A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

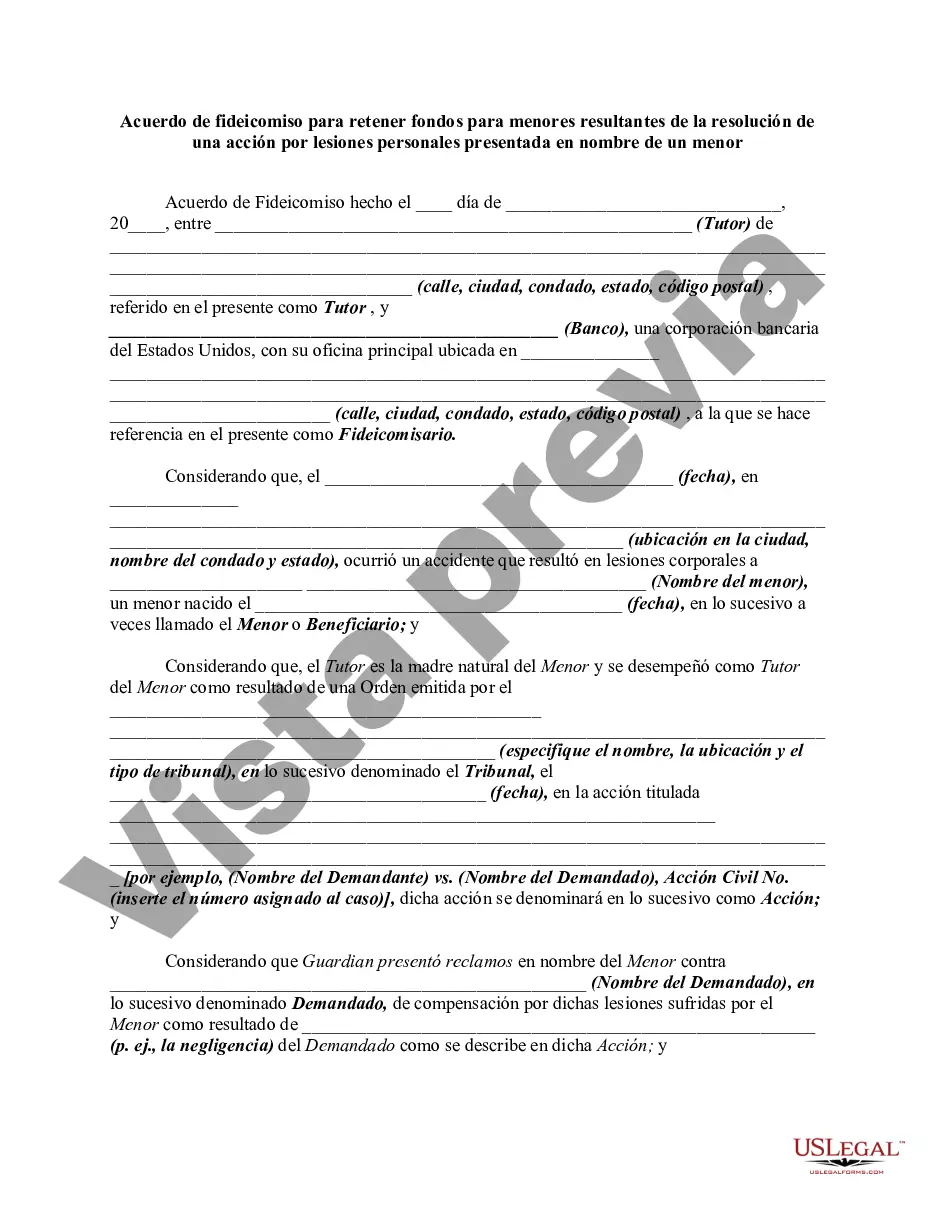

A Virginia Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal document that outlines the terms and conditions under which monetary settlement funds are held and managed for the benefit of a minor who has been awarded compensation in a personal injury lawsuit. This type of trust agreement ensures that the minor's settlement funds are properly protected and used for their best interests until they reach the age of majority. The trust agreement is tailored specifically for minors and is governed by Virginia state laws. It provides a framework for the management and distribution of the settlement funds to ensure that the minor's present and future needs are adequately taken care of. Key components of a Virginia Trust Agreement to Hold Funds for a Minor include: 1. Trustee Appointment: The agreement identifies an individual or a professional trustee who will be responsible for managing the funds on behalf of the minor. The trustee is appointed to have fiduciary duties to act in the best interests of the minor and make financial decisions prudently. 2. Specified Purpose: The trust agreement outlines the specific purpose for which the settlement funds can be used, such as medical expenses, education costs, housing, or any other expenses that benefit the minor's well-being. 3. Age of Distribution: The agreement specifies the age at which the trust assets will be distributed to the minor. In Virginia, the age of majority is 18, but the trust can be structured to provide for distributions at different stages or in installments as deemed appropriate by the parties involved. 4. Restricted Access: The agreement safeguards the funds from being accessed by anyone other than the trustee and limits the minor's access to the funds until they reach the designated age of distribution. This helps protect the funds from mismanagement or misuse. Types of Virginia Trust Agreement to Hold Funds for Minors may include: 1. Crummy Trust: This type of trust agreement allows for the annual exclusion of gift taxes on contributions made to the trust. It allows the minor to withdraw the gifted funds within a limited timeframe (30-60 days) to qualify for the annual gift tax exclusion. 2. Supplemental Needs Trust: This trust is designed to provide for the minor's additional needs beyond what governmental benefits provide. It is typically used when the minor has special needs or disabilities and requires ongoing support and care. 3. Educational Trust: This type of trust agreement is specifically structured to cover the minor's educational expenses. It ensures that the settlement funds are utilized solely for educational purposes, such as tuition, books, supplies, or future educational opportunities. In conclusion, a Virginia Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal instrument that safeguards the settlement funds on behalf of a minor until they reach the age of majority. It ensures that the funds are used responsibly and for the minor's benefit, addressing their present and future needs in accordance with relevant Virginia laws.A Virginia Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal document that outlines the terms and conditions under which monetary settlement funds are held and managed for the benefit of a minor who has been awarded compensation in a personal injury lawsuit. This type of trust agreement ensures that the minor's settlement funds are properly protected and used for their best interests until they reach the age of majority. The trust agreement is tailored specifically for minors and is governed by Virginia state laws. It provides a framework for the management and distribution of the settlement funds to ensure that the minor's present and future needs are adequately taken care of. Key components of a Virginia Trust Agreement to Hold Funds for a Minor include: 1. Trustee Appointment: The agreement identifies an individual or a professional trustee who will be responsible for managing the funds on behalf of the minor. The trustee is appointed to have fiduciary duties to act in the best interests of the minor and make financial decisions prudently. 2. Specified Purpose: The trust agreement outlines the specific purpose for which the settlement funds can be used, such as medical expenses, education costs, housing, or any other expenses that benefit the minor's well-being. 3. Age of Distribution: The agreement specifies the age at which the trust assets will be distributed to the minor. In Virginia, the age of majority is 18, but the trust can be structured to provide for distributions at different stages or in installments as deemed appropriate by the parties involved. 4. Restricted Access: The agreement safeguards the funds from being accessed by anyone other than the trustee and limits the minor's access to the funds until they reach the designated age of distribution. This helps protect the funds from mismanagement or misuse. Types of Virginia Trust Agreement to Hold Funds for Minors may include: 1. Crummy Trust: This type of trust agreement allows for the annual exclusion of gift taxes on contributions made to the trust. It allows the minor to withdraw the gifted funds within a limited timeframe (30-60 days) to qualify for the annual gift tax exclusion. 2. Supplemental Needs Trust: This trust is designed to provide for the minor's additional needs beyond what governmental benefits provide. It is typically used when the minor has special needs or disabilities and requires ongoing support and care. 3. Educational Trust: This type of trust agreement is specifically structured to cover the minor's educational expenses. It ensures that the settlement funds are utilized solely for educational purposes, such as tuition, books, supplies, or future educational opportunities. In conclusion, a Virginia Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal instrument that safeguards the settlement funds on behalf of a minor until they reach the age of majority. It ensures that the funds are used responsibly and for the minor's benefit, addressing their present and future needs in accordance with relevant Virginia laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.