Virginia Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

It is feasible to invest multiple hours online searching for the authentic file template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of valid forms that are reviewed by professionals.

You can easily obtain or print the Virginia Sample Letter for Compromise on a Debt from the service.

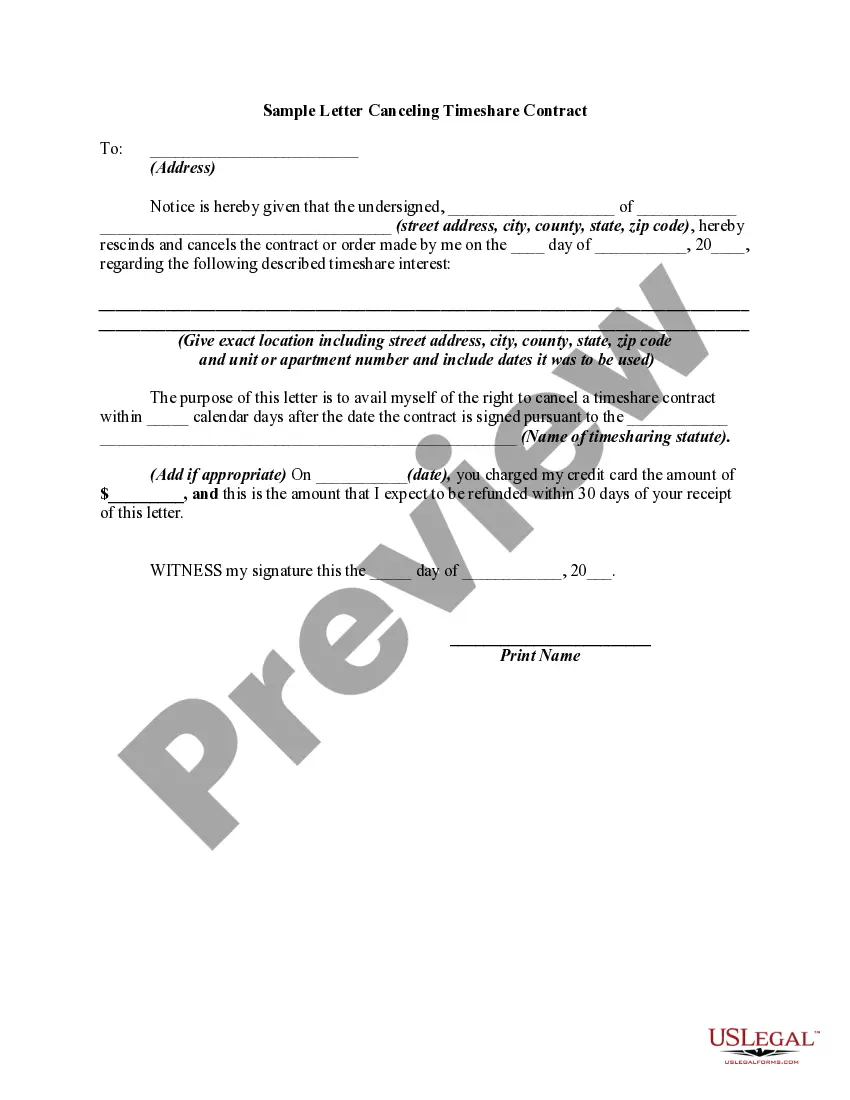

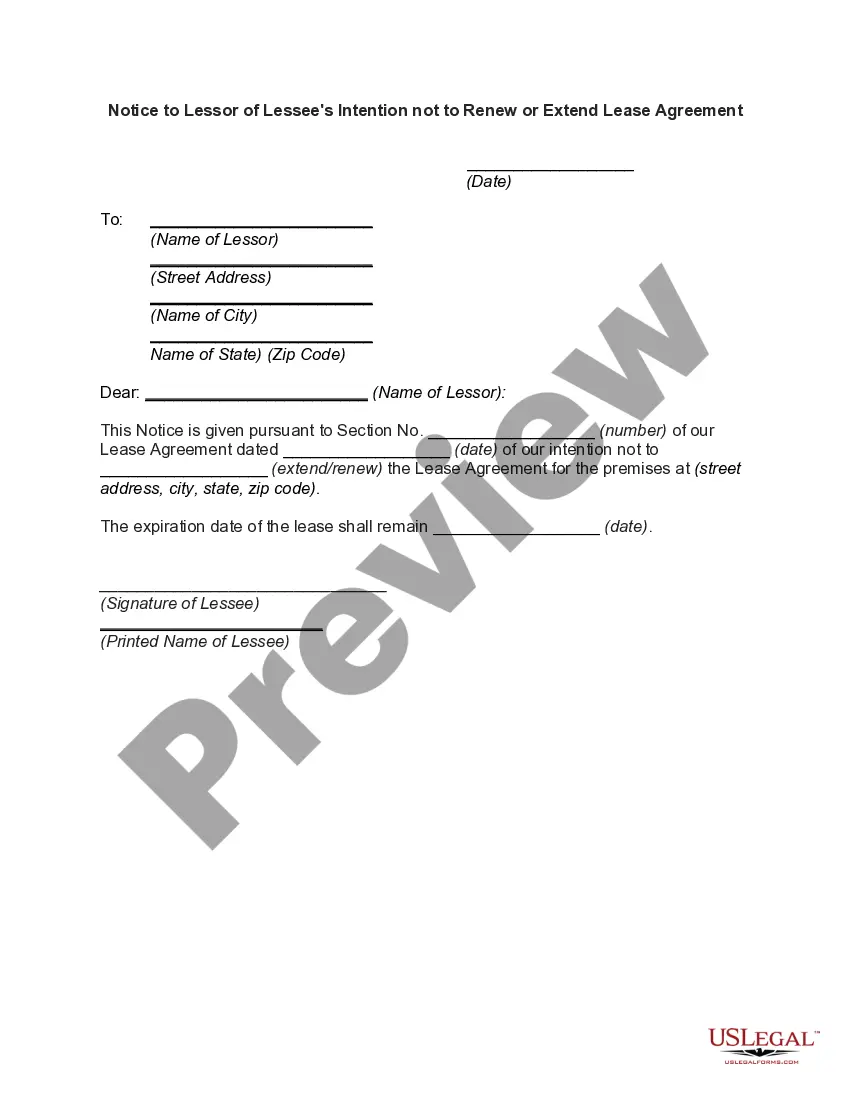

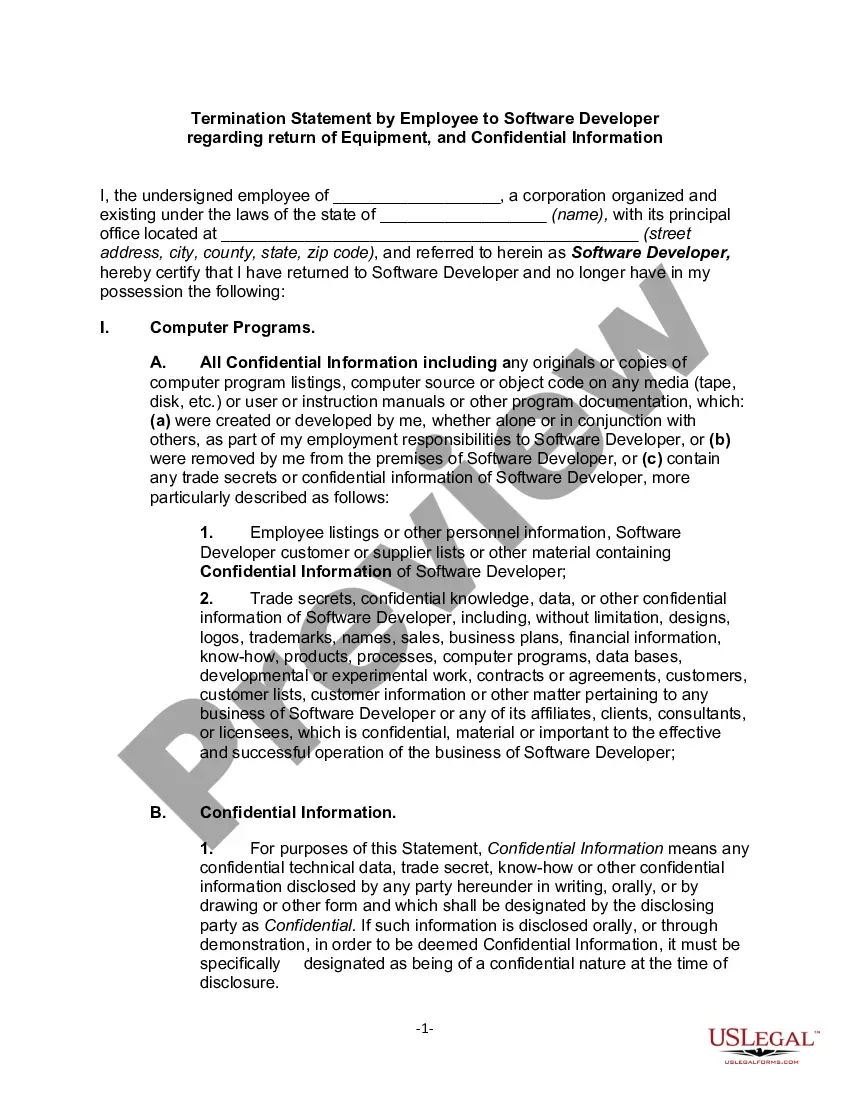

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, alter, print, or sign the Virginia Sample Letter for Compromise on a Debt.

- Each legitimate document template you obtain is yours forever.

- To retrieve an additional copy of any purchased form, visit the My documents section and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have selected the correct document template for the county/city of your choice.

- Examine the form details to confirm you have picked the proper template.

Form popularity

FAQ

In Virginia, property taxes can generally go unpaid for a year before the local government takes action. After this period, a tax lien can be placed on your property, leading to potential foreclosure. If you are struggling with unpaid property taxes, consider using a Virginia Sample Letter for Compromise on a Debt to negotiate a repayment plan or settle your debt.

Yes, the IRS can pursue your spouse for your debt if you file jointly, as both partners share responsibility for the tax liabilities. However, options like innocent spouse relief may protect one partner in certain situations. Preparing a Virginia Sample Letter for Compromise on a Debt can provide additional support in mitigation discussions.

To qualify for innocent spouse relief in Virginia, you need to show you were unaware of the tax issues caused by your spouse's actions. This relief protects individuals from liability when they did not benefit from underreported income or erroneous tax claims. A Virginia Sample Letter for Compromise on a Debt can sometimes aid in your case by outlining your position clearly.

The spouse tax adjustment in Virginia refers to the modification of tax liabilities based on a spouse's income and tax situation. This adjustment can potentially reduce tax burdens for couples, particularly when one spouse has incurred debt. Utilizing a Virginia Sample Letter for Compromise on a Debt may help in negotiating a more favorable tax arrangement.

The spousal exemption in Virginia allows a spouse to protect a certain amount of their household assets from creditors when one partner incurs debt. This exemption can provide significant relief in financial situations, especially when combined with a Virginia Sample Letter for Compromise on a Debt. It is crucial to understand how this exemption works to effectively manage shared financial responsibilities.

Filing Virginia state taxes late can result in various penalties. Typically, you may face a late filing penalty of 5% for each month your return is overdue, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax amount, increasing your overall debt. To manage your tax obligations and explore options, including using a Virginia Sample Letter for Compromise on a Debt, consider resources like US Legal Forms that help you navigate these issues effectively.

Yes, Virginia does offer innocent spouse relief, allowing one spouse to separate themselves from the debt of the other under certain circumstances. To qualify, you must demonstrate that you did not know about the debt and that it would be unjust to hold you liable. Gathering necessary documentation is critical for your application. For assistance, you can use resources like the Virginia Sample Letter for Compromise on a Debt.

When writing a letter of debt settlement, start by clearly stating the purpose of your letter. Include necessary details like your account number and the amount you propose to settle. Clearly express your reasoning and offer a payment plan or a lump sum amount. Utilizing a Virginia Sample Letter for Compromise on a Debt can provide a helpful structure for your letter.

Upon acceptance of your Offer in Compromise, you will receive a formal notification from the tax authority. This letter outlines your agreed payment plan or settlement, detailing how to fulfill your obligation. It's crucial to adhere to the agreed timeline to avoid future complications. Keep your Virginia Sample Letter for Compromise on a Debt handy for your records and further reference.