This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

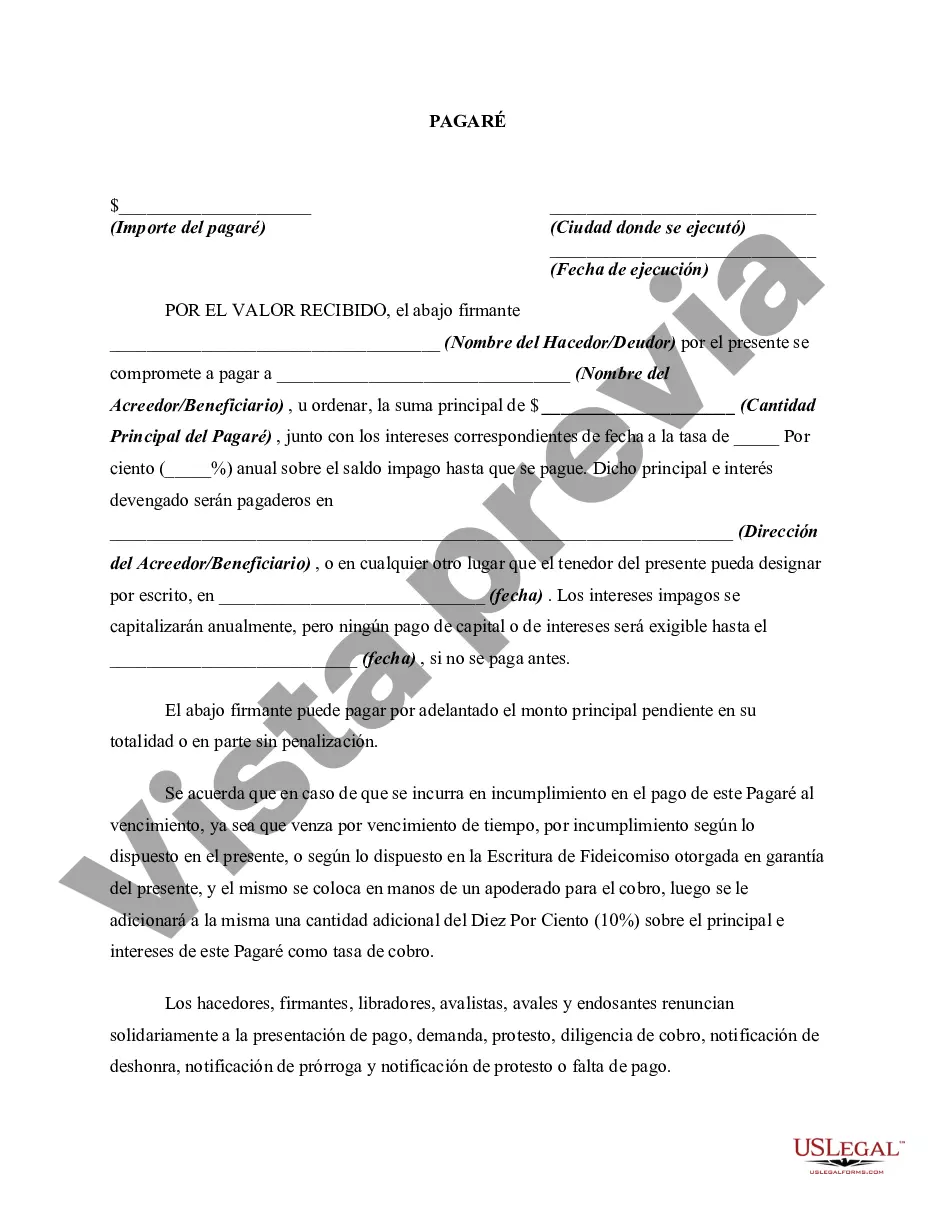

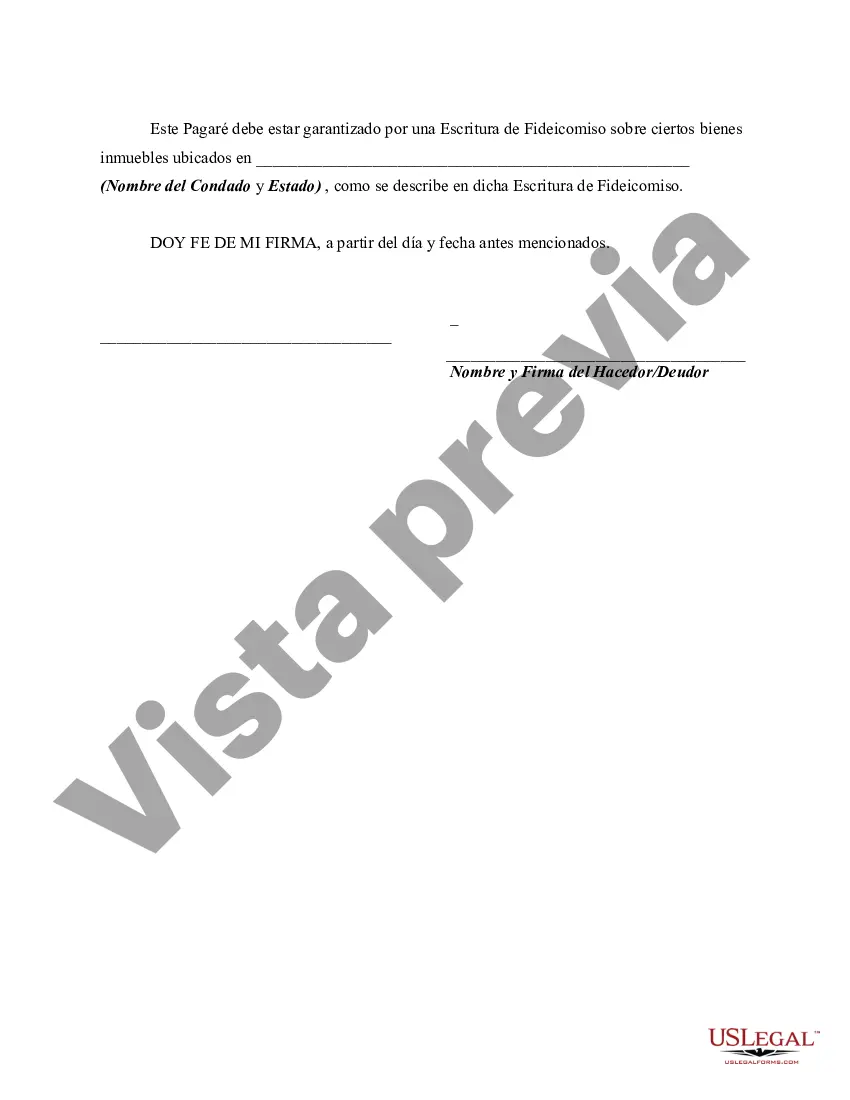

A Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Virginia. It is a financial instrument used to document a loan transaction where the borrower is not required to make any payments towards the principal or interest until the maturity date. This type of promissory note is commonly used in situations where the lender agrees to extend a loan with the understanding that the borrower will repay the entire principal amount along with accrued interest at the end of the agreed-upon term. The primary advantage of this type of promissory note is that it allows the borrower to delay the payment obligations until the maturity date, providing them with more flexibility in managing their finances. By deferring the payments, the borrower can utilize the funds for other purposes during the loan term, such as investment opportunities or business development. Additionally, the interest in this promissory note is compounded annually. This means that the interest earned on the loan is added to the principal balance on a yearly basis. As a result, the borrower accrues interest on both the principal amount and any previously accumulated interest, leading to higher overall repayment obligations at the maturity date. It's worth noting that while this description covers the general concept of a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there may be variations or specific types of promissory notes tailored to specific loan agreements or circumstances. For example, you may come across variations such as a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Semi-Annually or a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Monthly. Each of these variations will differ in the frequency at which interest is compounded, potentially impacting the overall repayment obligations of the borrower. In summary, a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document outlining the terms and conditions of a loan agreement in Virginia. This type of promissory note allows the borrower to defer all principal and interest payments until the maturity date, providing them with more flexibility. The interest on such a note is typically compounded annually, resulting in a higher overall repayment obligation at the end of the loan term. Different variations of this type of promissory note may exist, such as those with different compounding frequencies like semi-annual or monthly.A Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Virginia. It is a financial instrument used to document a loan transaction where the borrower is not required to make any payments towards the principal or interest until the maturity date. This type of promissory note is commonly used in situations where the lender agrees to extend a loan with the understanding that the borrower will repay the entire principal amount along with accrued interest at the end of the agreed-upon term. The primary advantage of this type of promissory note is that it allows the borrower to delay the payment obligations until the maturity date, providing them with more flexibility in managing their finances. By deferring the payments, the borrower can utilize the funds for other purposes during the loan term, such as investment opportunities or business development. Additionally, the interest in this promissory note is compounded annually. This means that the interest earned on the loan is added to the principal balance on a yearly basis. As a result, the borrower accrues interest on both the principal amount and any previously accumulated interest, leading to higher overall repayment obligations at the maturity date. It's worth noting that while this description covers the general concept of a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, there may be variations or specific types of promissory notes tailored to specific loan agreements or circumstances. For example, you may come across variations such as a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Semi-Annually or a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Monthly. Each of these variations will differ in the frequency at which interest is compounded, potentially impacting the overall repayment obligations of the borrower. In summary, a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document outlining the terms and conditions of a loan agreement in Virginia. This type of promissory note allows the borrower to defer all principal and interest payments until the maturity date, providing them with more flexibility. The interest on such a note is typically compounded annually, resulting in a higher overall repayment obligation at the end of the loan term. Different variations of this type of promissory note may exist, such as those with different compounding frequencies like semi-annual or monthly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.