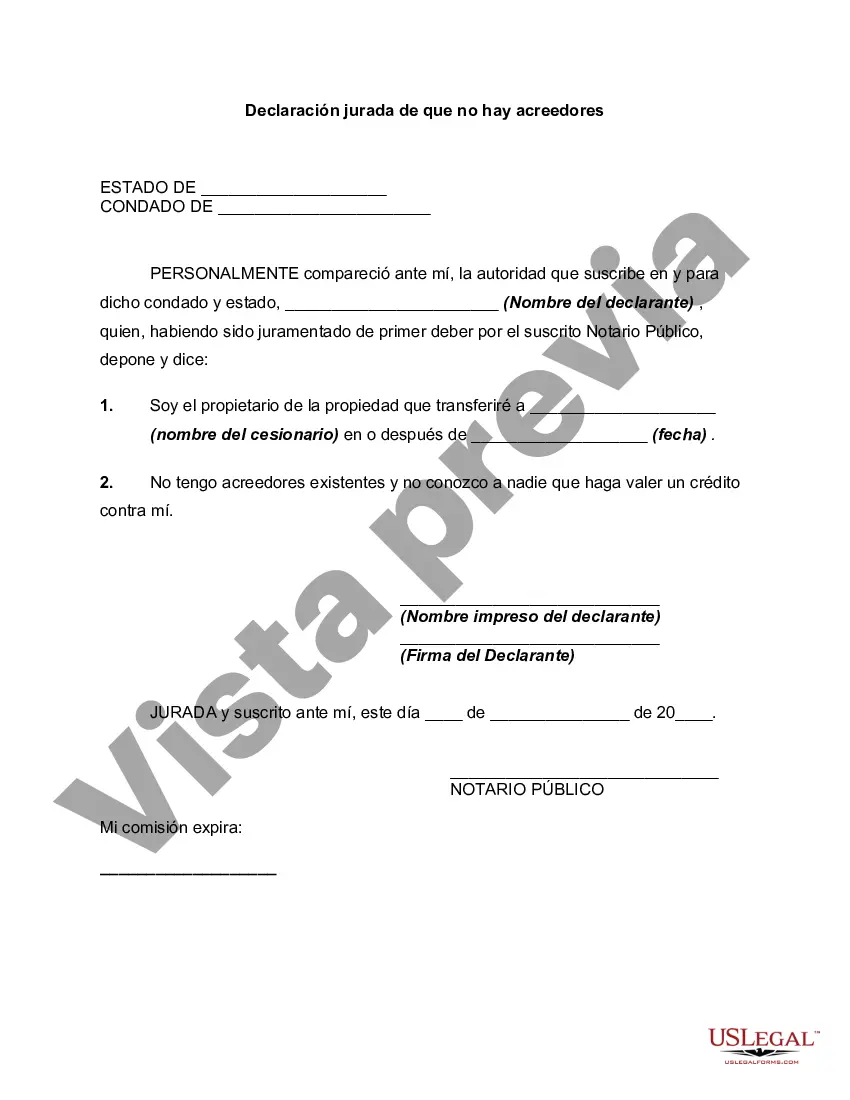

Virginia Affidavit That There Are No Creditors is a legal document used in the state of Virginia to declare that an individual has no outstanding creditors. This affidavit is typically filed during the probate process to transfer assets to the beneficiaries of a deceased individual, stating that all debts have been settled and there are no remaining creditors. However, it is important to note that there may be different types of Virginia Affidavits That There Are No Creditors, depending on the specific circumstances: 1. Probate Affidavit: This type of affidavit is commonly used during the probate process when settling the estate of a deceased person. It is filed with the court to declare that the deceased individual had no outstanding creditors. 2. Small Estate Affidavit: In some cases, when the value of the estate is below a certain threshold, a simplified probate process called "small estate administration" may be allowed. In this case, a Small Estate Affidavit That There Are No Creditors can be used to declare that the estate qualifies for this simplified process due to the absence of creditors. 3. Affidavit of Debts Paid: This affidavit may be required when resolving financial matters, such as during the sale or transfer of real estate property. It states that all debts associated with the property have been paid and there are no creditors with valid claims against it. The keywords relevant to this topic include: — Virginia Affidavit That There Are No Creditors — Probate procesVirginianni— - Settling the estate — Deceased individual's debt— - Small estate administration — Simplified probatprocesses— - Estate value threshold — Affidavit of DebtPieai— - Real estate transfer — Valid claims againspropertyttttttttty.ty

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Declaración jurada de que no hay acreedores - Affidavit That There Are No Creditors

Description

How to fill out Virginia Declaración Jurada De Que No Hay Acreedores?

If you have to complete, obtain, or printing legitimate papers layouts, use US Legal Forms, the greatest assortment of legitimate forms, which can be found online. Utilize the site`s simple and practical lookup to discover the papers you require. A variety of layouts for company and individual functions are sorted by types and states, or key phrases. Use US Legal Forms to discover the Virginia Affidavit That There Are No Creditors with a few clicks.

Should you be currently a US Legal Forms consumer, log in to your bank account and click on the Acquire button to find the Virginia Affidavit That There Are No Creditors. You may also access forms you formerly downloaded inside the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for the proper metropolis/nation.

- Step 2. Utilize the Review option to look through the form`s information. Never neglect to see the description.

- Step 3. Should you be not satisfied together with the develop, take advantage of the Look for area at the top of the display to locate other models of your legitimate develop web template.

- Step 4. Upon having located the shape you require, click on the Get now button. Choose the pricing program you prefer and add your qualifications to register for an bank account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal bank account to complete the purchase.

- Step 6. Pick the file format of your legitimate develop and obtain it on your system.

- Step 7. Full, edit and printing or indicator the Virginia Affidavit That There Are No Creditors.

Every legitimate papers web template you acquire is the one you have eternally. You possess acces to every single develop you downloaded inside your acccount. Click on the My Forms segment and pick a develop to printing or obtain yet again.

Compete and obtain, and printing the Virginia Affidavit That There Are No Creditors with US Legal Forms. There are millions of expert and condition-certain forms you can use for your personal company or individual demands.

Form popularity

FAQ

Generally, estates cannot realistically close before six months after the decedent's death because the surviving spouse has the right to make her claim for an elective share within that six months. Courts can grant an extension for a spouse to file the elective share claim.

Generally, the affidavit may be used for the transfer of personal assets for estates with less than $50,000.00 of personal assets (i.e. does not include their house and various other assets) to transfer certain assets. Virginia Code Section 64.2-601 outlines when this affidavit may be used.

A Virginia small estate affidavit, known formally as the Virginia Small Estate Act Affidavit, may be used to expedite a probate process for an estate worth less than $50,000 (excluding real estate). The form may not be used until at least sixty (60) days have passed since the date of death of the decedent.

A Virginia small estate affidavit, known formally as the Virginia Small Estate Act Affidavit, may be used to expedite a probate process for an estate worth less than $50,000 (excluding real estate). The form may not be used until at least sixty (60) days have passed since the date of death of the decedent.

Generally, estates cannot realistically close before six months after the decedent's death because the surviving spouse has the right to make her claim for an elective share within that six months.

The affidavit (Form CC-1612) gives the file number of the probate and the court with jurisdiction, as well as the name and date of death of the decedent and the name and address of the subscriber (affiant), stating what interest the subscriber has in the estate.

Whenever a release of a deed of trust or other obligation is recorded in the office of the clerk of any circuit court, such clerk shall record a certificate of satisfaction or certificate of partial satisfaction, stating that such deed or other obligation is released.

"Small asset" means any indebtedness owed to or any asset belonging or presently distributable to the decedent, other than real property, having a value, on the date of the decedent's death, of no more than $50,000.

In Virginia, any estate valued at greater than $50,000 at the time of the owner's passing must go through the probate procedure.

Virginia has no separate probate court. The will should be probated in the circuit court in the county or city where the decedent resided at the time of death.