Utah Employment of Chief Executive Officer with Stock Incentives — A Comprehensive Guide In Utah, the employment of Chief Executive Officer (CEO) with stock incentives offers an enticing opportunity for qualified professionals to secure executive positions in leading organizations. This arrangement provides CEOs with the potential for substantial financial gains, aligning their interests with the long-term success of the company. This article will delve into the details of Utah's employment of CEOs with stock incentives, including the various types of stock incentives available. Utah's CEOs with stock incentives play a critical role in driving growth, profitability, and strategic decision-making within companies operating across diverse industries. These executives shoulder substantial responsibilities, overseeing day-to-day operations, setting business objectives, and working closely with the board of directors to ensure shareholders' interests are protected. To attract and retain talented CEOs, Utah companies often offer stock incentives as part of their employment packages. These incentives serve as an added motivation for CEOs to excel in their roles and contribute to the company's overall success. Stock incentives come in different forms, including: 1. Stock Options: Stock options provide CEOs with the right to purchase company shares at a predetermined price, known as the exercise price or strike price. These options typically have a vesting period, encouraging long-term commitment and alignment with the company's objectives. As the stock price rises, CEOs can exercise their options at a lower price, thereby reaping significant financial rewards. 2. Restricted Stock Units (RSS): RSS grant CEOs a specified number of company shares at no cost. However, these shares are subject to a vesting schedule, ensuring that CEOs remain with the company for a certain period to receive the full benefit. RSS often align with performance-based criteria or the achievement of predetermined milestones. 3. Performance Shares: Performance shares are linked to specific performance targets established by the company. CEOs are granted shares based on the achievement of these goals, incentivizing exceptional performance and driving results aligned with the company's strategic objectives. Such targets may include revenue growth, profitability, or market share expansion. 4. Stock Appreciation Rights (SARS): SARS provide CEOs with financial gain equivalent to the appreciation in the company's stock price, without requiring them to directly purchase shares. These incentives allow CEOs to benefit from market growth while minimizing their investment risk. Utah's employment of CEOs with stock incentives offers a win-win situation for both executives and companies. CEOs have the opportunity to accumulate significant wealth as the company thrives, while organizations can attract and retain top talent by offering competitive compensation packages. Furthermore, stock incentives foster a strong sense of ownership and commitment among CEOs, as they directly benefit from the value they help create. This alignment of interests enhances decision-making, as CEOs are motivated to make strategic choices that maximize shareholder value. In summary, Utah's employment of Chief Executive Officer with stock incentives encompasses various forms of stock options such as stock options, restricted stock units (RSS), performance shares, and stock appreciation rights (SARS). By incorporating these equity-based incentives into compensation packages, companies in Utah can secure top-tier executives who are driven to achieve outstanding results.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Utah Empleo de Director General con Incentivos en Acciones - Employment of Chief Executive Officer with Stock Incentives

Description

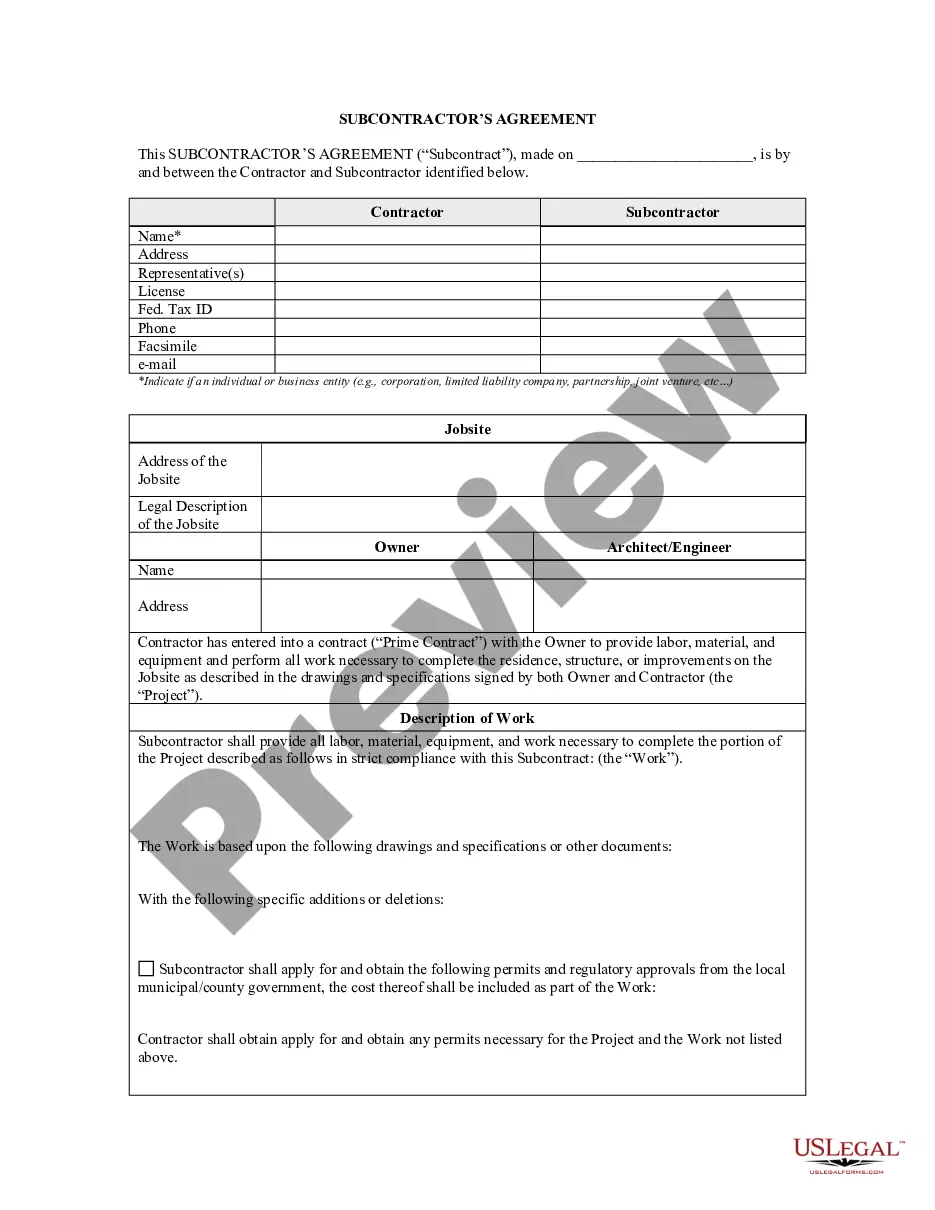

How to fill out Utah Empleo De Director General Con Incentivos En Acciones?

You are able to devote hrs on the web attempting to find the lawful record format that meets the federal and state demands you require. US Legal Forms offers a huge number of lawful varieties that happen to be examined by specialists. You can actually obtain or printing the Utah Employment of Chief Executive Officer with Stock Incentives from your service.

If you already have a US Legal Forms bank account, it is possible to log in and click the Acquire option. Next, it is possible to total, revise, printing, or indicator the Utah Employment of Chief Executive Officer with Stock Incentives. Each lawful record format you buy is your own permanently. To obtain an additional duplicate of any acquired develop, proceed to the My Forms tab and click the related option.

If you use the US Legal Forms site initially, stick to the basic directions beneath:

- Initially, be sure that you have chosen the proper record format to the region/town of your choosing. See the develop information to make sure you have selected the proper develop. If available, use the Preview option to search with the record format too.

- If you would like get an additional variation of the develop, use the Research discipline to obtain the format that meets your requirements and demands.

- Once you have found the format you would like, click Purchase now to continue.

- Choose the pricing prepare you would like, type your credentials, and sign up for an account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal bank account to purchase the lawful develop.

- Choose the file format of the record and obtain it for your system.

- Make alterations for your record if needed. You are able to total, revise and indicator and printing Utah Employment of Chief Executive Officer with Stock Incentives.

Acquire and printing a huge number of record themes using the US Legal Forms website, which provides the largest collection of lawful varieties. Use professional and state-particular themes to deal with your small business or personal demands.

Form popularity

FAQ

While compensation is largely based on performance, EPI reports that CEO has still far outpaced the performance of the stock market. Lawrence Mishel, study lead author and president of EPI, says CEO pay has risen because it has had little resistance from corporate boards in pursuit of higher compensation.

Stock-related compensation comprises around 85% of CEO compensation. Stock-related compensation is a key reason why CEOs earn so much more than even high earners. It used to be that in the 1950s, 60s, and 70s, CEOs made 3.3 times what a top 0.1% earner made.

Stock options can cause CEOs to focus on short-term performance or to manipulate numbers to meet targets. Executives act more like owners when they have a stake in the business in the form of stock ownership.

'CEOs are key to success' On one side, free-market economists argue high executive pay is justified if it aligns with the interests of executives and shareholders. If businesses are willing to pay these sums, they say, that is value that the market thinks the executives are worth.

Increasing CEO pay is not linked to increasing CEO productivity. The explosion of pay for CEOs of large firms is not strongly associated with evidence that these CEOs have become far more productive in their ability to generate returns to shareholders.

In most publicly held companies, the compensation of top executives is virtually independent of performance. On average, corporate America pays its most important leaders like bureaucrats.

In 2019, the last year for which we have figures, average CEO compensation, including the value of stock options granted (whether exercised or not), grew by 14% to $21.3 million, continuing an ongoing pattern.

Performance. One of the most popular ways to evaluate executive compensation is by comparing pay and performance. Unfortunately, many executives are given raises and bonuses even when their companies are faltering. Comparing pay to stock performance can help you determine whether executives are overpaid.

CEOs of public corporations get paid based on the recommendations of the board of directors. The pay package can include salary, bonus, stock options, and deferred compensation, along with use of the company jet to fly to the company villa in Tuscany or Aspen and a limo to drive you to an expense account lunch.