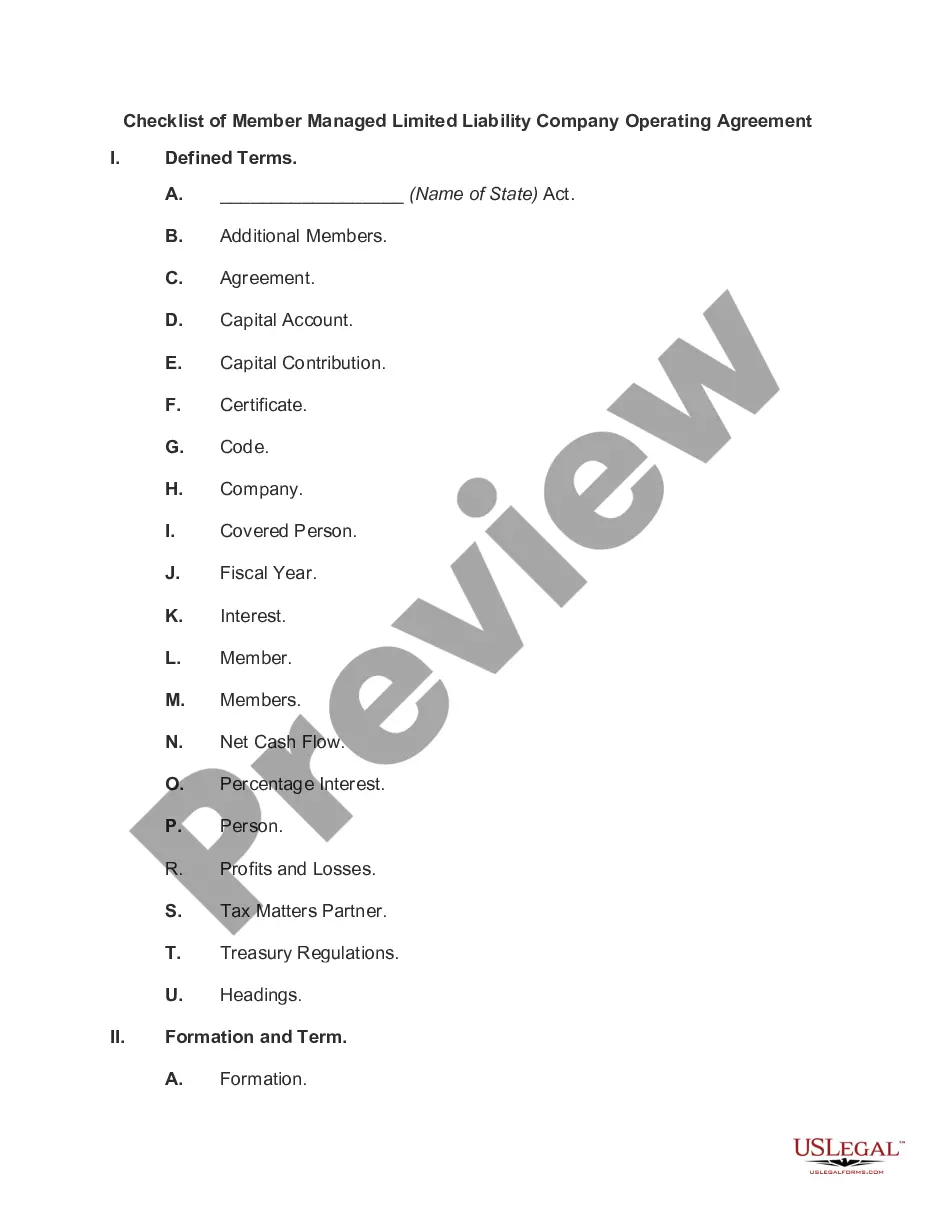

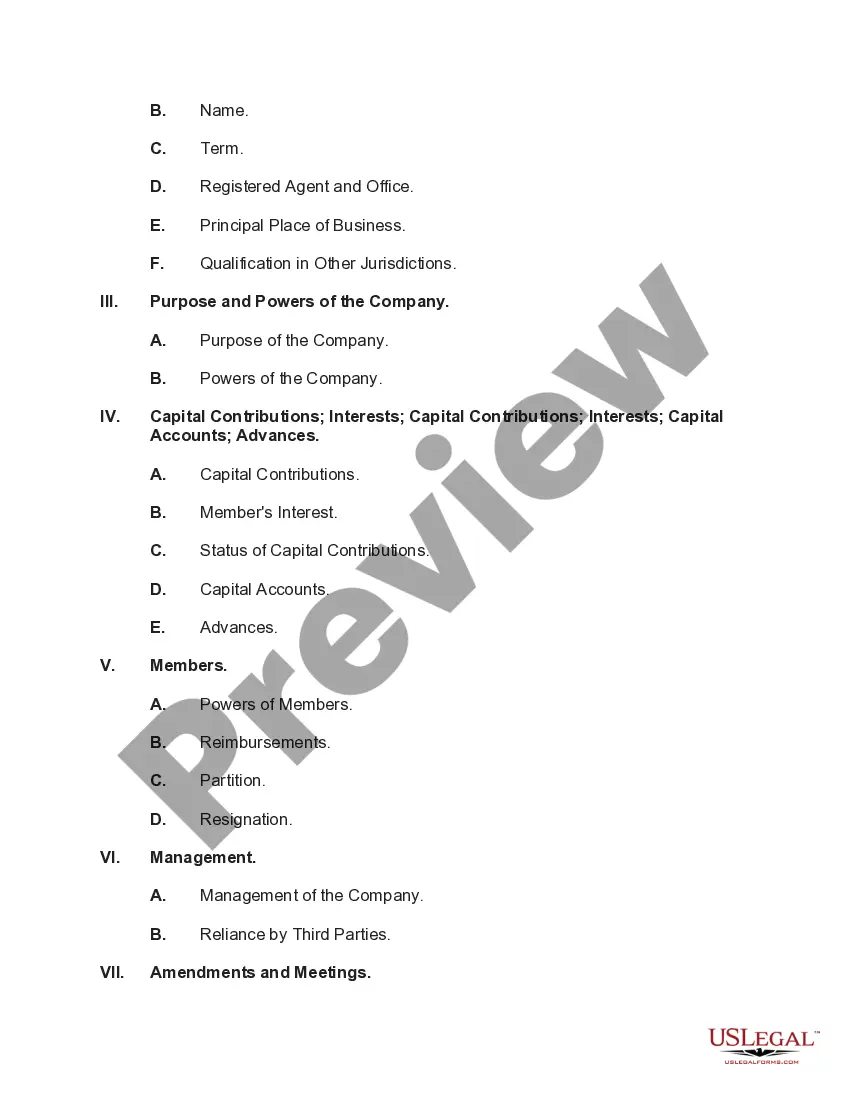

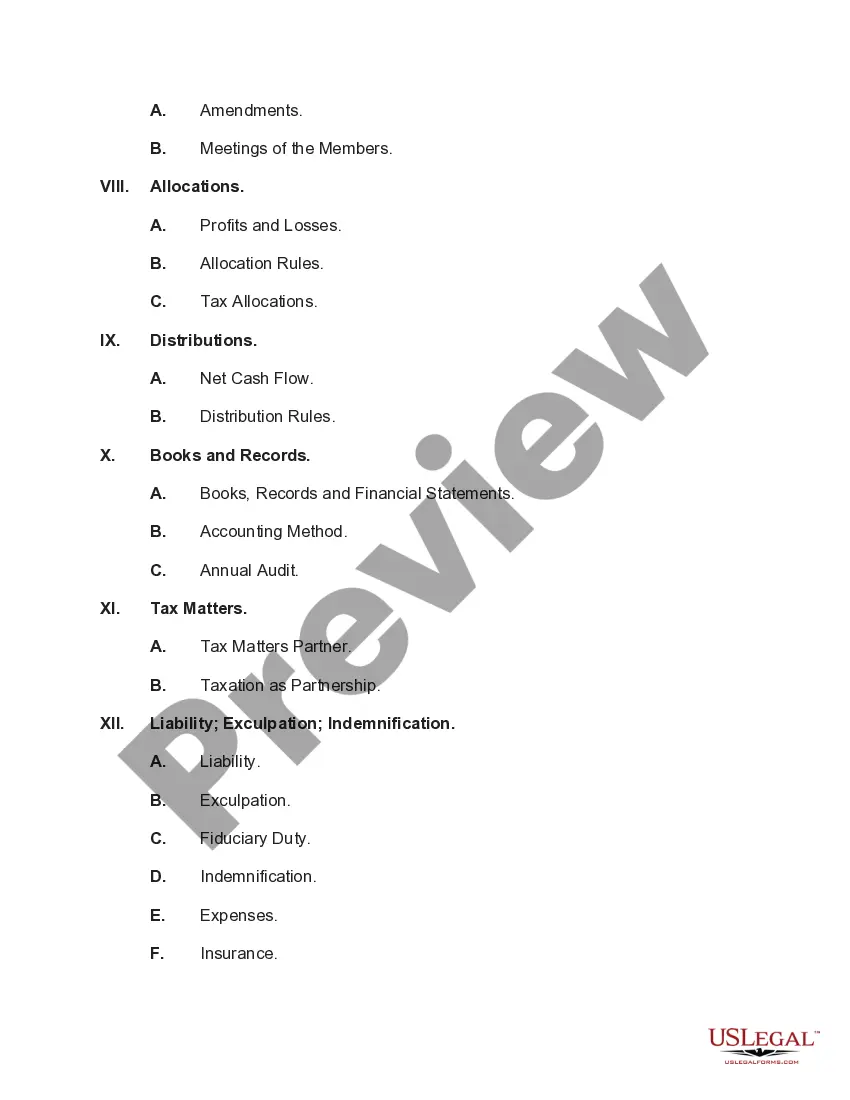

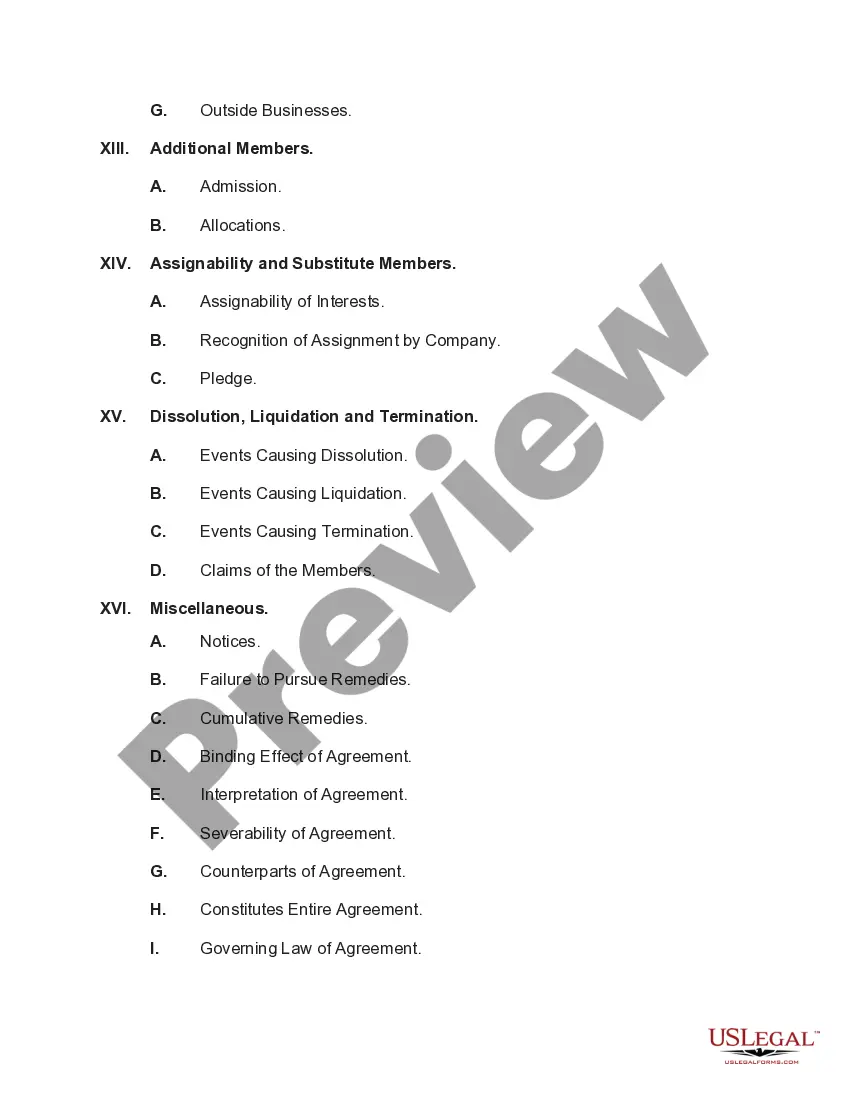

Utah Checklist of Member Managed Limited Liability Company Operating Agreement

Description

How to fill out Checklist Of Member Managed Limited Liability Company Operating Agreement?

Are you currently within a situation the place you will need documents for both company or specific purposes just about every working day? There are plenty of legal document themes available on the Internet, but finding types you can rely isn`t effortless. US Legal Forms delivers a large number of develop themes, such as the Utah Checklist of Member Managed Limited Liability Company Operating Agreement, that happen to be composed to meet federal and state specifications.

If you are currently acquainted with US Legal Forms web site and have a merchant account, just log in. After that, you can obtain the Utah Checklist of Member Managed Limited Liability Company Operating Agreement format.

If you do not have an account and wish to start using US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is to the proper town/area.

- Utilize the Preview key to examine the shape.

- Read the outline to actually have selected the right develop.

- When the develop isn`t what you`re trying to find, use the Look for industry to get the develop that meets your needs and specifications.

- Whenever you find the proper develop, click Buy now.

- Select the prices prepare you want, fill out the specified details to make your bank account, and pay for the transaction making use of your PayPal or bank card.

- Choose a hassle-free file format and obtain your duplicate.

Discover all the document themes you have purchased in the My Forms food selection. You can aquire a more duplicate of Utah Checklist of Member Managed Limited Liability Company Operating Agreement at any time, if required. Just go through the required develop to obtain or printing the document format.

Use US Legal Forms, the most considerable collection of legal forms, to save efforts and avoid mistakes. The support delivers appropriately manufactured legal document themes which you can use for a range of purposes. Produce a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

You are not legally required to have an Operating Agreement to form and run a Utah LLC. Still, it is recommended that you have one to further protect yourself from personal risk and liability in case of lawsuits against the company.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

How to Start an LLC in UtahSelect a name for your Utah LLC.Designate a registered agent. Our picks of the best LLC services.File a Certificate of Organization.Draft an operating agreement.Obtain an IRS Employer Identification Number (EIN)Fulfill your Utah LLC's additional legal obligations.