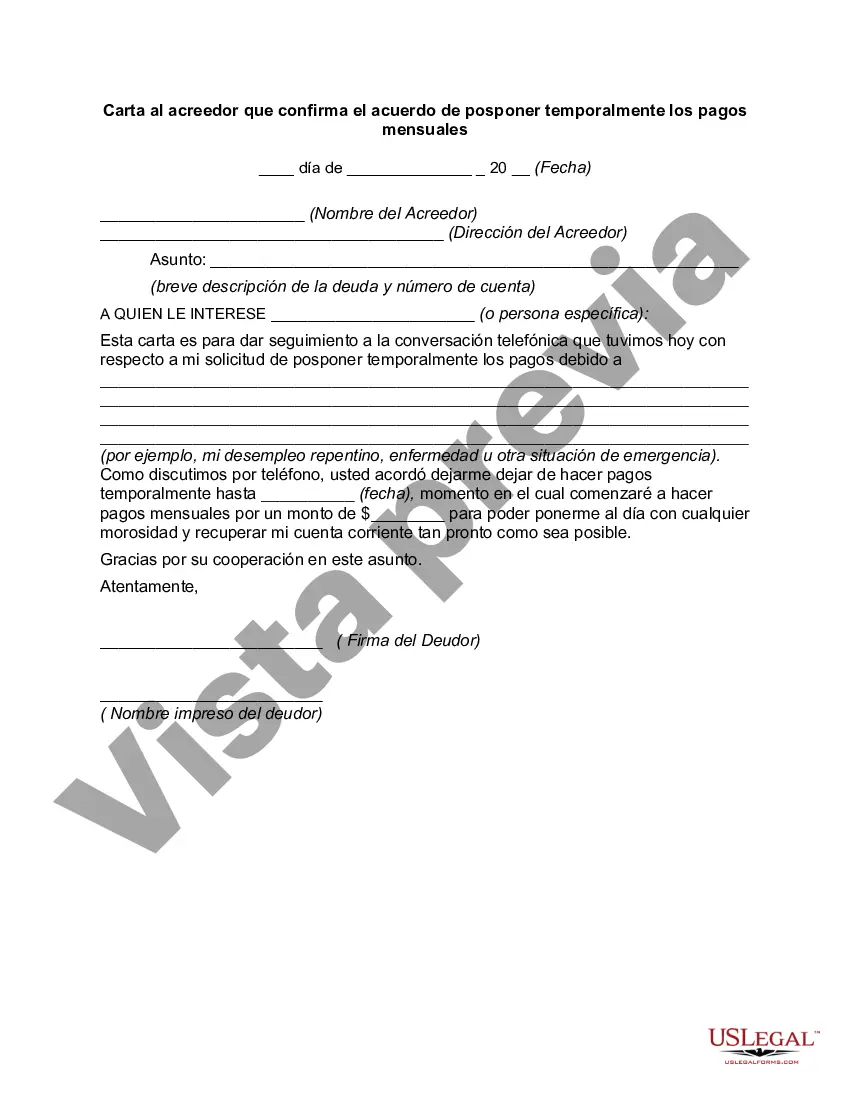

Title: Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments: A Detailed Description Introduction: In the state of Utah, individuals facing financial difficulties may need to seek temporary relief from their monthly payment obligations. To formalize this arrangement, a Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments can be drafted. This letter serves as a legally binding document outlining the agreement between the debtor and creditor. Below, we will dive into the key components, benefits, and types of such letters. Key Components of a Utah Letter to Creditor Confirming Agreement: 1. Heading: The letter should include the date, debtor's name, creditor's information, and a unique identifying reference number (if applicable). 2. Salutation: A courteous greeting indicating the recipient's name. 3. Introduction: A clear and concise statement explaining the purpose of the letter — to confirm the agreement for temporarily postponing monthly payments. 4. Background: A brief outline of the financial difficulties that led to the need for temporary relief. 5. Request for Temporary Postponement: A detailed request for the creditor to agree to suspend or postpone the monthly payments for a specific time frame. 6. Proposed Payment Plan: If relevant, the debtor can propose an alternative plan for repaying the deferred payments, such as increased monthly payments after the temporary postponement period ends. 7. Legal Considerations: Include a statement clarifying that the agreement does not waive the debtor's obligation to repay the debt, nor does it relieve the debtor from paying any interest or fees accrued during the postponement period. 8. Signature and Date: The debtor's signature, printed name, and date should be included to validate the agreement. Benefits of a Utah Letter to Creditor Confirming Agreement: 1. Legally Binding: By documenting the agreement in writing, both parties are protected legally, ensuring clarity and preventing any potential misunderstandings. 2. Relief for Debtors: Temporary postponement of monthly payments can provide much-needed breathing room for individuals facing financial hardship, allowing them to focus on stabilizing their situation. 3. Cooperation and Communication: The letter encourages open dialogue between the debtor and creditor, fostering a cooperative relationship during a challenging time. 4. Credit Score Protection: Formalized agreement can shield the debtor's credit score from negative effects due to non-payment during the temporary postponement period. Types of Utah Letters to Creditor Confirming Agreement: 1. Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Mortgage Payments: Specifically tailored for individuals seeking temporary relief from mortgage payments. 2. Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Auto Loan Payments: Geared towards individuals who need temporary respite from auto loan monthly installments. 3. Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Credit Card Payments: Designed for individuals looking to suspend credit card payments temporarily. Conclusion: A Utah Letter to Creditor Confirming Agreement to Temporarily Postpone Monthly Payments is an essential document for individuals experiencing financial hardship in Utah. By clearly outlining the agreement terms, both debtors and creditors can navigate challenging situations with transparency and legal protection. Whether seeking temporary relief for mortgage, auto loan, or credit card payments, individuals can leverage these letters to initiate a cooperative dialogue, provide temporary financial respite, and safeguard their credit scores.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Utah Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

Choosing the best legal record format can be quite a struggle. Naturally, there are a variety of templates accessible on the Internet, but how will you obtain the legal kind you want? Take advantage of the US Legal Forms web site. The assistance provides thousands of templates, like the Utah Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed, that you can use for business and personal requires. All the types are inspected by professionals and satisfy state and federal requirements.

Should you be currently signed up, log in for your accounts and click the Down load option to find the Utah Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. Make use of accounts to appear through the legal types you possess ordered formerly. Check out the My Forms tab of your respective accounts and get an additional backup of your record you want.

Should you be a new end user of US Legal Forms, here are straightforward instructions so that you can comply with:

- First, be sure you have selected the proper kind for the area/state. It is possible to examine the shape making use of the Preview option and browse the shape outline to guarantee it will be the best for you.

- When the kind does not satisfy your preferences, use the Seach industry to discover the correct kind.

- Once you are certain the shape would work, click the Get now option to find the kind.

- Select the prices plan you desire and enter the needed information. Build your accounts and pay money for an order using your PayPal accounts or credit card.

- Opt for the submit format and obtain the legal record format for your system.

- Comprehensive, change and printing and sign the received Utah Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

US Legal Forms is the greatest collection of legal types for which you can find different record templates. Take advantage of the company to obtain appropriately-produced files that comply with status requirements.