Utah Demand for Information from Limited Liability Company (LLC) by Member regarding Financial Records, etc. In the state of Utah, members of a limited liability company (LLC) have the right to demand certain information regarding the financial records and operations of the company. This demand for information serves as a mechanism to ensure transparency and accountability within the LLC. Being aware of the various types of Utah demands for information can help both LLC members and legal practitioners navigate this aspect of business law effectively. One type of demand for information that LLC members can make is a request for financial statements. This includes comprehensive balance sheets, income statements, and cash flow statements. By obtaining these financial records, members can gain insights into the financial health and performance of the company, identifying areas of concern or potential growth. Another type of demand for information pertains to the LLC's tax returns. Members have the right to access the LLC's filed tax returns, including any schedules or attachments. This information enables members to ensure compliance with tax laws and regulations, understand tax deductions or credits, and assess the accuracy of the company's financial reporting. Members can also request information related to the LLC's business operations. This may include agreements, contracts, or leases entered into by the company. By examining these documents, members can evaluate the contractual relationships of the LLC and identify any potential risks or opportunities. Additionally, a Utah demand for information can extend to the LLC's meeting minutes and governance-related documents. Members have the right to review and obtain copies of meeting minutes from both member and manager meetings, allowing them to stay informed about important decisions and discussions that shape the company's direction. It is important to note that when making a demand for information, LLC members must typically follow specific procedures outlined by the Utah Revised Limited Liability Company Act. This may involve submitting a written request to the LLC's registered agent or the designated contact person specified in the operating agreement. In conclusion, Utah demands for information from LLC members regarding financial records, tax returns, business operations, and governance-related documents play a vital role in ensuring transparency and accountability within the company. Familiarizing oneself with the different types of demands and the necessary procedures will help both members and legal professionals navigate this aspect of Utah's business law effectively.

Utah Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

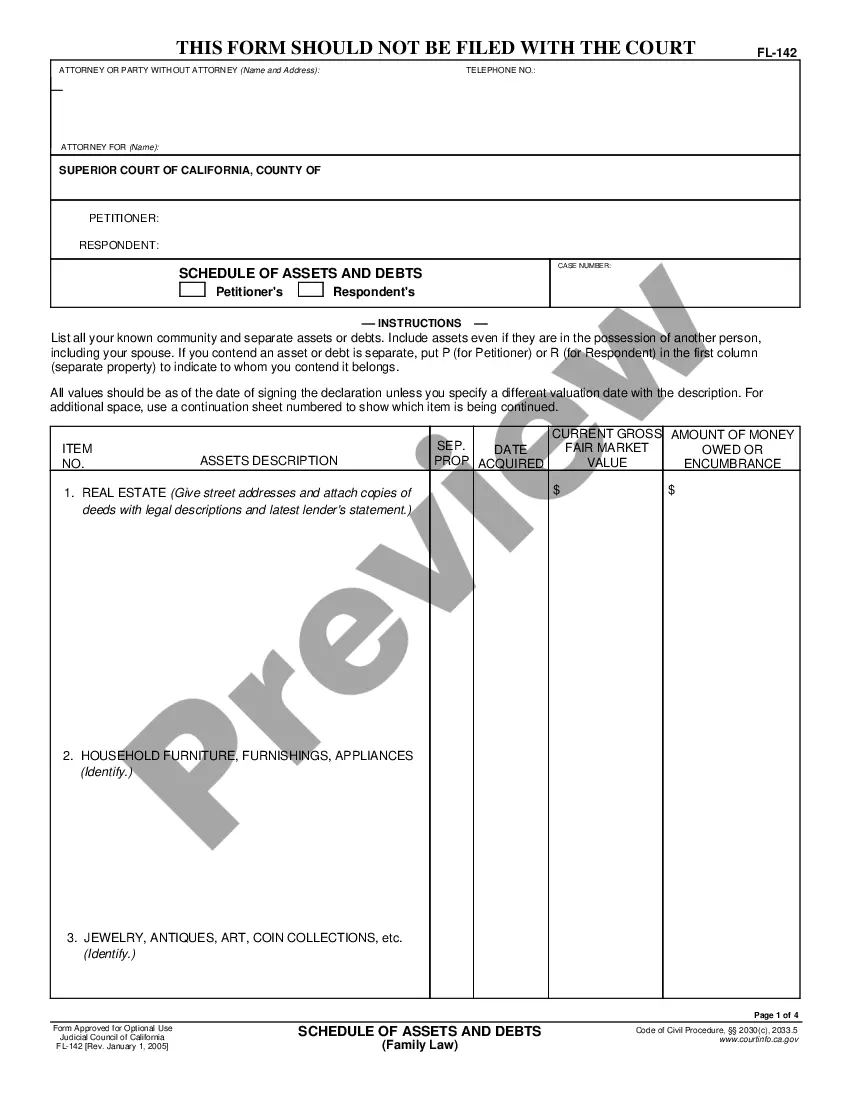

How to fill out Utah Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

US Legal Forms - one of many largest libraries of legal varieties in America - delivers a wide range of legal document layouts you are able to down load or print. Utilizing the site, you may get a huge number of varieties for company and individual reasons, categorized by categories, claims, or keywords and phrases.You can find the newest models of varieties like the Utah Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. in seconds.

If you have a membership, log in and down load Utah Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. through the US Legal Forms catalogue. The Acquire option will appear on every single develop you view. You get access to all formerly delivered electronically varieties inside the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, listed here are straightforward instructions to obtain began:

- Be sure to have picked the right develop for the city/area. Click on the Review option to review the form`s content. Look at the develop information to ensure that you have chosen the correct develop.

- In the event the develop does not satisfy your requirements, utilize the Lookup field towards the top of the display screen to get the one who does.

- In case you are happy with the shape, confirm your decision by clicking on the Buy now option. Then, select the rates program you like and provide your accreditations to register for the accounts.

- Process the deal. Make use of your Visa or Mastercard or PayPal accounts to perform the deal.

- Find the formatting and down load the shape on the product.

- Make alterations. Fill out, revise and print and indicator the delivered electronically Utah Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

Each web template you added to your bank account does not have an expiration date and it is the one you have permanently. So, if you wish to down load or print another duplicate, just check out the My Forms section and then click about the develop you want.

Obtain access to the Utah Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc. with US Legal Forms, the most substantial catalogue of legal document layouts. Use a huge number of expert and express-specific layouts that meet up with your organization or individual needs and requirements.