Utah Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

Locating the correct sanctioned document template can be a challenge.

It's clear that there are numerous designs accessible online, but how do you find the sanctioned form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, such as the Utah Travel Expense Reimbursement Form, which can be utilized for business and personal purposes.

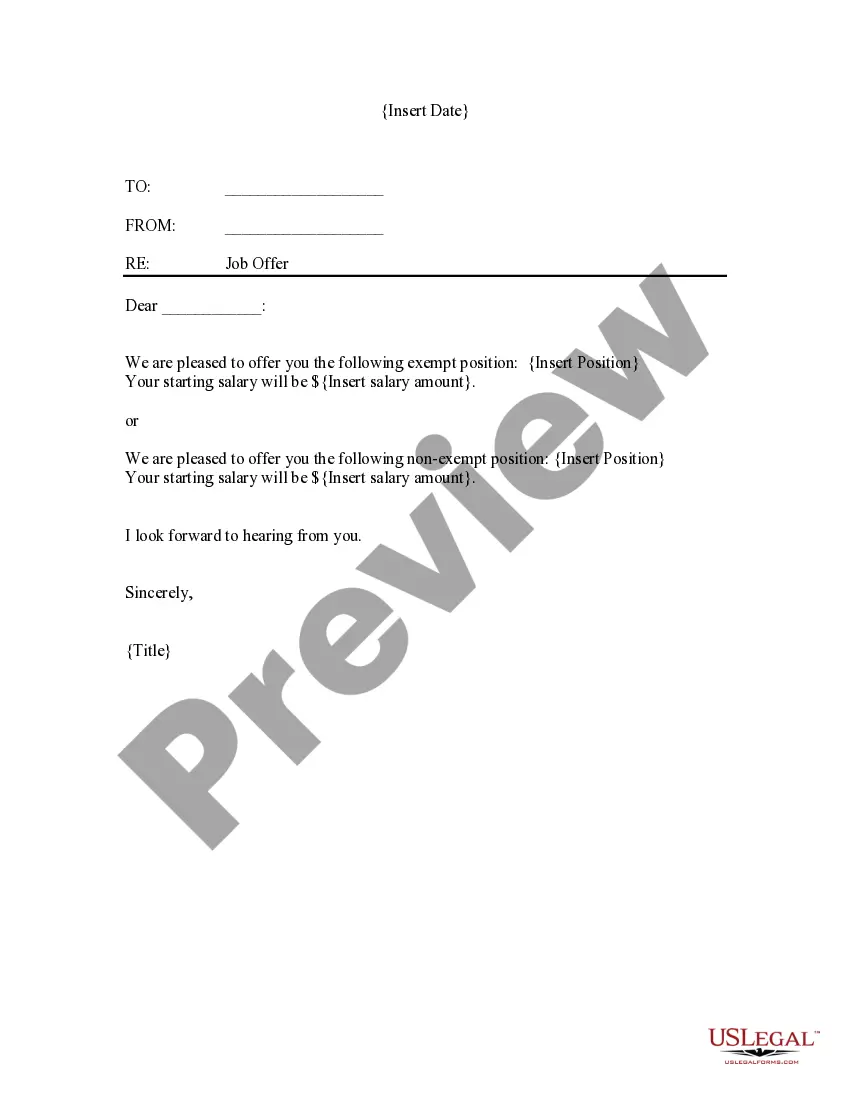

You can review the form using the Preview button and read the form description to ensure it is suitable for your needs.

- All templates are reviewed by specialists and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to access the Utah Travel Expense Reimbursement Form.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, verify that you have selected the correct form for your city/region.

Form popularity

FAQ

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

Under California labor laws, you are entitled to reimbursement for travel expenses or losses that are directly related to your job.

In 2021, the standard mileage reimbursement for business-related driving is 58.5 cents per mile driven. This number is based on an annual study of the fixed and variable costs of operating a vehicle.

Companies spend around 10% of their revenue on business travel-related expenses. This was reported in the New York Journal and given how significant the percentage is, it's critical that companies are strategic about managing their business travel expenditure.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

Give an explanation for requesting the refund or reimbursement. Request the refund or reimbursement. If you have enclosed receipts or other documents for reimbursement, tell the reader about them. Explain how or when you want to receive the refund or reimbursement and thank the reader.

Reimbursable travel expenses include the ordinary expenses of public or private transportation as well as unusual costs due to special circumstances.

While unreimbursed work-related travel expenses generally are deductible on a taxpayer's individual tax return (subject to a 50% limit for meals and entertainment) as a miscellaneous itemized deduction, many employees won't be able to benefit from the deduction.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.