Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets involves the process of winding up a partnership business in the state of Utah. In this procedure, the partnership's assets are sold off, and the proceeds are distributed among the partners in proportion to their ownership interests. This allows for a fair and equitable division of resources as the partnership comes to an end. One type of Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets is voluntary liquidation. This occurs when partners collectively decide to dissolve the partnership and proceed with the sale and distribution of assets. Another type is forced liquidation, which happens when a court orders the dissolution and liquidation of the partnership due to various reasons such as fraud, misconduct, or inability to agree on important matters. The process begins by gathering all the partnership's assets, including tangible and intangible properties, accounts receivable, inventory, and any outstanding debts owed to the partnership. These assets are then appraised or valued to determine their current market worth. The partners may appoint an independent appraiser or use agreed-upon valuation methods to ensure fairness. Once the assets are properly valued, they are put up for sale to generate cash. This can be done through auctions, private sales, or by hiring a business broker to facilitate the process. The proceeds from the sale are used to pay off any outstanding debts and liabilities of the partnership, including taxes, loans, and other obligations. After all the debts are settled, the remaining funds are distributed among the partners in proportion to their ownership interests. This ensures that each partner receives a share of the assets that is proportional to their investment and involvement in the partnership. It is important to note that while Utah law governs the liquidation process, partnerships may have their own specific guidelines and agreements outlined in their partnership agreement. Hence, it is crucial to consult the partnership agreement and seek legal advice to ensure compliance with any additional requirements or restrictions. Overall, Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that enables the fair and orderly dissolution of a partnership. It allows for the sale of assets to generate funds for settling debts and the subsequent distribution of remaining assets among partners in proportion to their ownership interests.

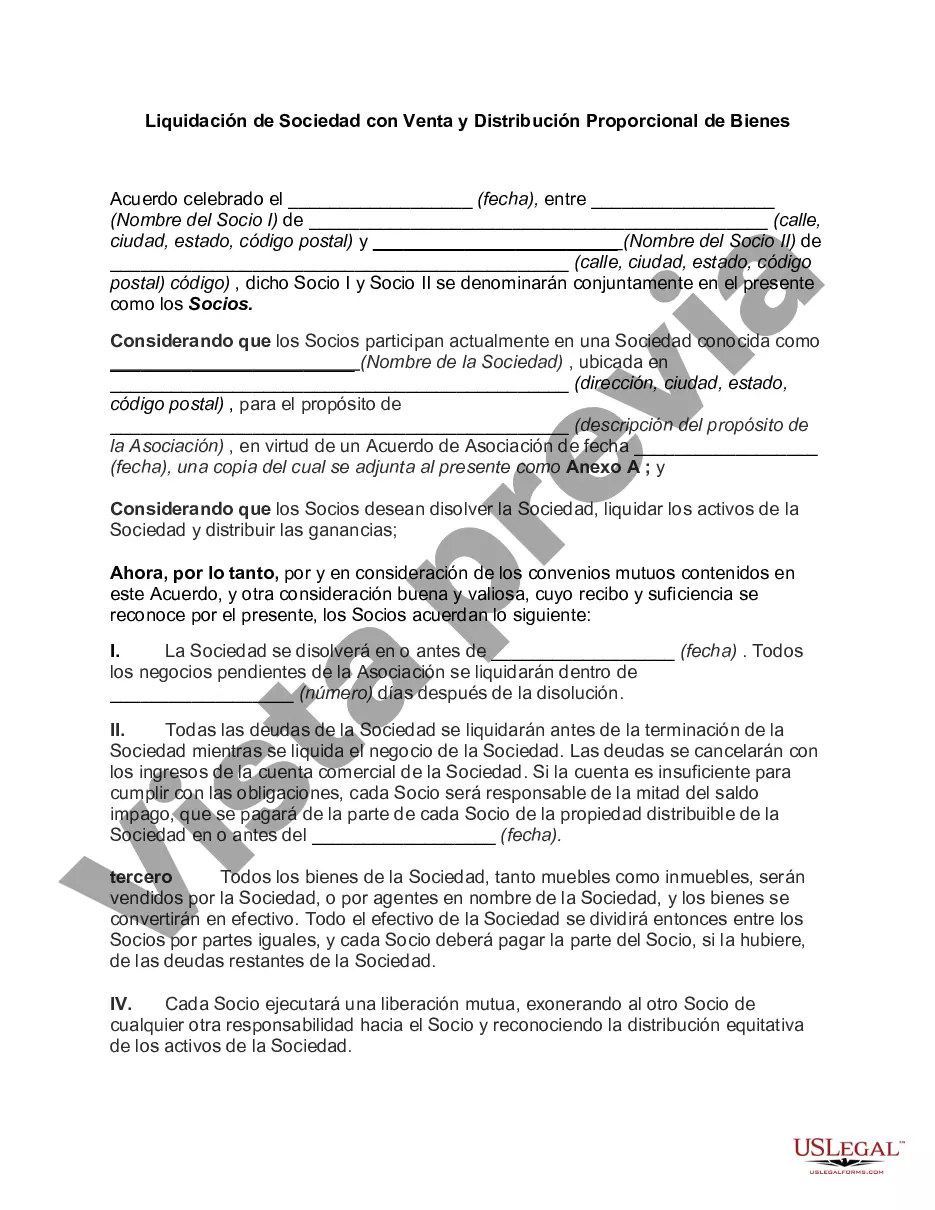

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Liquidación de Sociedad con Venta y Distribución Proporcional de Bienes - Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Utah Liquidación De Sociedad Con Venta Y Distribución Proporcional De Bienes?

US Legal Forms - one of the biggest libraries of authorized varieties in the States - provides a wide array of authorized record web templates you can acquire or printing. Using the site, you can find 1000s of varieties for enterprise and individual purposes, sorted by classes, claims, or key phrases.You will find the most up-to-date types of varieties just like the Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets within minutes.

If you already have a registration, log in and acquire Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets through the US Legal Forms local library. The Download switch can look on every single form you perspective. You have accessibility to all in the past saved varieties in the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, listed below are basic recommendations to help you started off:

- Be sure to have chosen the right form to your city/county. Go through the Preview switch to check the form`s content material. See the form explanation to actually have selected the proper form.

- When the form does not match your demands, utilize the Lookup industry towards the top of the screen to obtain the one which does.

- Should you be satisfied with the shape, validate your selection by visiting the Purchase now switch. Then, choose the costs prepare you like and provide your qualifications to sign up for an accounts.

- Process the financial transaction. Use your credit card or PayPal accounts to complete the financial transaction.

- Find the file format and acquire the shape on the gadget.

- Make modifications. Fill out, revise and printing and sign the saved Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Each and every design you added to your account lacks an expiry time and is your own property for a long time. So, if you would like acquire or printing yet another duplicate, just go to the My Forms segment and click on about the form you need.

Gain access to the Utah Liquidation of Partnership with Sale and Proportional Distribution of Assets with US Legal Forms, probably the most extensive local library of authorized record web templates. Use 1000s of professional and status-distinct web templates that satisfy your company or individual requires and demands.