Utah Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

Selecting the optimal legal document template can be a challenge. Naturally, there is a multitude of styles accessible online, but how can you acquire the legal form you require.

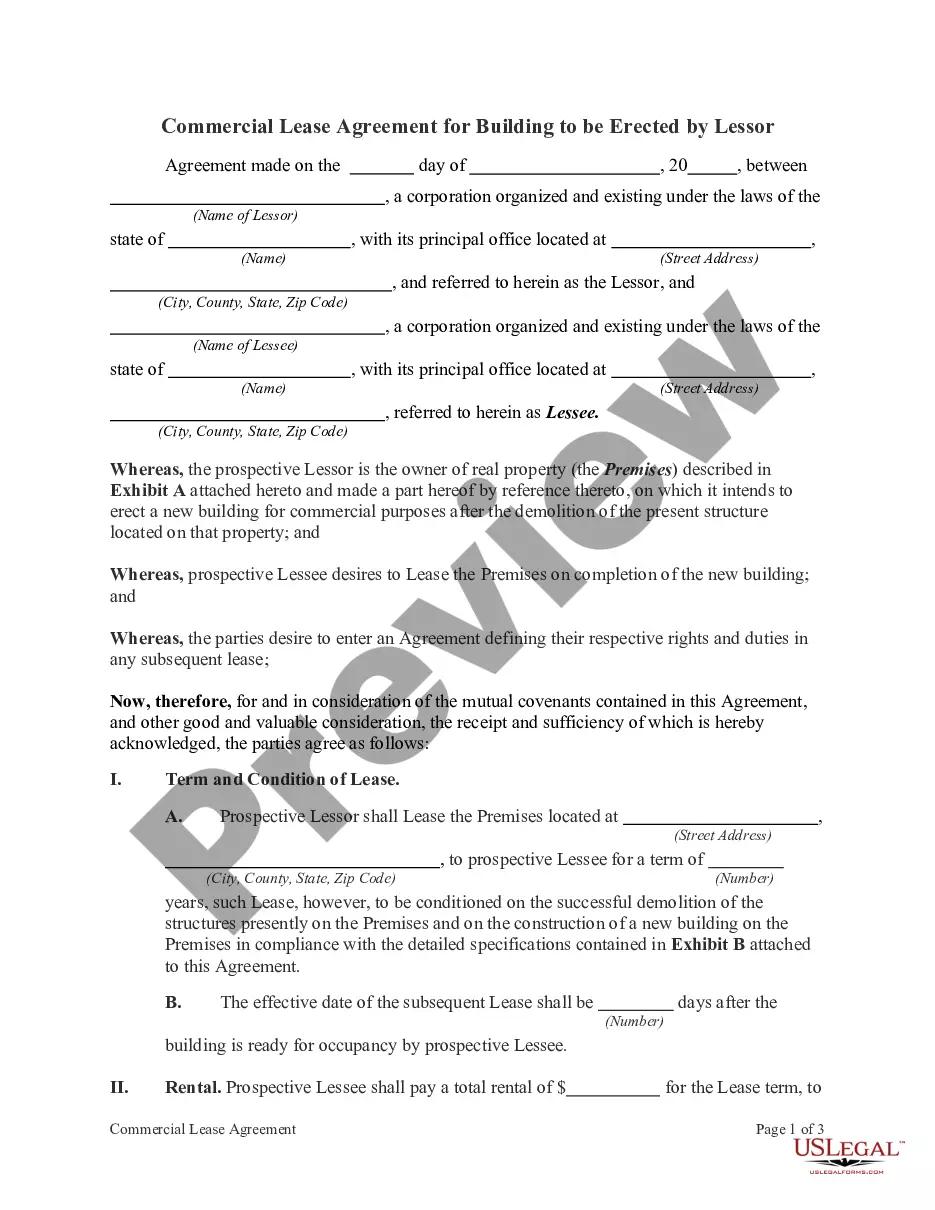

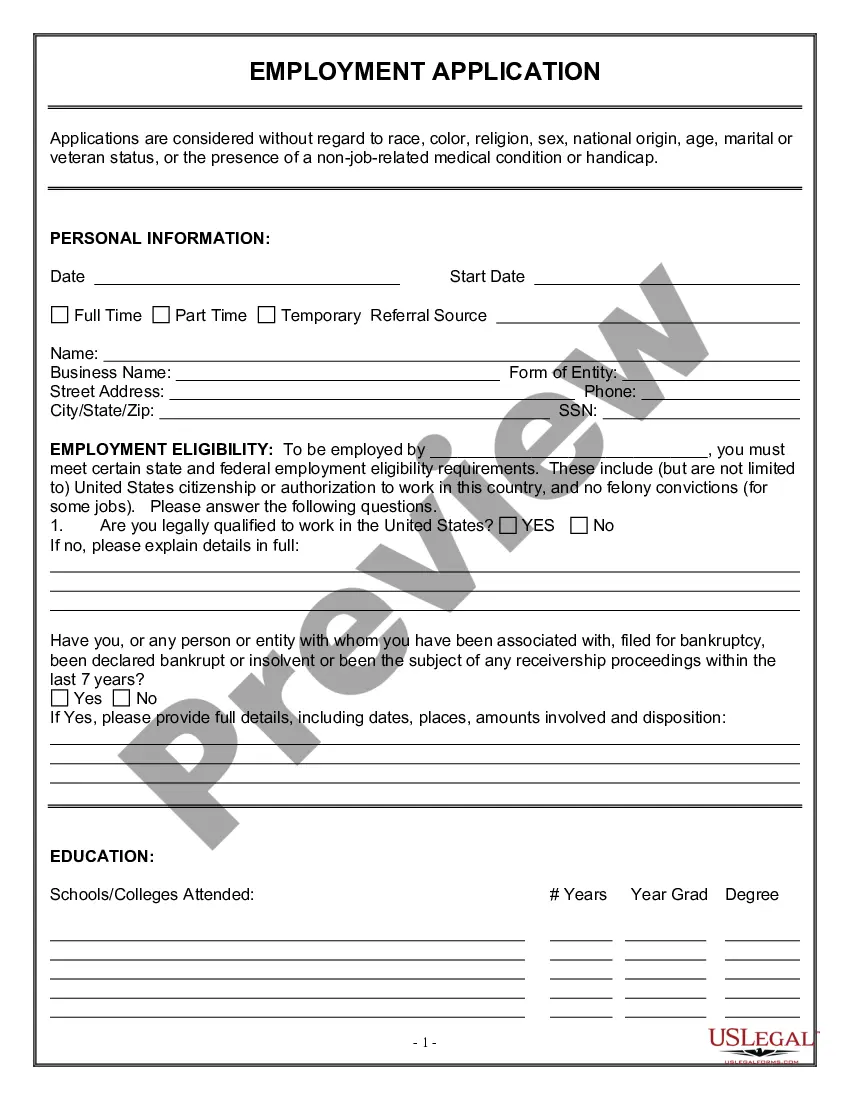

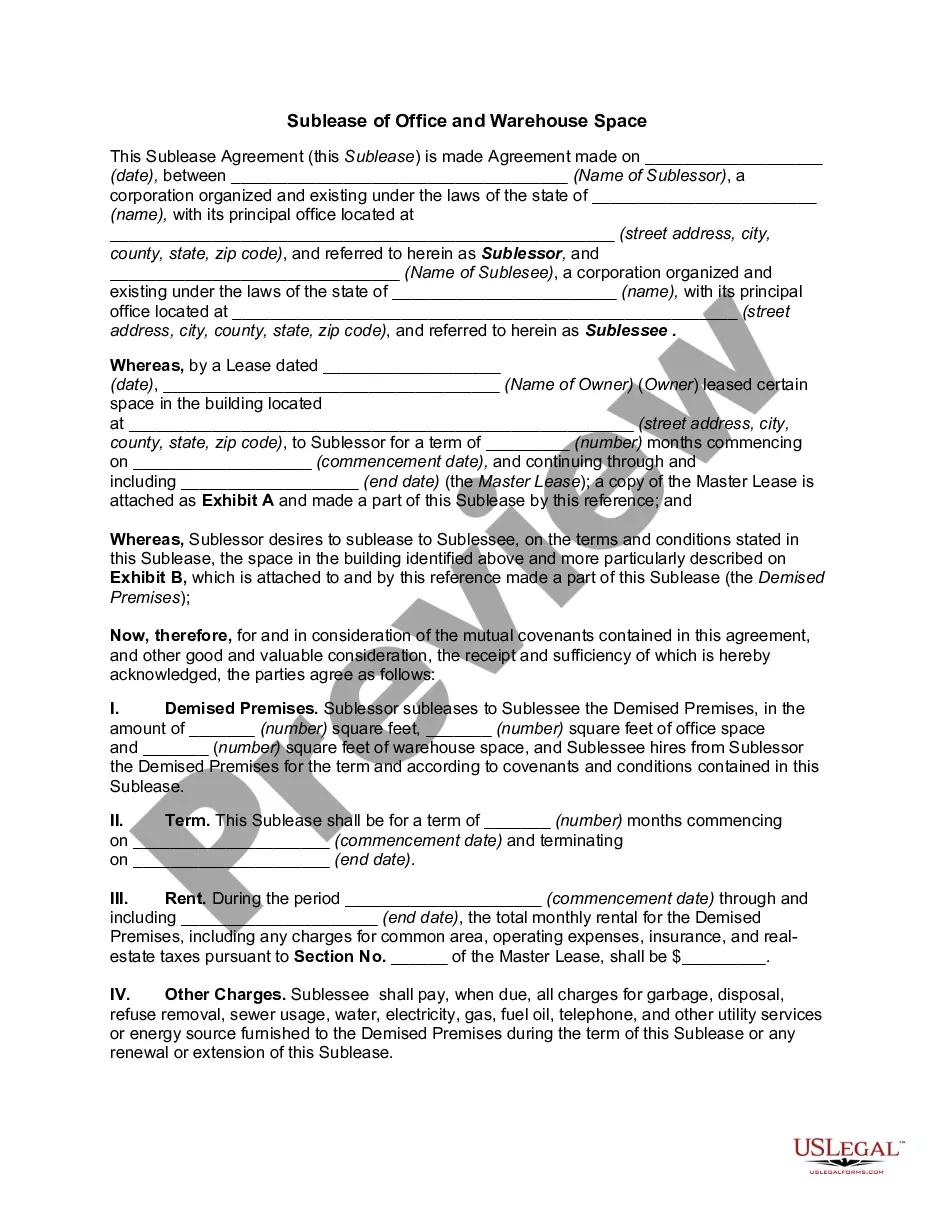

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Utah Joint Trust with Income Payable to Trustors During Joint Lives, suitable for both business and personal use. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Download button to access the Utah Joint Trust with Income Payable to Trustors During Joint Lives. Use your account to search for the legal forms you have previously acquired. Navigate to the My documents tab in your account to retrieve another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can explore various document templates. Take advantage of the service to acquire professionally crafted documents that meet state requirements.

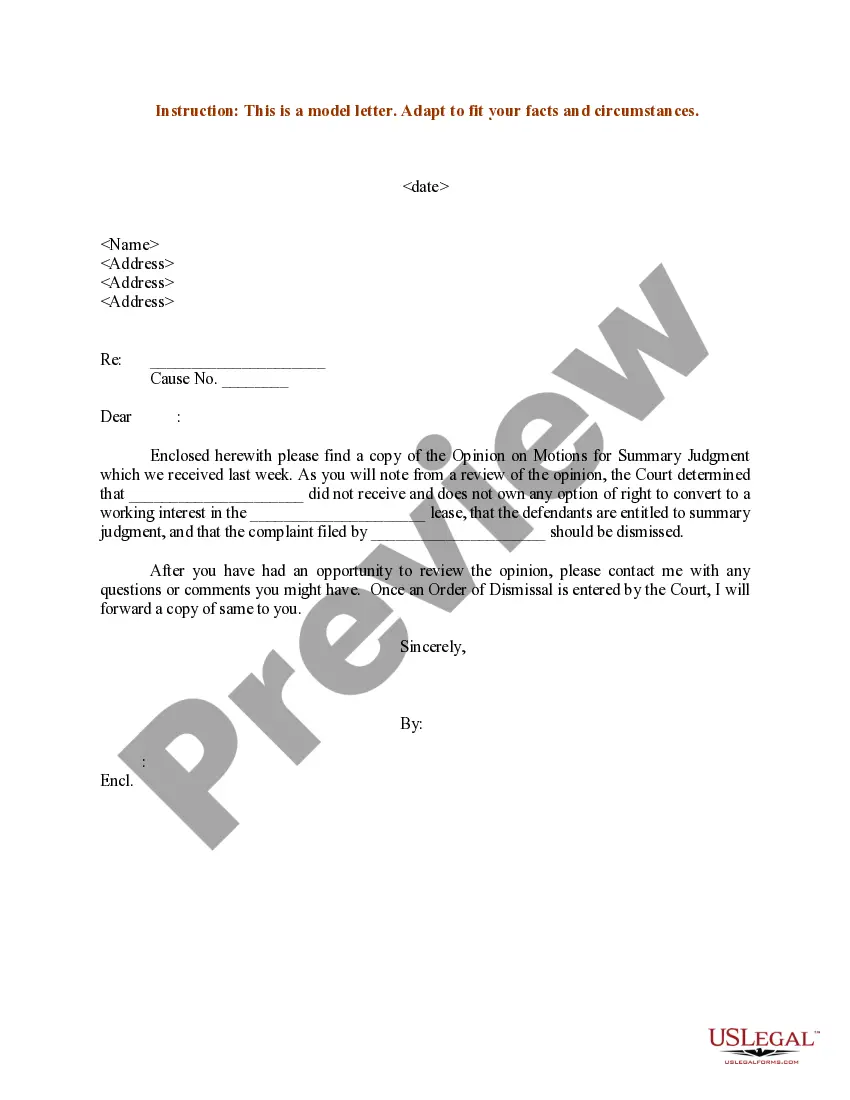

- First, ensure you have selected the appropriate form for your area/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is appropriate, click the Get now button to obtain the form.

- Choose the pricing plan you prefer and input the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Utah Joint Trust with Income Payable to Trustors During Joint Lives.

Form popularity

FAQ

In Utah, anyone who meets certain income thresholds must file a tax return, regardless of age or marital status. This includes individuals managing income distributions through a Utah Joint Trust with Income Payable to Trustors During Joint Lives. To protect yourself and ensure compliance, take the time to review the filing requirements for trusts and individual incomes closely.

Yes, Utah does impose underpayment penalties if taxpayers do not meet estimated tax payment requirements. For those managing a Utah Joint Trust with Income Payable to Trustors During Joint Lives, it is vital to ensure that estimated taxes are calculated accurately. Making timely estimated payments helps avoid penalties and keeps your trust finances on track.

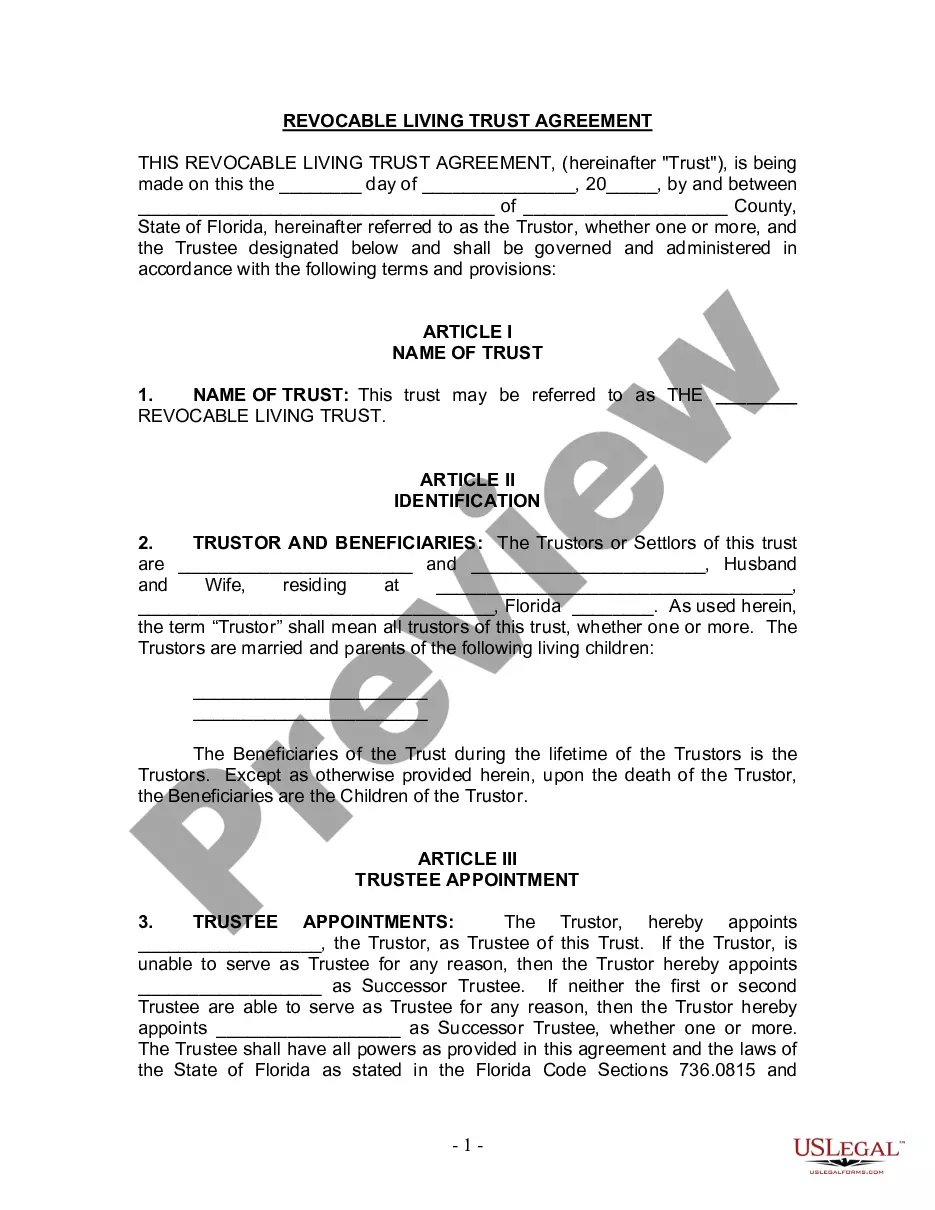

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Disadvantages of a Family Trust You must prepare and submit legal documents, which the court charges a fee to process. The second financial disadvantage of a family trust is the lack of tax benefits, especially when it comes to filing income taxes. When the grantor dies, the trust must file a federal tax return.

A family trust structure can protect your family's wealth from creditors. Usually, when a person owes money and cannot meet the repayment requirements, the creditor can access the person's personal asset to recoup the debt payable. Personal assets include your home, car, and other property a person owns in their name.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

Lawyers often use hourly fee schedules, and the price associated with creating a living trust is generally at least $1,000.

The trust can state that they have the authority to act independently, but if it doesn't state, then the default standard is that they have to make all decisions together.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

You live in your house and use your assets as you normally would without restriction. After your death, all the assets are already in the trust and the successor trustee steps in and continues managing them. The trustee then distributes the assets to your beneficiaries according to your instructions.