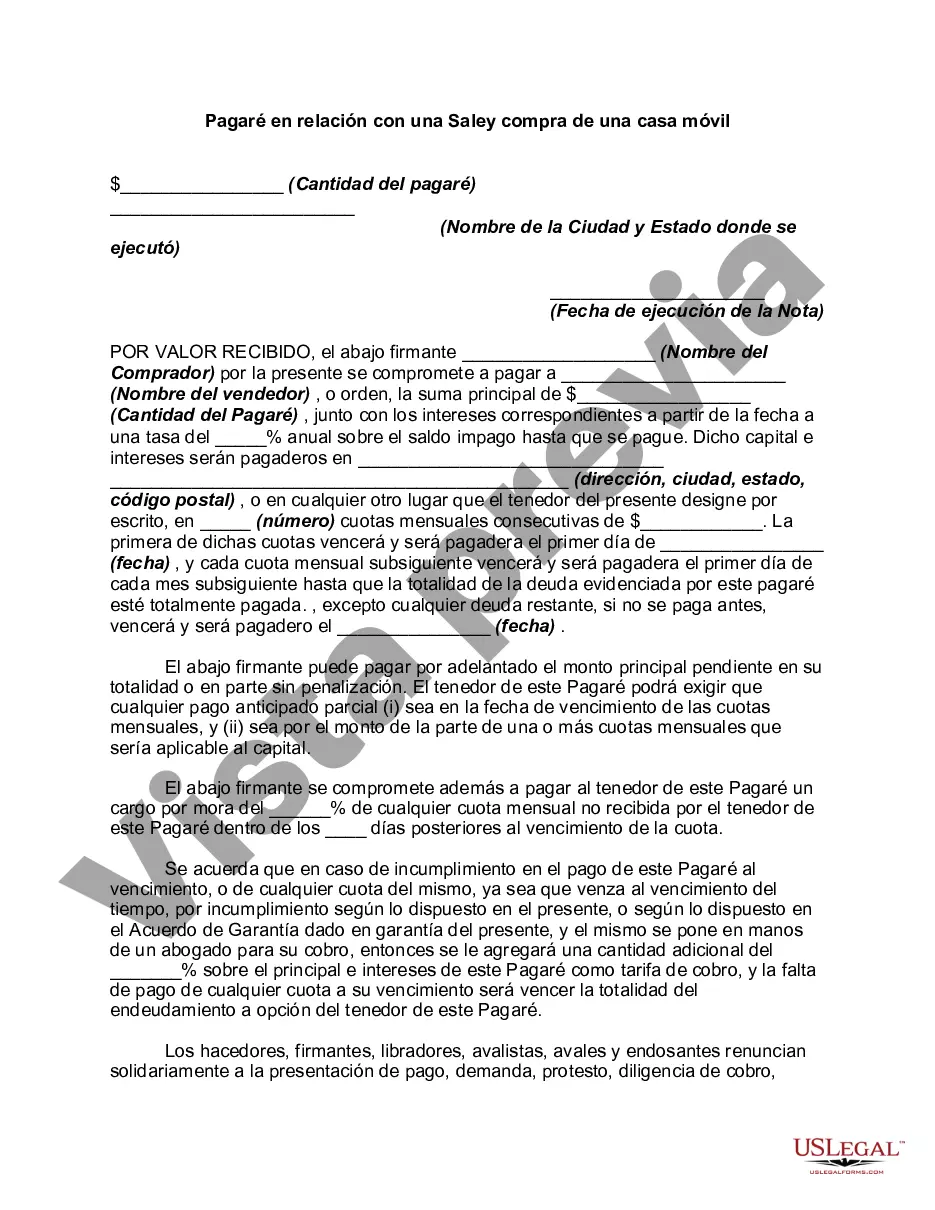

A Virginia Promissory Note in connection with a sale and purchase of a mobile home is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller of a mobile home. This note serves as evidence of the debt owed by the buyer to the seller and contains important information regarding the loan, repayment terms, and the consequences of default. The Virginia Promissory Note for a sale and purchase of a mobile home typically includes the following details: 1. Parties Involved: The note identifies the parties involved, i.e., the buyer (borrower) and the seller (lender). It includes their legal names, contact information, and addresses. 2. Mobile Home Description: The note provides a detailed description of the mobile home being sold, including its make, model, year, vehicle identification number (VIN), and any additional features. This serves as a reference for the transaction. 3. Purchase Price and Down Payment: The agreed-upon purchase price of the mobile home is specified, along with any down payment made by the buyer. The note may outline whether the down payment is refundable or non-refundable in case of default. 4. Loan Amount, Interest Rate, and Term: The principal loan amount, the interest rate charged, and the loan term are clearly stated in the promissory note. Additionally, any late payment fees or penalties for non-payment may be specified. 5. Monthly Payment Details: The note outlines the amount of the monthly payment the buyer is obligated to make, including the due date and the acceptable methods of payment. It may also mention any grace period given before late fees are applied. 6. Security Interest: If the buyer offers the mobile home as collateral for the loan, details regarding the security interest are included in the note. This outlines the legal rights of the seller in case of default, including repossession and sale of the mobile home to satisfy the debt. 7. Default and Remedies: The note specifies the actions the seller can take in case of default, such as accelerating the loan, seizing the collateral, or pursuing legal action for recovery. It outlines the process for resolving disputes and any additional costs or attorney's fees. Different types of Virginia Promissory Notes in connection with a sale and purchase of a mobile home may vary based on the specific terms and conditions agreed upon by the buyer and seller. These variations include differences in interest rates, loan term lengths, down payment requirements, and security interest provisions. Promissory notes play a crucial role in protecting the rights and interests of both parties involved in a mobile home sale and purchase transaction. It is essential to consult with legal professionals to draft a comprehensive and enforceable Virginia Promissory Note that aligns with the specific needs of the buyer and seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Virginia Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

If you need to complete, down load, or print legitimate document templates, use US Legal Forms, the most important selection of legitimate varieties, that can be found on the Internet. Use the site`s simple and easy hassle-free search to find the files you want. Numerous templates for enterprise and person functions are categorized by types and claims, or search phrases. Use US Legal Forms to find the Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home in a couple of mouse clicks.

Should you be currently a US Legal Forms consumer, log in for your bank account and click the Acquire switch to obtain the Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home. You may also access varieties you earlier delivered electronically from the My Forms tab of your respective bank account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your correct metropolis/region.

- Step 2. Take advantage of the Preview method to look through the form`s content. Never neglect to see the outline.

- Step 3. Should you be unhappy together with the type, take advantage of the Look for area at the top of the display to locate other variations from the legitimate type template.

- Step 4. When you have located the form you want, go through the Buy now switch. Opt for the rates strategy you choose and include your references to register on an bank account.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Find the structure from the legitimate type and down load it on your product.

- Step 7. Full, revise and print or indication the Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

Each legitimate document template you purchase is the one you have forever. You might have acces to every single type you delivered electronically in your acccount. Click on the My Forms area and pick a type to print or down load yet again.

Contend and down load, and print the Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home with US Legal Forms. There are millions of specialist and state-particular varieties you can use for the enterprise or person requirements.

Form popularity

FAQ

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

There is not requirement for a pronote to be in non-judicial stamp paper. Pronote should contain the date, place of execution, money payable, details of the promissor and promisee and the signature of the promissor across the stamp. Attesting witness or registration is not required.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.