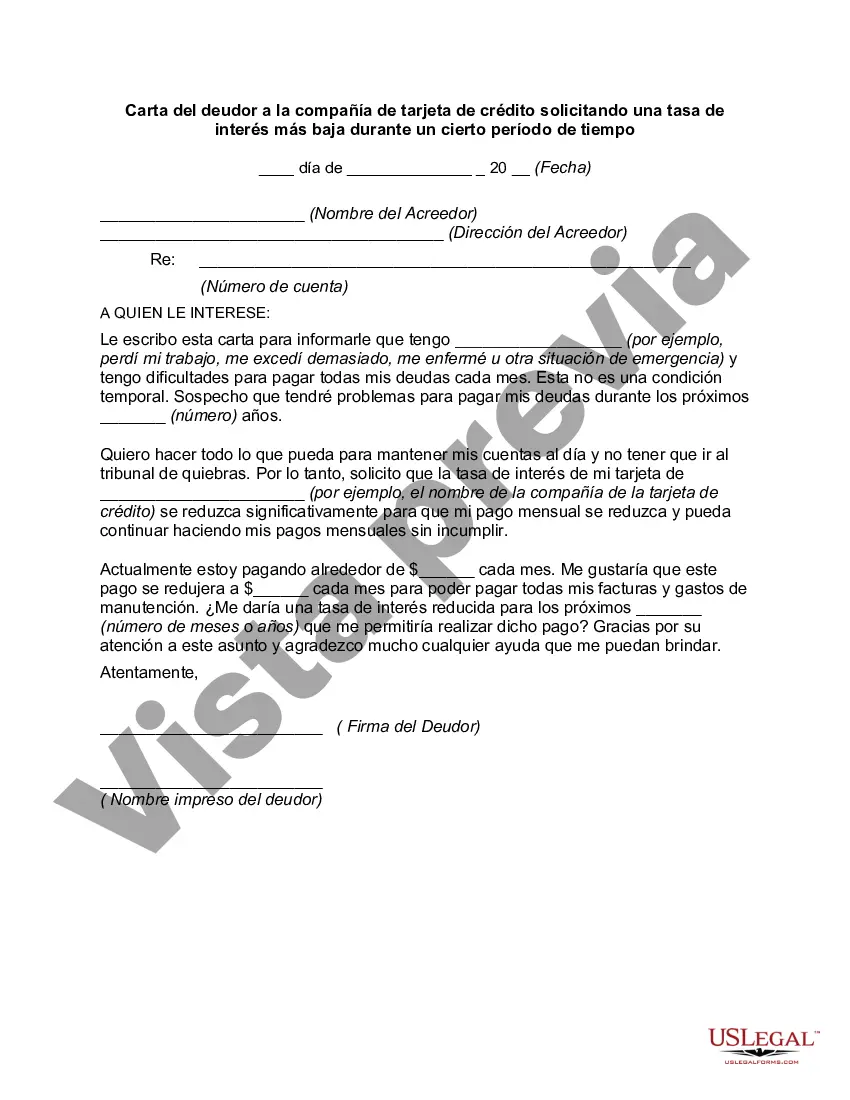

Title: Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: A Utah Letter from Debtor to a Credit Card Company requesting a lower interest rate for a specific duration serves as a formal communication seeking financial relief. This letter aims to present a compelling case to the credit card company, emphasizing the debtor's intent, financial situation, and the benefits of temporarily reducing the interest rate. Below, we outline the various types of letters that can be written to address different scenarios in Utah. 1. Standard Utah Letter from Debtor to Credit Card Company Requesting Lower Interest Rate: In this type of letter, the debtor seeks a standard reduction in the interest rate for a specific period. The purpose is to alleviate financial burden and ultimately gain control over credit card debt while adhering to Utah's legal framework. 2. Utah Hardship Letter from Debtor to Credit Card Company Seeking Temporary Interest Rate Reduction: Utah residents facing financial hardship due to unforeseen circumstances, such as unemployment, medical emergencies, or natural disasters, may write a hardship letter. This letter highlights the debtor's temporary inability to meet the current interest rate obligations and requests a lower interest rate to ease their financial strain. 3. Utah Debt Consolidation Letter from Debtor to Credit Card Company Requesting Interest Rate Reduction: Debt consolidation involves merging multiple debts into a single loan, often with a lower interest rate. In this case, a debtor from Utah may write a personalized letter to their credit card company, explaining their intention to consolidate their debts and requesting a reduced interest rate during the consolidation period. 4. Utah Balance Transfer Request Letter from Debtor to Credit Card Company: Sometimes, Utah debtors may opt for balance transfers to move their credit card balance from one card to another with a lower interest rate. This letter is written to the current credit card company, informing them of the debtor's intention to transfer the balance and seeking a reduced interest rate during this transition. Main Content: Regardless of the specific type of Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, the main content should include: 1. Debtor's basic information, including name, address, and contact details. 2. Detailed explanation of why the debtor is seeking a lower interest rate. 3. Current financial circumstances, including income, expenses, and any hardships being faced. 4. The desired duration for the lowered interest rate and how it will help the debtor make timely repayments. 5. Supporting documents, such as pay stubs, medical bills, or unemployment records, to validate the debtor's claims. 6. Polite and professional tone throughout the letter, emphasizing the debtor's willingness to resolve the financial situation responsibly. Conclusion: By using a Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, debtors in Utah can formally request temporary financial relief. Addressing the specific circumstances of the debtor and following the guidelines of the respective letter types mentioned above can increase the likelihood of receiving a favorable response from the credit card company. Remember to draft the letter carefully, with a clear objective, supporting evidence, and respectful language.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Utah Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Choosing the best lawful document design can be a battle. Needless to say, there are plenty of templates available on the Internet, but how would you find the lawful type you want? Make use of the US Legal Forms site. The services provides a huge number of templates, like the Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, that you can use for business and private requires. Every one of the forms are examined by specialists and meet up with federal and state requirements.

Should you be currently registered, log in in your accounts and then click the Obtain key to obtain the Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Use your accounts to check through the lawful forms you possess ordered previously. Visit the My Forms tab of your respective accounts and obtain one more backup of the document you want.

Should you be a fresh consumer of US Legal Forms, allow me to share straightforward directions that you should follow:

- First, make sure you have chosen the proper type for the city/state. You are able to look over the shape utilizing the Preview key and read the shape outline to guarantee it will be the right one for you.

- In the event the type does not meet up with your needs, use the Seach field to discover the correct type.

- Once you are certain that the shape would work, click on the Purchase now key to obtain the type.

- Opt for the rates program you desire and type in the needed information. Create your accounts and pay money for the order using your PayPal accounts or credit card.

- Choose the submit file format and obtain the lawful document design in your product.

- Total, change and print out and indicator the received Utah Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is the largest catalogue of lawful forms that you can find different document templates. Make use of the service to obtain expertly-produced papers that follow express requirements.