Establishing a Qualified Personal Residence Trust (QPRT) involves transferring the residence to a trust that names the persons who are to receive the residence at the end of the stated term, usually a child or children of the donor. The donor is the tr A Utah Qualified Personnel Residence Trust (PRT) is a legal tool designed to help individuals protect their primary residences from estate taxes while still being able to live in and enjoy the property. It is a popular estate planning strategy used in Utah and follows the guidelines set by the Internal Revenue Code Section 2702. A PRT essentially allows homeowners to transfer their primary residences, typically their main homes, into an irrevocable trust while retaining the right to live in the property for a specific period of time, usually a term of years. By doing so, the homeowner can effectively remove the property from their taxable estate, potentially reducing estate taxes. The main objective of a Utah PRT is to reduce estate taxes by taking advantage of the current value of the property and any subsequent appreciation that occurs during the trust term. This can provide significant tax savings for individuals with valuable homes and sizable estates. It is important to note that there are no specific types of Utah Parts mentioned; however, different variations of this trust can be structured to suit an individual's unique needs and circumstances. Some variations may involve factors such as the length of the trust term or the transfer of fractional interests in the property to other beneficiaries. Utah Parts may be particularly beneficial for individuals who have a significant amount of wealth tied up in their primary residence and want to pass it on to their heirs without subjecting it to hefty estate taxes. While estate taxes can vary, utilizing a PRT can allow homeowners to transfer their property to beneficiaries while minimizing the tax burden. Overall, a Utah PRT offers individuals the ability to protect their primary residences, enjoy the benefits of homeownership, and potentially reduce their taxable estate. Consulting with an experienced estate planning attorney is highly recommended ensuring the trust is properly established and to determine the best strategy based on individual circumstances.

A Utah Qualified Personnel Residence Trust (PRT) is a legal tool designed to help individuals protect their primary residences from estate taxes while still being able to live in and enjoy the property. It is a popular estate planning strategy used in Utah and follows the guidelines set by the Internal Revenue Code Section 2702. A PRT essentially allows homeowners to transfer their primary residences, typically their main homes, into an irrevocable trust while retaining the right to live in the property for a specific period of time, usually a term of years. By doing so, the homeowner can effectively remove the property from their taxable estate, potentially reducing estate taxes. The main objective of a Utah PRT is to reduce estate taxes by taking advantage of the current value of the property and any subsequent appreciation that occurs during the trust term. This can provide significant tax savings for individuals with valuable homes and sizable estates. It is important to note that there are no specific types of Utah Parts mentioned; however, different variations of this trust can be structured to suit an individual's unique needs and circumstances. Some variations may involve factors such as the length of the trust term or the transfer of fractional interests in the property to other beneficiaries. Utah Parts may be particularly beneficial for individuals who have a significant amount of wealth tied up in their primary residence and want to pass it on to their heirs without subjecting it to hefty estate taxes. While estate taxes can vary, utilizing a PRT can allow homeowners to transfer their property to beneficiaries while minimizing the tax burden. Overall, a Utah PRT offers individuals the ability to protect their primary residences, enjoy the benefits of homeownership, and potentially reduce their taxable estate. Consulting with an experienced estate planning attorney is highly recommended ensuring the trust is properly established and to determine the best strategy based on individual circumstances.

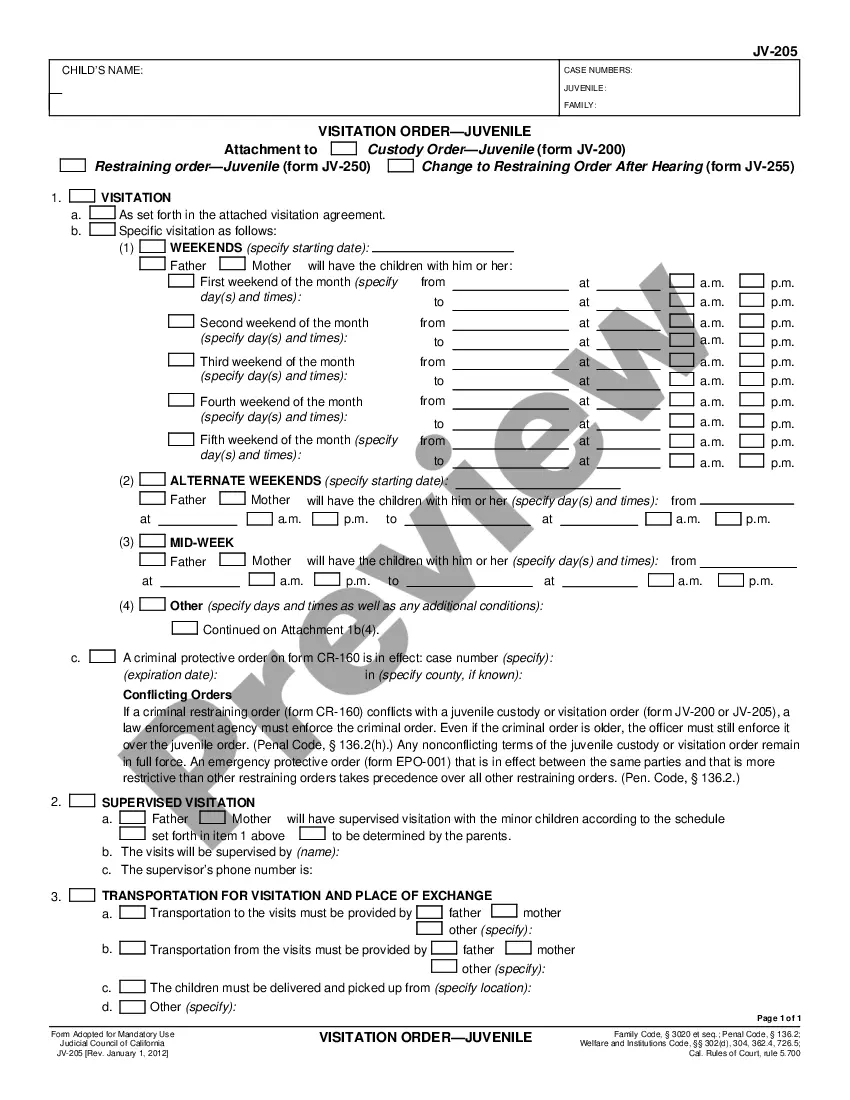

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.