A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

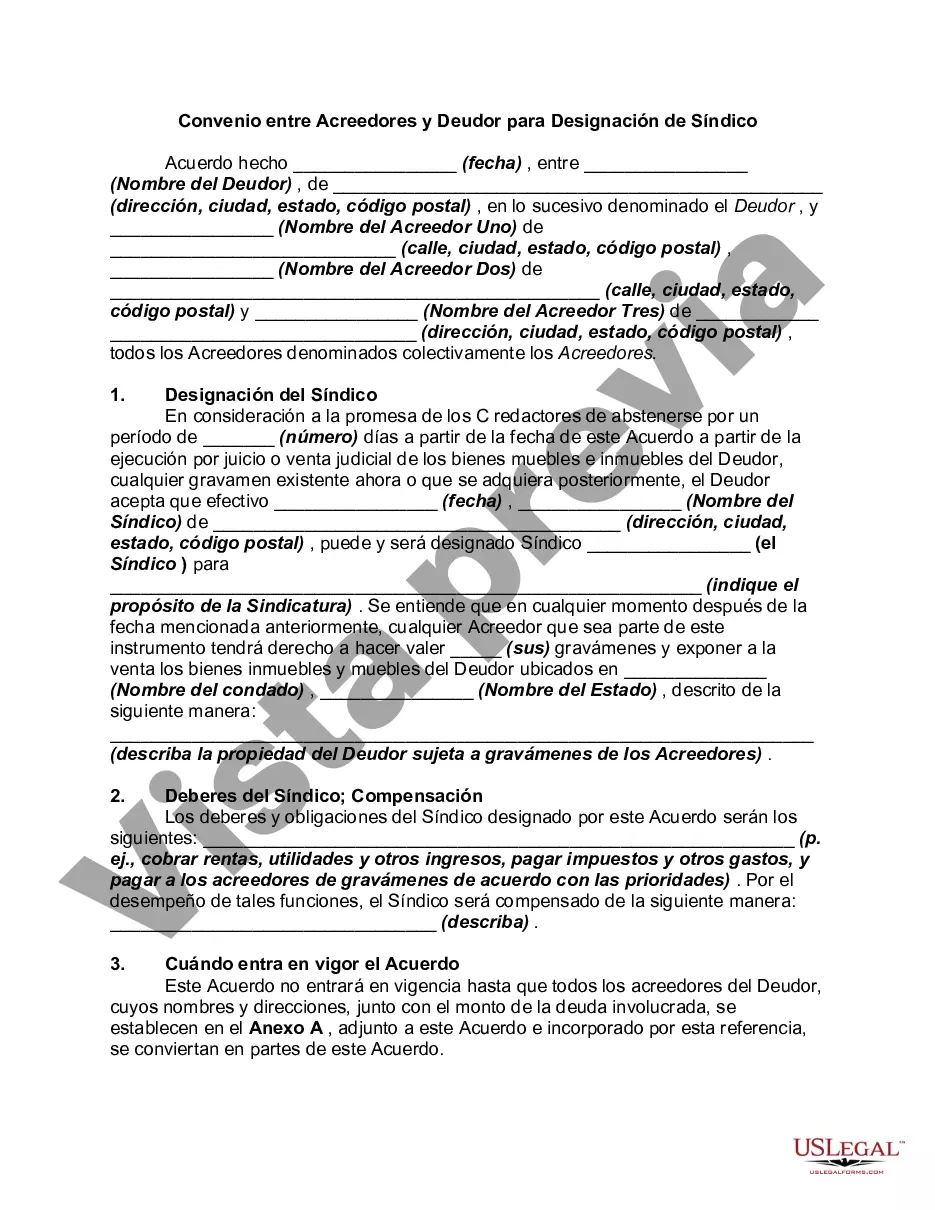

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines agreements between creditors and debtors regarding the appointment of a receiver to manage and oversee the debtor's assets and finances. This agreement aims to resolve financial difficulties faced by the debtor while protecting the interests of the creditors. The Virginia Agreement between Creditors and Debtor for Appointment of Receiver is essential when creditors believe that the debtor is not capable of handling financial obligations and managing their assets efficiently. By appointing a receiver, creditors can ensure that their interests are safeguarded and that the debtor's assets are properly managed to fulfill outstanding debts. There are a few different types of Virginia Agreement between Creditors and Debtor for Appointment of Receiver, including: 1. General Virginia Agreement: This agreement is used when multiple creditors have a collective interest in appointing a receiver to manage the debtor's assets. It outlines the terms, conditions, and responsibilities of the receiver, as well as the debtor's obligations during the receivership process. 2. Specific Virginia Agreement: In cases where a single creditor seeks to appoint a receiver, a specific Virginia Agreement may be utilized. This agreement focuses on the specific obligations and arrangements between that creditor and the debtor. It may include details such as the appointment duration, the receiver's fee structure, and the debtor's obligation to cooperate during the receivership. 3. Virginia Agreement for Insolvency Proceedings: This particular type of agreement is utilized when the debtor is facing insolvency. It outlines the procedures and requirements for the appointment of a receiver in situations where the debtor cannot meet its financial obligations and requires assistance in managing its assets effectively. Key terms and keywords relevant to Virginia Agreement between Creditors and Debtor for Appointment of Receiver include: — Receivership: The state or position of being under the control and management of a receiver appointed by creditors. — Creditor: A person or entity to whom the debtor owes money or has an outstanding financial obligation. — Debtor: The individual, business, or entity who owes money or has financial obligations to a creditor. — Assets: Property, possessions, or rights owned by the debtor that hold economic value and can be used to fulfill outstanding debts. — Financial Difficulties: The financial challenges, constraints, or issues faced by the debtor in meeting its financial obligations. — Insolvency: The state of being unable to pay debts as they become due or when the liabilities of the debtor exceed its assets. — Receiver: An individual or entity appointed by the court or agreed upon by the creditors and debtor to manage the debtor's assets and financial affairs. — Obligations: The responsibilities, duties, or tasks that the debtor and creditors must fulfill under the Virginia Agreement. — Cooperation: The act of working together and providing necessary support and information to ensure effective receivership proceedings. In summary, the Virginia Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that establishes the framework for appointing a receiver to manage the financial affairs of a debtor. This agreement aims to address financial difficulties faced by the debtor while protecting the interests of the creditors. Different types of agreements may exist based on the number of creditors involved or the debtor's specific circumstances.Virginia Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines agreements between creditors and debtors regarding the appointment of a receiver to manage and oversee the debtor's assets and finances. This agreement aims to resolve financial difficulties faced by the debtor while protecting the interests of the creditors. The Virginia Agreement between Creditors and Debtor for Appointment of Receiver is essential when creditors believe that the debtor is not capable of handling financial obligations and managing their assets efficiently. By appointing a receiver, creditors can ensure that their interests are safeguarded and that the debtor's assets are properly managed to fulfill outstanding debts. There are a few different types of Virginia Agreement between Creditors and Debtor for Appointment of Receiver, including: 1. General Virginia Agreement: This agreement is used when multiple creditors have a collective interest in appointing a receiver to manage the debtor's assets. It outlines the terms, conditions, and responsibilities of the receiver, as well as the debtor's obligations during the receivership process. 2. Specific Virginia Agreement: In cases where a single creditor seeks to appoint a receiver, a specific Virginia Agreement may be utilized. This agreement focuses on the specific obligations and arrangements between that creditor and the debtor. It may include details such as the appointment duration, the receiver's fee structure, and the debtor's obligation to cooperate during the receivership. 3. Virginia Agreement for Insolvency Proceedings: This particular type of agreement is utilized when the debtor is facing insolvency. It outlines the procedures and requirements for the appointment of a receiver in situations where the debtor cannot meet its financial obligations and requires assistance in managing its assets effectively. Key terms and keywords relevant to Virginia Agreement between Creditors and Debtor for Appointment of Receiver include: — Receivership: The state or position of being under the control and management of a receiver appointed by creditors. — Creditor: A person or entity to whom the debtor owes money or has an outstanding financial obligation. — Debtor: The individual, business, or entity who owes money or has financial obligations to a creditor. — Assets: Property, possessions, or rights owned by the debtor that hold economic value and can be used to fulfill outstanding debts. — Financial Difficulties: The financial challenges, constraints, or issues faced by the debtor in meeting its financial obligations. — Insolvency: The state of being unable to pay debts as they become due or when the liabilities of the debtor exceed its assets. — Receiver: An individual or entity appointed by the court or agreed upon by the creditors and debtor to manage the debtor's assets and financial affairs. — Obligations: The responsibilities, duties, or tasks that the debtor and creditors must fulfill under the Virginia Agreement. — Cooperation: The act of working together and providing necessary support and information to ensure effective receivership proceedings. In summary, the Virginia Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that establishes the framework for appointing a receiver to manage the financial affairs of a debtor. This agreement aims to address financial difficulties faced by the debtor while protecting the interests of the creditors. Different types of agreements may exist based on the number of creditors involved or the debtor's specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.