Utah Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

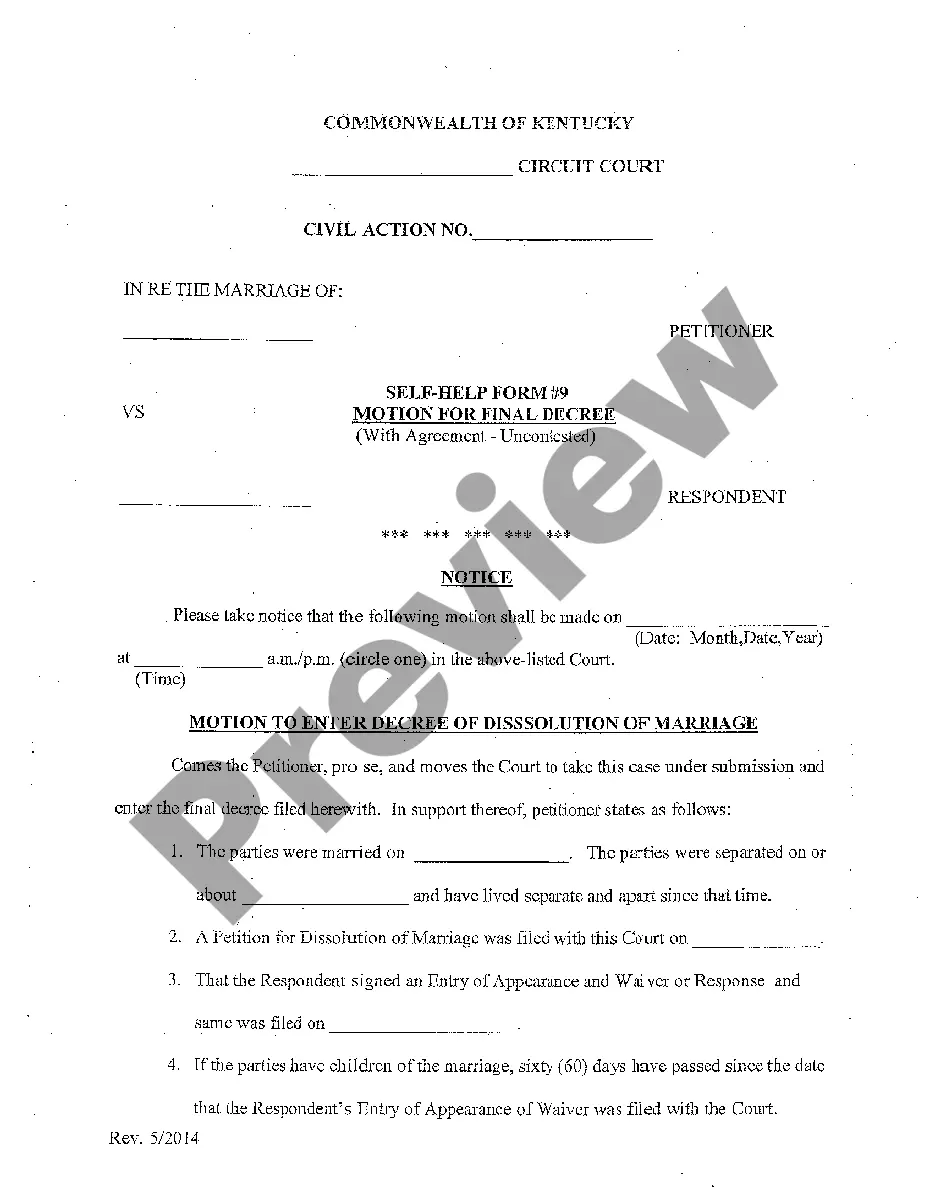

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

Finding the right legal papers format might be a have a problem. Naturally, there are a lot of layouts available on the net, but how can you get the legal kind you require? Use the US Legal Forms site. The assistance delivers a huge number of layouts, such as the Utah Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock, that you can use for company and personal requirements. All of the varieties are inspected by specialists and meet up with state and federal demands.

When you are already listed, log in to the account and click on the Acquire button to get the Utah Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock. Utilize your account to appear from the legal varieties you possess bought earlier. Check out the My Forms tab of your account and acquire yet another copy from the papers you require.

When you are a brand new user of US Legal Forms, here are simple guidelines so that you can comply with:

- Initially, make certain you have selected the appropriate kind for your personal town/area. It is possible to look through the form utilizing the Preview button and read the form information to ensure this is the best for you.

- In case the kind is not going to meet up with your preferences, use the Seach field to discover the correct kind.

- When you are certain that the form is suitable, click on the Get now button to get the kind.

- Choose the rates strategy you want and enter the necessary info. Make your account and purchase an order using your PayPal account or charge card.

- Select the data file structure and download the legal papers format to the product.

- Total, change and print and sign the received Utah Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock.

US Legal Forms may be the biggest local library of legal varieties where you can see a variety of papers layouts. Use the company to download skillfully-created documents that comply with condition demands.

Form popularity

FAQ

If the company pays cash dividends, future dividends would be adjusted to reflect the new, lower number of shares outstanding. So, if a company paid its shareholders a $1-per-share dividend and it undergoes a reverse split, the dividend becomes $5 per share or five times the old payout.

Listing Rule 5250(b)(4) will require companies to provide public notice of a reverse split, using a Reg FD-compliant method, no later than p.m. ET at least two business days prior to the proposed market effective date.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Depending on the particular facts, companies pursuing a reverse stock split may also be required to file a proxy statement on Schedule 14A, if shareholder approval is required, or a Schedule 13E-3, if the reverse stock split will result in the company ?going private.? Corporate filings can be found on EDGAR.?

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged. What Are Reverse Stock Splits and How Do They Work? fool.com ? terms ? reverse-stock-split fool.com ? terms ? reverse-stock-split