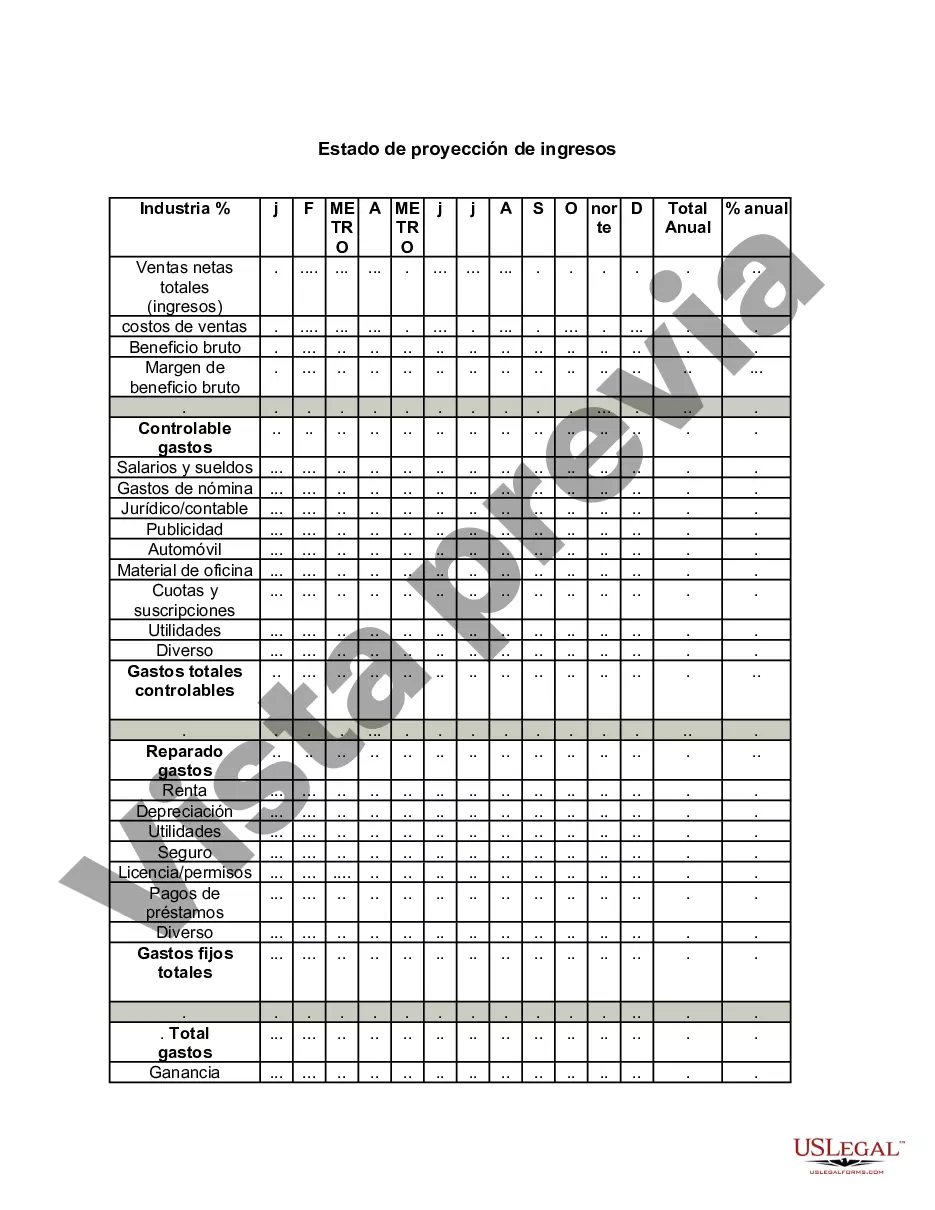

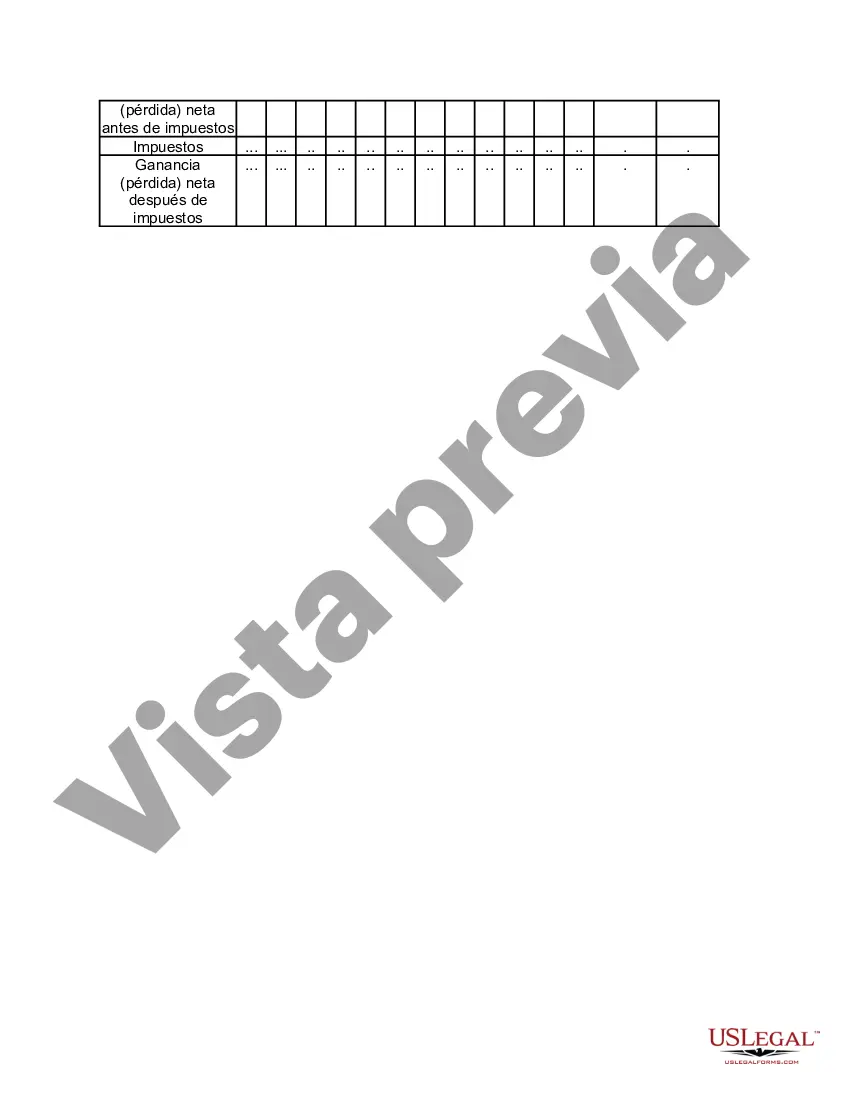

The Virginia Income Projections Statement is a financial document that provides an estimation of an individual's or business's future income in the state of Virginia. This statement is based on various factors such as current earnings, projected growth, and inflation rates. It plays a crucial role in financial planning and budgeting for individuals, businesses, and organizations operating in Virginia. The Virginia Income Projections Statement helps individuals and businesses make informed decisions about investments, loans, and other financial matters. It is particularly useful for individuals who are self-employed, as it helps them anticipate their income and plan their expenses accordingly. Similarly, businesses can use this statement to forecast their revenue and determine their profitability over a specific time period. By utilizing relevant keywords, here is further information about the Virginia Income Projections Statement: 1. Types of Virginia Income Projections Statement: — Individual Income Projections: This type of statement pertains to personal income projections for individuals residing and working in Virginia. It includes projections for employment income, self-employment income, rental income, royalties, pensions, and any other sources of income. — Business Income Projections: This statement focuses on estimating future income for businesses operating in Virginia. It takes into account factors such as sales revenue, gross profit, operating expenses, and potential revenue streams to project the business's overall income. 2. Accuracy: The Virginia Income Projections Statement strives to provide accurate predictions based on historical data, economic indicators, and industry trends. However, it is essential to note that projections may not always align perfectly with actual income due to unforeseen circumstances, market fluctuations, or changes in personal or business circumstances. 3. Financial Planning: The Virginia Income Projections Statement serves as a valuable tool for financial planning. It allows individuals and businesses to formulate effective strategies and make informed decisions regarding their financial goals, such as savings, investments, and retirement planning. 4. Tax Planning: This statement is also crucial for tax planning purposes. By estimating future income, individuals and businesses can anticipate their tax liability and accordingly plan for tax deductions, credits, or adjustments to maximize tax efficiency. 5. Risks and Limitations: It is important to consider the risks and limitations associated with income projections. These projections are based on assumptions and variables susceptible to change, making it necessary to update and review the statement periodically for accuracy. In conclusion, the Virginia Income Projections Statement is a vital financial document that assists individuals and businesses in estimating their future income. It aids in financial planning, tax planning, and decision-making processes, while enabling a proactive approach towards managing personal and business finances effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Estado de proyección de ingresos - Income Projections Statement

Description

How to fill out Virginia Estado De Proyección De Ingresos?

US Legal Forms - among the most significant libraries of authorized kinds in the USA - offers a wide range of authorized record themes you are able to obtain or print out. While using web site, you will get a huge number of kinds for enterprise and personal uses, sorted by types, says, or search phrases.You can get the latest variations of kinds just like the Virginia Income Projections Statement within minutes.

If you currently have a registration, log in and obtain Virginia Income Projections Statement from your US Legal Forms collection. The Obtain switch can look on every form you look at. You gain access to all in the past saved kinds inside the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share basic recommendations to get you started:

- Ensure you have picked out the correct form for your personal area/state. Click the Review switch to check the form`s content material. Read the form explanation to ensure that you have selected the appropriate form.

- In case the form does not suit your needs, utilize the Search discipline at the top of the monitor to get the one that does.

- If you are happy with the form, confirm your choice by clicking the Buy now switch. Then, opt for the costs plan you like and supply your references to sign up on an bank account.

- Process the purchase. Use your bank card or PayPal bank account to accomplish the purchase.

- Pick the structure and obtain the form on your gadget.

- Make alterations. Fill out, change and print out and sign the saved Virginia Income Projections Statement.

Every single format you included in your bank account does not have an expiration time and it is yours for a long time. So, if you want to obtain or print out yet another version, just go to the My Forms portion and then click in the form you want.

Gain access to the Virginia Income Projections Statement with US Legal Forms, the most substantial collection of authorized record themes. Use a huge number of professional and status-certain themes that fulfill your company or personal demands and needs.