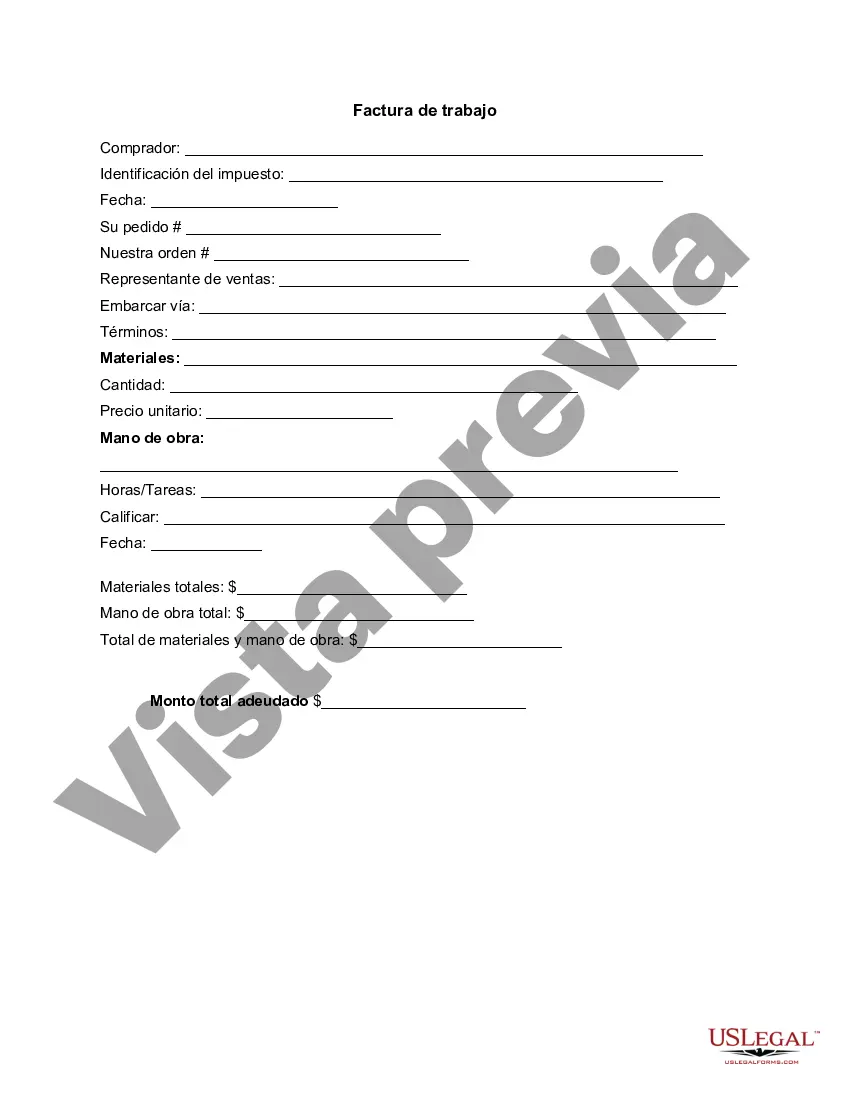

Virginia Invoice Template for Baker is a professionally designed document that enables bakers to efficiently manage their invoicing and billing tasks. This template offers a range of customizable features and fields, catering specifically to the needs of baking business owners in the state of Virginia. By utilizing this template, bakers can streamline their invoicing process and maintain a structured payment system, all while presenting a professional image to their clients. Key Features: 1. Contact Information: The Virginia Invoice Template for Baker includes sections to input the baker's name, business name, address, phone number, email, and website. This ensures that the invoice includes all necessary details for easy communication and reference. 2. Invoice Number and Date: Every invoice generated using this template is assigned a unique identification number, allowing for easy tracking and organization. It also includes spaces to include the invoice date, ensuring accurate record-keeping. 3. Client Details: The template has designated sections to include the client's name, contact information, and billing address. This helps maintain a thorough database of client information for future reference or follow-ups. 4. Itemized List: This template gives bakers the flexibility to add multiple items and services they provide. With separate columns for item descriptions, quantities, rates, and total cost, bakers can clearly outline the services or products rendered, making it easier for clients to review and understand the invoice. 5. Taxes and Discounts: Virginia Invoice Template for Baker includes sections to add applicable taxes, such as sales tax or other state-specific taxes. Additionally, it provides space to enter any discounts or promotional offers applied to the invoice, ensuring accurate calculations. 6. Terms and Conditions: In order to maintain transparency and avoid any confusion regarding payment terms, this template allocates space to include detailed terms and conditions of the baker's business. This can help establish clear expectations regarding due dates, late payment penalties, and refund policies. 7. Payment Information: The invoice template for bakers in Virginia includes a section for clients to provide their preferred payment methods, such as credit card, check, or online payment platforms. By including this information on the invoice, bakers can facilitate swift and convenient payment processing. Types of Virginia Invoice Template for Baker: 1. Basic Invoice Template: This template provides the core features necessary for generating a simple invoice, including sections for contact information, item descriptions, quantities, rates, and totals. 2. Customizable Invoice Template: With this template, bakers can personalize the invoice as per their branding requirements. It allows customization of the logo, colors, fonts, and layout to maintain a consistent visual identity. 3. Sales Invoice Template: This template is designed specifically for bakers who sell their baked goods directly to customers. It includes additional sections for calculating taxes, discounts, and shipping charges if applicable. 4. Monthly Invoice Template: Bakers who prefer monthly billing cycles can use this template, which offers sections for itemizing services provided over an entire month, simplifying the invoicing process for recurring clients. In conclusion, Virginia Invoice Template for Baker is a versatile tool that enables bakers to streamline their invoicing process while maintaining professionalism and efficiency. With its customizable options and various types, this template caters to the specific needs of bakers in Virginia, helping them manage their billing tasks effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Plantilla de factura para panadero - Invoice Template for Baker

Description

How to fill out Virginia Plantilla De Factura Para Panadero?

Finding the right legitimate file template can be a have difficulties. Needless to say, there are tons of templates available on the Internet, but how will you get the legitimate kind you will need? Use the US Legal Forms web site. The support offers thousands of templates, for example the Virginia Invoice Template for Baker, that you can use for company and personal requirements. Every one of the forms are checked by professionals and meet up with federal and state requirements.

Should you be already registered, log in to the account and click the Acquire option to find the Virginia Invoice Template for Baker. Make use of your account to appear with the legitimate forms you have purchased previously. Proceed to the My Forms tab of the account and get yet another backup of your file you will need.

Should you be a whole new end user of US Legal Forms, allow me to share simple instructions so that you can follow:

- First, make certain you have selected the correct kind for your area/area. It is possible to examine the shape utilizing the Review option and read the shape explanation to guarantee this is basically the right one for you.

- In the event the kind will not meet up with your needs, make use of the Seach discipline to get the appropriate kind.

- Once you are certain the shape is suitable, click the Buy now option to find the kind.

- Choose the rates strategy you need and type in the necessary information and facts. Create your account and pay money for the order utilizing your PayPal account or charge card.

- Select the file formatting and acquire the legitimate file template to the gadget.

- Comprehensive, edit and produce and signal the received Virginia Invoice Template for Baker.

US Legal Forms will be the largest collection of legitimate forms where you can discover a variety of file templates. Use the service to acquire expertly-produced papers that follow status requirements.