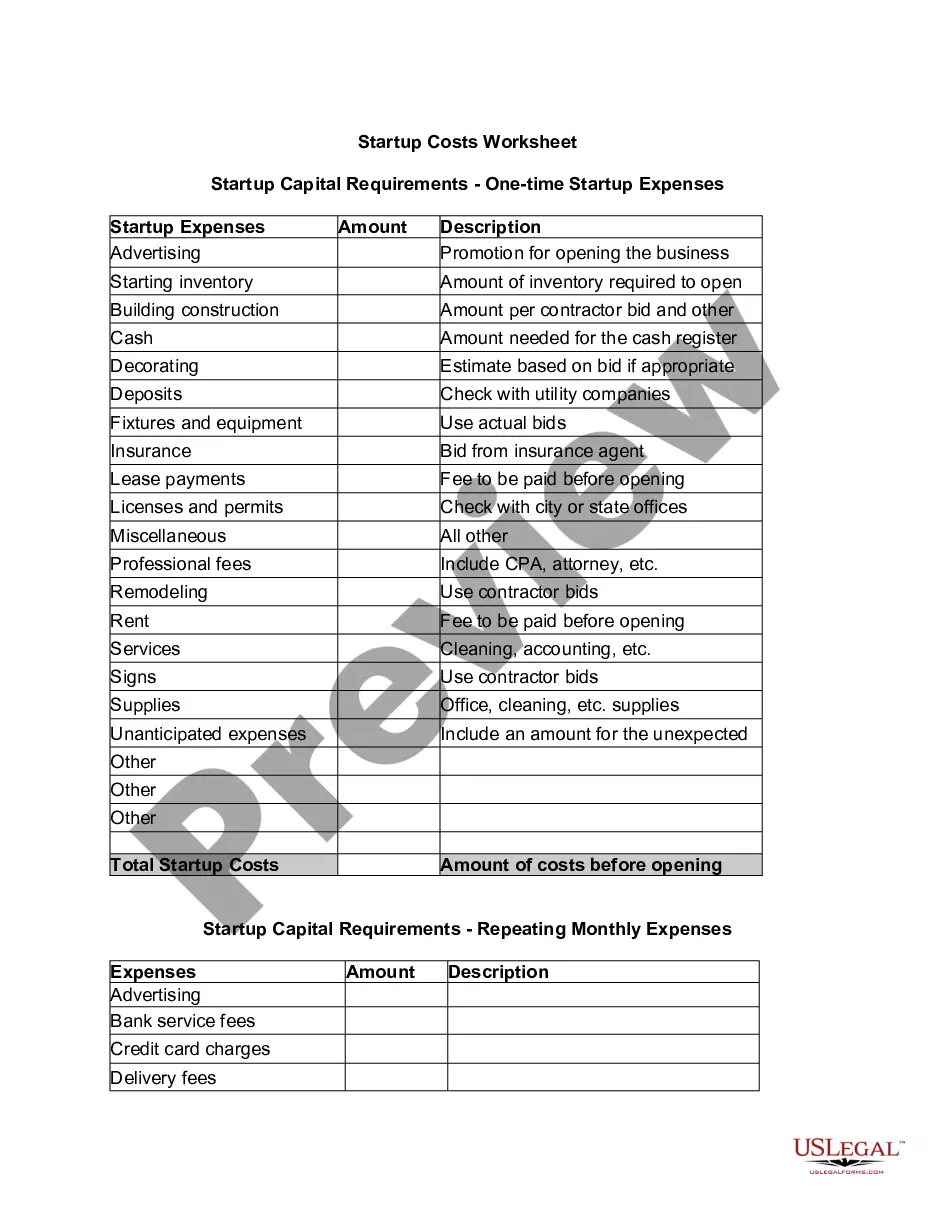

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

Under GAAP, you report organizational or startup costs as an expense when you incur them. If you spend $5,000 on employee training prior to opening, you'd record $5,000 as a startup expense and reduce your cash account by $5,000. When you make out your taxes, the accounting for startup costs is more complicated.

Essentially, the accounting for startup activities is to expense them as incurred. While the guidance is simple enough, the key issue is not to assume that other costs similar to start-up costs should be treated in the same way.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

You can either deduct or amortize start-up expenses once your business begins rather than filing business taxes with no income. If you were actively engaged in your trade or business but didn't receive income, then you should file and claim your expenses.

The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

Start-up expenses are the costs of getting your business up and running. These include buying or leasing space, marketing costs, equipment, licenses, salaries, and the cost of servicing loans. Start-up assets are items of value, such as cash on hand, equipment, land, buildings, inventory, etc.

How much can I deduct? If you spent less than $50,000 total on your business start-up costs, you can deduct $5,000 of those costs immediately, in the year that your business starts operating. Same thing goes for your total organizational costs.