Utah Termination of Trust by Trustee refers to the legal process by which a trustee concludes or terminates a trust in the state of Utah. This process entails a series of actions that allows the trustee to close a trust either due to completion of its goals, meeting certain conditions, or as a result of the granter's explicit instructions. In Utah, there are different types of termination of trusts that trustees can pursue, including: 1. Termination upon Trust Purpose Completion: In cases where the trust's objectives have been fulfilled or are no longer feasible, the trustee can initiate the termination process. This could happen when the trust's purpose, such as providing financial support for education, has been achieved, or when ongoing management becomes unnecessary. 2. Termination by Consent of all Beneficiaries: Trustees may terminate a trust if all beneficiaries, both current and future, provide their consent. This often occurs when beneficiaries unanimously agree that the trust no longer serves their best interests or when circumstances have significantly changed since the trust's creation. 3. Termination by Court Order: The trustee can seek court approval to terminate a trust in situations where it becomes impossible, partially or entirely, to achieve the trust's purpose or when the trust no longer serves its intended function due to change in circumstances, such as a substantial change in tax laws. 4. Termination due to Trust Property Depletion: When the trust's assets have been depleted to an extent that continuing the trust becomes impractical or uneconomical, the trustee can initiate the termination process. However, before taking this step, the trustee must ensure that all beneficiaries' interests and rights have been appropriately fulfilled. 5. Termination through Trust Agreement Provision: Some trusts may include specific provisions that allow trustees to terminate the trust under certain circumstances. Trustees can use such provisions to dissolve the trust in accordance with the granter's intent and the agreement's terms. In order to facilitate the Utah Termination of Trust by Trustee, it is crucial for the trustee to carefully follow the provisions set forth by the Utah Uniform Trust Code, seek legal counsel to ensure compliance with all legal requirements, and act in the best interests of the trust and all beneficiaries involved. Successful termination of a trust involves meticulous documentation, distribution of remaining assets, and closing all administrative matters associated with the trust.

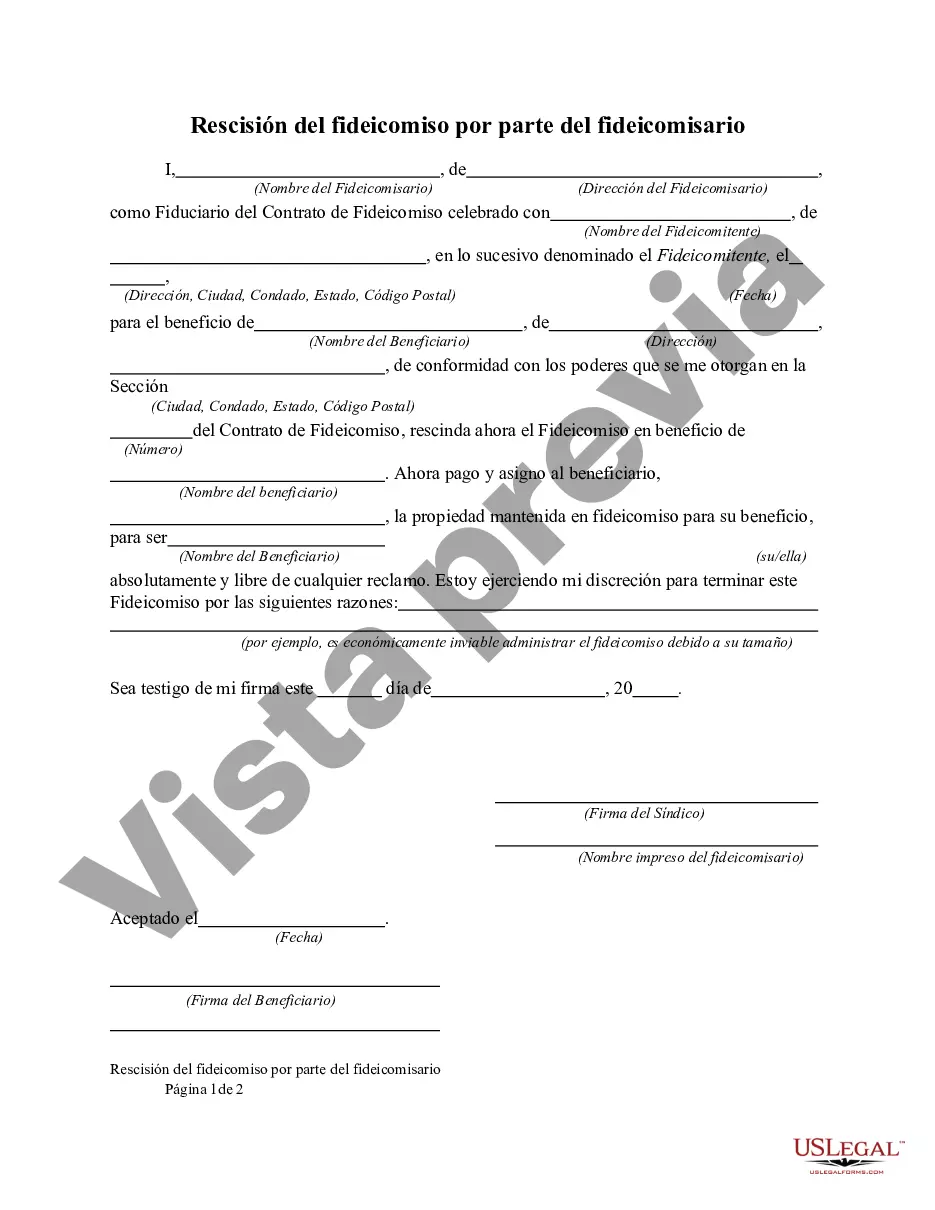

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Rescisión del fideicomiso por parte del fideicomisario - Termination of Trust by Trustee

Description

How to fill out Utah Rescisión Del Fideicomiso Por Parte Del Fideicomisario?

If you have to complete, obtain, or print out legitimate file templates, use US Legal Forms, the largest assortment of legitimate forms, which can be found on the web. Use the site`s easy and hassle-free lookup to obtain the papers you will need. Numerous templates for organization and person purposes are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the Utah Termination of Trust by Trustee within a number of click throughs.

When you are currently a US Legal Forms customer, log in to the bank account and click on the Obtain button to have the Utah Termination of Trust by Trustee. You can even accessibility forms you previously downloaded within the My Forms tab of your bank account.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the correct city/country.

- Step 2. Use the Review choice to look through the form`s content. Don`t forget to learn the explanation.

- Step 3. When you are unhappy with all the form, take advantage of the Research area on top of the display screen to discover other types of the legitimate form template.

- Step 4. After you have discovered the shape you will need, click on the Acquire now button. Opt for the pricing program you prefer and add your credentials to register for an bank account.

- Step 5. Process the transaction. You should use your bank card or PayPal bank account to finish the transaction.

- Step 6. Pick the formatting of the legitimate form and obtain it in your device.

- Step 7. Full, revise and print out or indicator the Utah Termination of Trust by Trustee.

Each legitimate file template you purchase is the one you have eternally. You might have acces to each and every form you downloaded with your acccount. Click on the My Forms section and decide on a form to print out or obtain once more.

Be competitive and obtain, and print out the Utah Termination of Trust by Trustee with US Legal Forms. There are millions of skilled and state-certain forms you can utilize for the organization or person requires.

Form popularity

FAQ

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Further, a trust will be considered as terminated when all the assets have been distributed except for a reasonable amount which is set aside in good faith for the payment of unascertained or contingent liabilities and expenses (not including a claim by a beneficiary in the capacity of beneficiary).

A trust can be terminated for the following reasons: The trust assets have been fully distributed, making it uneconomical to continue with the trust. The money remaining in the trust makes it uneconomical to continue with the trust. The trust has served its purpose in terms of its stated objective.

The trustee will be required to give notice to beneficiaries and distribute the trust assets in a manner consistent with the purposes of the trust. An irrevocable trust can also be terminated with the consent of the settlor and all beneficiaries.

When Trust Fund Distributions to Beneficiaries Are Made Even a simple trust may require 12-18 months before they can end trust administration and transfer of trust property to beneficiaries, although it can take several years if the trust is complex.

In our experience, many Trustees fail to understand that Trust distributions must be made timely. In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. But that presumes there are no problems, such as a lawsuit or inheritance fights.

How a trust can be dissolved will depend on the trust in question. Some trusts will be terminated by the occurrence of a particular event (for example, on the death of a beneficiary or when they come of age) whereas others will be terminated by the actions of the trustees or beneficiaries.

A trust can also be terminated if it involves illegal conduct or if it cannot operate properly as a trust due to its small size. Additionally, beneficiaries can only terminate a trust if they are all in agreement. Unless specified in the trust, trustees are never allowed to terminate a trust.

Ways a Trust Can EndIf the trust property was cash or stocks, this can happen when all of the money, plus interest, gets paid to beneficiary. If the property was some other asset, like a house, then the trust may end when the house is destroyed or the trust itself comes to an end.