The Virginia Employment Contract of Consultant with Nonprofit Corporation is a legally binding agreement that outlines the terms and conditions of the consultant's engagement with a nonprofit organization in Virginia. This contract serves to establish a professional relationship between the consultant and the nonprofit corporation, ensuring clarity and protection for both parties involved. Keywords: Virginia, employment contract, consultant, nonprofit corporation The Virginia Employment Contract of Consultant with Nonprofit Corporation typically covers various aspects, including but not limited to: 1. Scope of work: This section clearly defines the services or tasks the consultant will perform for the nonprofit corporation. It outlines the specific duties, responsibilities, and expectations of the consultant. 2. Payment and compensation: The contract outlines the payment structure and compensation terms agreed upon between the nonprofit corporation and the consultant. This includes details such as the hourly rate, fixed fee, or any other mutually agreed-upon payment arrangement. It may also include information regarding reimbursements for authorized expenses incurred during the consultant's engagement. 3. Term and termination: This section specifies the duration of the consultant's engagement with the nonprofit corporation. It covers the start and end dates of the contract and may also include provisions for early termination by either party. Additionally, it can outline the procedures for giving notice or resolving disputes related to termination. 4. Confidentiality and non-disclosure: This clause ensures that any proprietary or confidential information obtained by the consultant during their engagement remains confidential. It prohibits the consultant from sharing or using such information for personal gain or any purpose other than serving the nonprofit corporation. This safeguard helps protect the organization's sensitive data or trade secrets. 5. Intellectual property rights: If the consultant produces any original or intellectual property during their engagement, this section clarifies who retains ownership. It may outline the transfer, licensing, or usage rights associated with any work created by the consultant on behalf of the nonprofit corporation. Different types of Virginia Employment Contracts of Consultant with Nonprofit Corporation: 1. General Consultant Agreement: This is a standard employment contract for consultants engaging with nonprofit corporations in Virginia. It covers a wide range of consultancy services and is adaptable for various fields. 2. Project-based Consultant Agreement: This type of contract is specifically tailored for consultants engaged for a specific project or task. It outlines the project's objectives, deliverables, timeline, and compensation structure. 3. Retainer-based Consultant Agreement: This agreement is suitable for consultants who have an ongoing and long-term relationship with a nonprofit corporation. It outlines the terms for retaining the consultant's services for a specific duration or for a particular number of hours per week/month. It is important to note that while this information provides a general overview, actual contracts may vary in content and complexity. Furthermore, it is advisable to consult legal professionals or relevant authorities when drafting or signing an employment contract in the nonprofit sector.

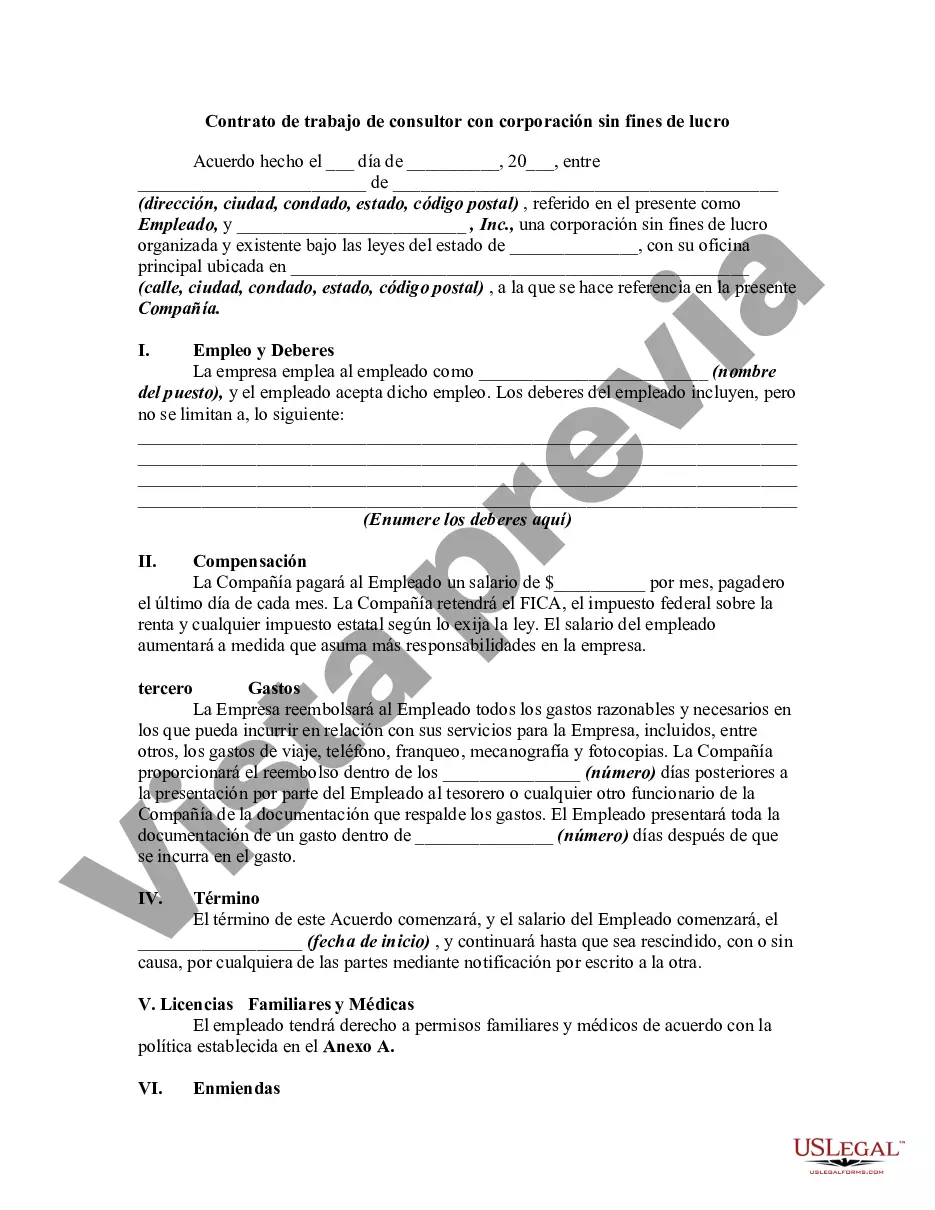

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Virginia Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

Are you presently within a placement in which you require paperwork for sometimes company or person uses nearly every time? There are tons of legal papers themes available on the Internet, but locating types you can rely on isn`t effortless. US Legal Forms offers thousands of form themes, such as the Virginia Employment Contract of Consultant with Nonprofit Corporation, that are composed to satisfy federal and state specifications.

If you are previously informed about US Legal Forms web site and also have an account, merely log in. After that, it is possible to download the Virginia Employment Contract of Consultant with Nonprofit Corporation design.

If you do not provide an accounts and need to begin using US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for that correct metropolis/county.

- Use the Review button to examine the form.

- See the description to ensure that you have chosen the right form.

- If the form isn`t what you`re seeking, take advantage of the Look for area to get the form that fits your needs and specifications.

- If you obtain the correct form, click Buy now.

- Pick the pricing plan you need, fill in the specified information to produce your account, and buy the order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free paper structure and download your backup.

Discover all the papers themes you have bought in the My Forms food list. You can obtain a extra backup of Virginia Employment Contract of Consultant with Nonprofit Corporation any time, if needed. Just go through the needed form to download or print out the papers design.

Use US Legal Forms, by far the most substantial selection of legal varieties, to conserve time as well as prevent blunders. The service offers skillfully manufactured legal papers themes which you can use for a variety of uses. Make an account on US Legal Forms and begin creating your daily life a little easier.