A Virginia Financing Statement is a legal document that provides notice to the public about a secured transaction. It is filed with the Virginia Secretary of State's office to establish a creditor's security interest in personal property collateral. Keywords: Virginia, Financing Statement, secured transaction, personal property collateral, creditor, security interest, legal document. There are several types of Virginia Financing Statements, including: 1. Uniform Commercial Code (UCC) Financing Statement: This is the most common type of financing statement filed in Virginia. It is governed by the Virginia Uniform Commercial Code and is used to secure a creditor's interest in personal property collateral, such as inventory, equipment, or accounts receivable. 2. Agricultural Liens Financing Statement: This type of financing statement is specific to agricultural transactions. It is filed to perfect a creditor's security interest in agricultural products, such as crops, livestock, and farm equipment, under the Virginia Agricultural Liens Act. 3. Aircraft Financing Statement: Filed for transactions involving aircraft, this financing statement establishes a creditor's security interest in aircraft, including airplanes and helicopters, located in Virginia. It is governed by the Federal Aviation Administration (FAA) regulations and state laws. 4. Manufactured Home Financing Statement: Used in transactions involving manufactured homes, this financing statement is filed to perfect a creditor's security interest in mobile homes or manufactured housing located in Virginia. It provides notice to other potential creditors that the mobile home is encumbered. 5. Motor Vehicle Financing Statement: Filed to establish a creditor's security interest in motor vehicles, including cars, trucks, motorcycles, and recreational vehicles (RVs). This document is essential for securing a loan or lease involving a Virginia registered vehicle. 6. Public Finance Financing Statement: Used in public finance transactions, such as municipal bonds or governmental loans, this financing statement is filed to perfect a creditor's security interest in public assets or revenue streams. It is important to note that each type of financing statement has its specific requirements and filing procedures according to the relevant laws and regulations. Filing a financing statement acts as a public record and protects the creditor's interest in the collateral in case of default or bankruptcy by the debtor.

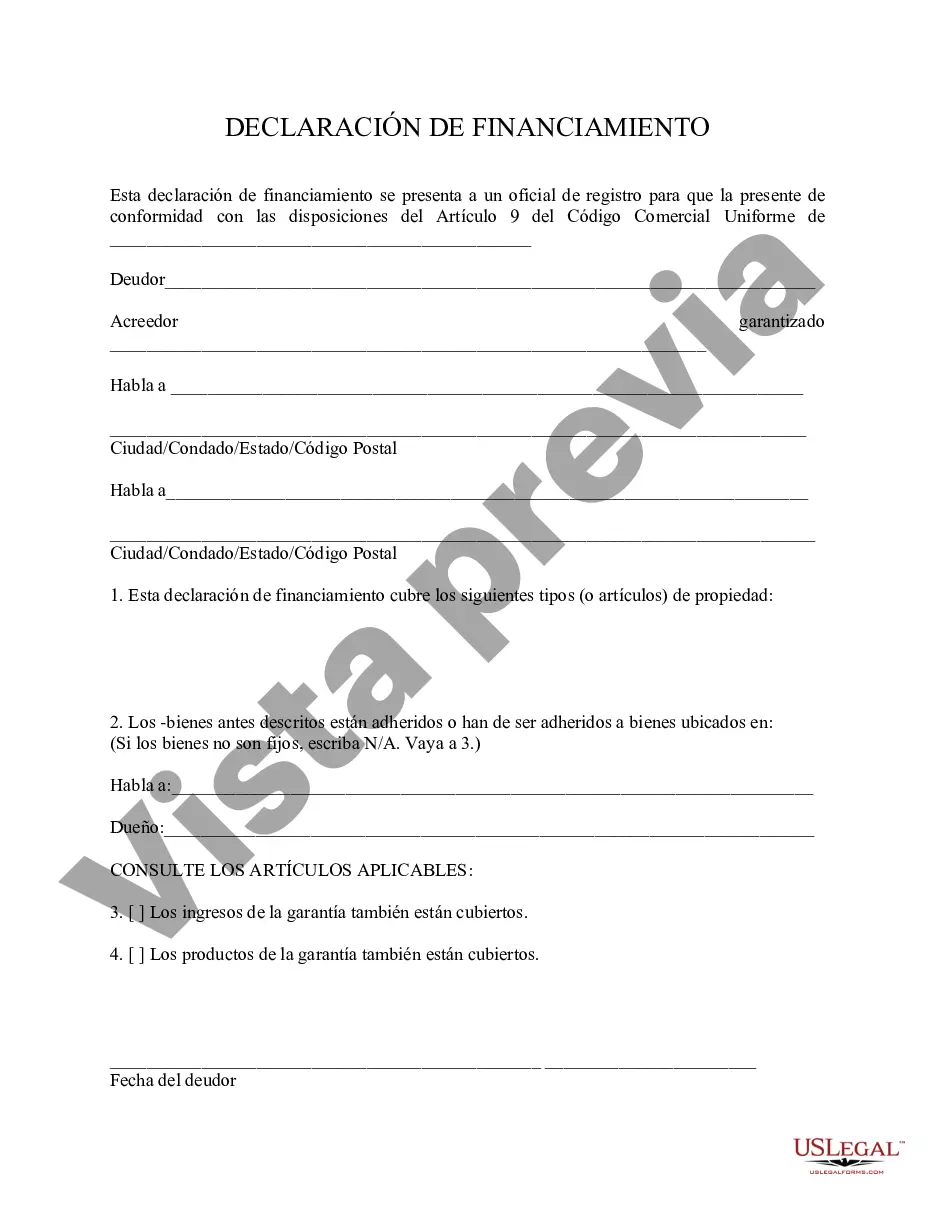

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Declaración de Financiamiento - Financing Statement

Description

How to fill out Virginia Declaración De Financiamiento?

Finding the right legal document design might be a struggle. Needless to say, there are a variety of layouts available on the net, but how can you obtain the legal kind you require? Use the US Legal Forms site. The services offers 1000s of layouts, like the Virginia Financing Statement, which you can use for business and private needs. All of the varieties are checked out by specialists and meet state and federal demands.

When you are previously registered, log in in your account and then click the Down load option to have the Virginia Financing Statement. Utilize your account to check from the legal varieties you possess bought in the past. Visit the My Forms tab of the account and acquire one more backup of the document you require.

When you are a whole new end user of US Legal Forms, listed below are simple guidelines for you to comply with:

- Initially, be sure you have chosen the proper kind for the city/area. You may look through the form making use of the Review option and browse the form outline to make sure this is basically the right one for you.

- In the event the kind does not meet your needs, utilize the Seach field to find the proper kind.

- Once you are positive that the form is proper, click the Buy now option to have the kind.

- Select the prices prepare you need and enter the needed details. Build your account and buy the transaction using your PayPal account or charge card.

- Select the document format and obtain the legal document design in your device.

- Comprehensive, modify and print out and sign the attained Virginia Financing Statement.

US Legal Forms will be the greatest local library of legal varieties for which you will find numerous document layouts. Use the service to obtain professionally-created paperwork that comply with condition demands.