It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

A Virginia Business Purchase Proposal is a comprehensive document that outlines the terms and conditions of acquiring a business in the state of Virginia. This proposal serves as a formal request to the owner or entity selling the business, expressing the interest of a potential buyer in acquiring the specified business. It details the buyer's proposed purchase price, terms of payment, proposed timeline, and other crucial aspects relevant to the transaction. Keywords: Virginia, Business Purchase Proposal, terms and conditions, acquiring, buyer, purchase price, terms of payment, timeline, transaction. There are various types of Virginia Business Purchase Proposals, each designed to cater to different scenarios and requirements. These include: 1. Asset Purchase Proposal: This type of proposal involves purchasing the assets of a Virginia-based business, such as equipment, inventory, goodwill, and intellectual property. The proposal outlines the specific assets to be acquired and the proposed purchase price for each item, along with any relevant conditions or warranties. 2. Stock Purchase Proposal: This proposal involves acquiring a majority or minority stake in a Virginia corporation by purchasing its shares. It provides details on the number of shares to be purchased, the proposed purchase price per share, and any conditions or restrictions attached to the transaction. 3. Merger/Acquisition Proposal: In the case of a merger or acquisition, this proposal outlines the terms and conditions for combining two Virginia-based businesses into a single entity or acquiring one business by another. It typically includes details about the valuation of both businesses, proposed ownership structure, management changes, and other relevant terms. 4. Franchise Purchase Proposal: This proposal pertains to the purchase of an existing franchise location in Virginia. It outlines the purchase price, proposed payment terms, transfer of franchise agreement, and any necessary approvals from the franchisor. 5. Partnership/Ownership Transition Proposal: This type of proposal is relevant when a current owner of a Virginia business is seeking a partner or an exit strategy. It outlines the terms for transferring ownership and the proposed structure of the partnership or transition, including financial arrangements and responsibilities. Overall, a Virginia Business Purchase Proposal is a crucial document that enables potential buyers to express their interest in acquiring a business in Virginia. It serves as a detailed outline of the proposed transaction, ensuring transparency and clarity between the buyer and the seller.A Virginia Business Purchase Proposal is a comprehensive document that outlines the terms and conditions of acquiring a business in the state of Virginia. This proposal serves as a formal request to the owner or entity selling the business, expressing the interest of a potential buyer in acquiring the specified business. It details the buyer's proposed purchase price, terms of payment, proposed timeline, and other crucial aspects relevant to the transaction. Keywords: Virginia, Business Purchase Proposal, terms and conditions, acquiring, buyer, purchase price, terms of payment, timeline, transaction. There are various types of Virginia Business Purchase Proposals, each designed to cater to different scenarios and requirements. These include: 1. Asset Purchase Proposal: This type of proposal involves purchasing the assets of a Virginia-based business, such as equipment, inventory, goodwill, and intellectual property. The proposal outlines the specific assets to be acquired and the proposed purchase price for each item, along with any relevant conditions or warranties. 2. Stock Purchase Proposal: This proposal involves acquiring a majority or minority stake in a Virginia corporation by purchasing its shares. It provides details on the number of shares to be purchased, the proposed purchase price per share, and any conditions or restrictions attached to the transaction. 3. Merger/Acquisition Proposal: In the case of a merger or acquisition, this proposal outlines the terms and conditions for combining two Virginia-based businesses into a single entity or acquiring one business by another. It typically includes details about the valuation of both businesses, proposed ownership structure, management changes, and other relevant terms. 4. Franchise Purchase Proposal: This proposal pertains to the purchase of an existing franchise location in Virginia. It outlines the purchase price, proposed payment terms, transfer of franchise agreement, and any necessary approvals from the franchisor. 5. Partnership/Ownership Transition Proposal: This type of proposal is relevant when a current owner of a Virginia business is seeking a partner or an exit strategy. It outlines the terms for transferring ownership and the proposed structure of the partnership or transition, including financial arrangements and responsibilities. Overall, a Virginia Business Purchase Proposal is a crucial document that enables potential buyers to express their interest in acquiring a business in Virginia. It serves as a detailed outline of the proposed transaction, ensuring transparency and clarity between the buyer and the seller.

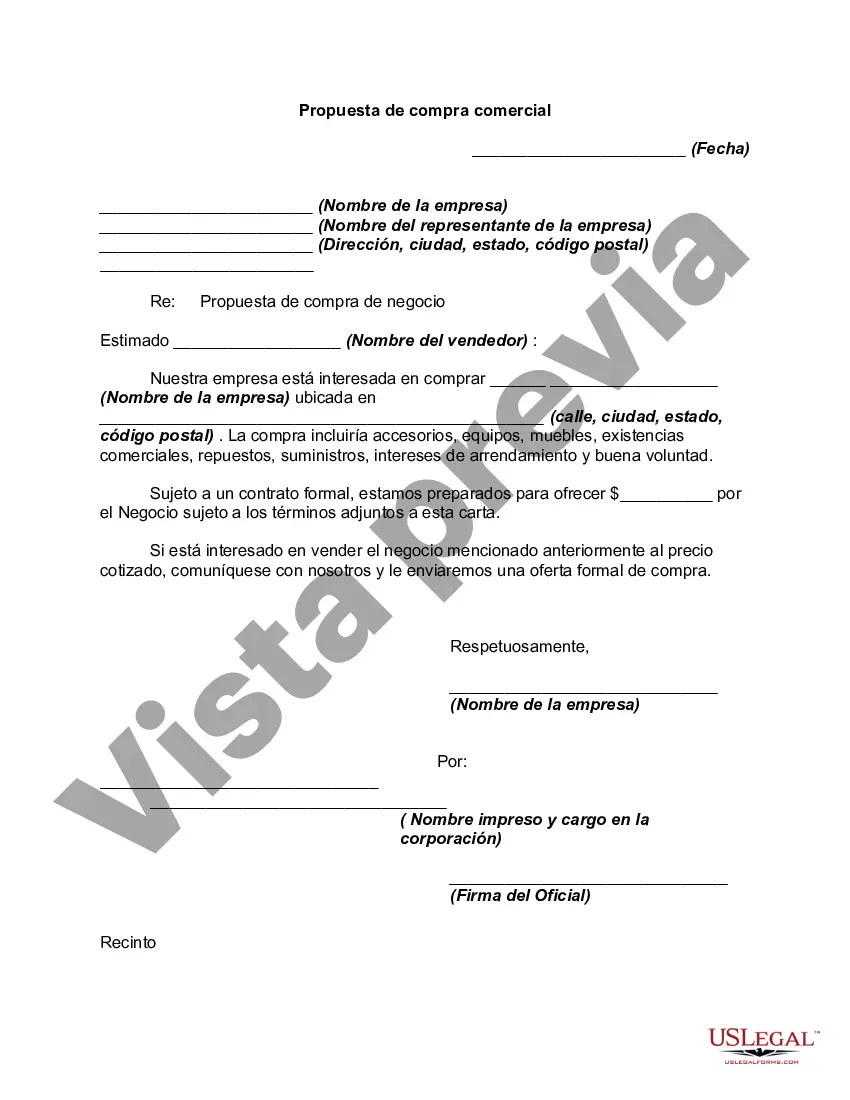

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.