The Virginia Contract for the International Sale of Goods with Purchase Money Security Interest is a legal agreement that governs the sale of goods between parties involved in international trade within the state of Virginia. This type of contract provides protection to both the buyer and the seller by outlining the terms and conditions of the transaction, including the rights and obligations of each party. In the Virginia Contract for the International Sale of Goods with Purchase Money Security Interest, the concept of "purchase money security interest" plays a crucial role. This term refers to the security interest or collateral that a seller retains in the goods sold until the buyer has paid the full purchase price. This security interest serves as a guarantee for the seller in case the buyer defaults on the payment. There are different types of Virginia Contracts for the International Sale of Goods with Purchase Money Security Interest, depending on the specific circumstances and needs of the parties involved. Some common variations include: 1. Explicit Security Agreement: This type of contract clearly outlines the terms and conditions related to the security interest, such as the amount of the purchase price, the description of collateral, and the rights and remedies of the parties in case of default. 2. Conditional Sales Contract: In this scenario, the buyer's ownership of the goods depends on the fulfillment of certain conditions, usually the payment of the full purchase price. Until the conditions are met, the seller retains the right to repossess the goods. 3. Chattel Mortgage: This type of contract allows the seller to retain the ownership of the goods as security until the buyer completes the payment. The buyer possesses and uses the goods, but the seller can reclaim them if the buyer defaults. 4. Title Retention Agreement: In this arrangement, the seller sells the goods to the buyer but retains the legal ownership until the full payment is made. The buyer possesses the goods, but the seller has the right to reclaim them in case of non-payment. When drafting a Virginia Contract for the International Sale of Goods with Purchase Money Security Interest, it is essential to incorporate important keywords in order to accurately describe the contract and make it legally enforceable. Some relevant keywords to consider include "purchase money security interest," "parties' rights and obligations," "default and remedies," "security agreement," "conditional sales," "chattel mortgage," and "title retention agreement." By including these keywords, the contract can be properly identified and recognized by relevant legal authorities.

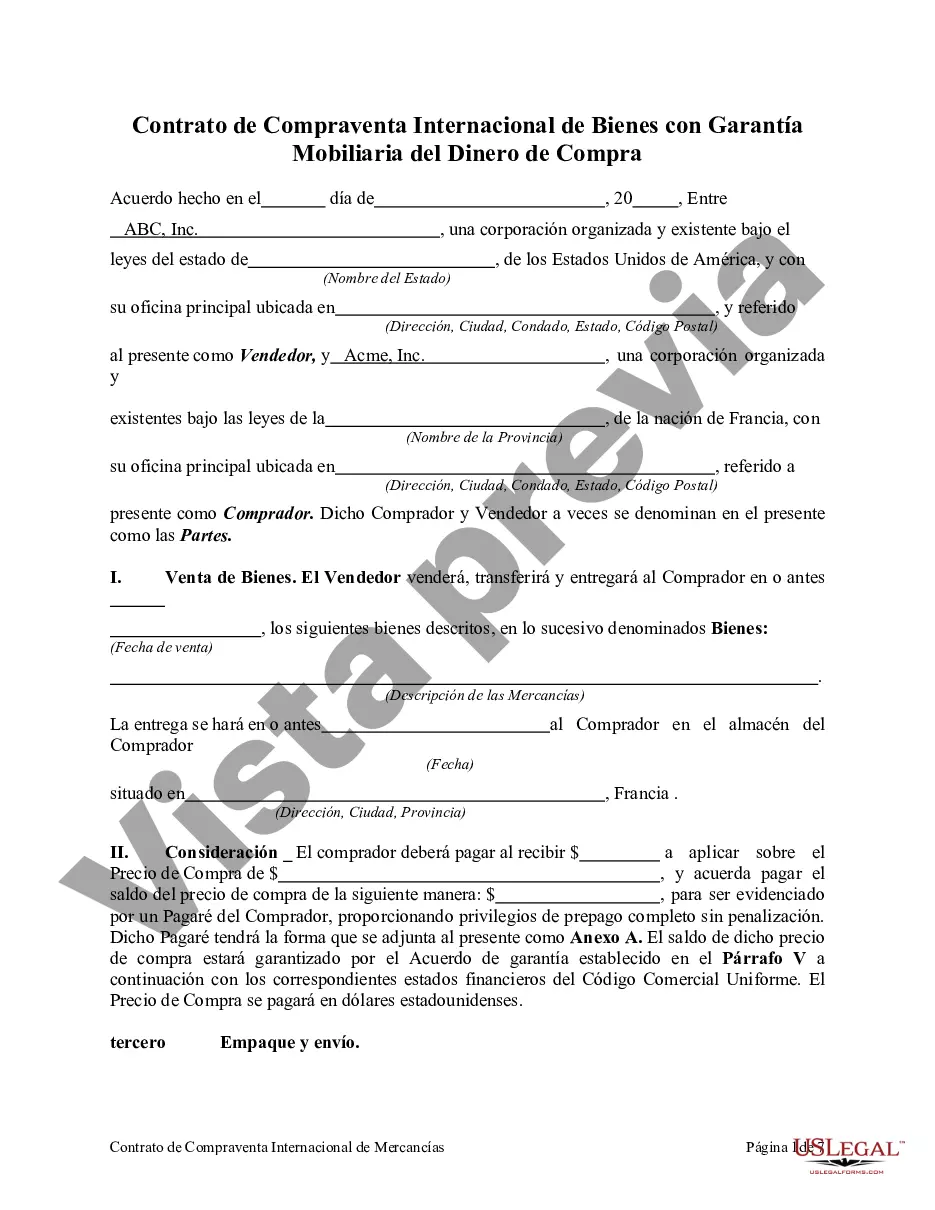

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Contrato de Compraventa Internacional de Bienes con Garantía Mobiliaria del Dinero de Compra - Contract for the International Sale of Goods with Purchase Money Security Interest

Description

How to fill out Virginia Contrato De Compraventa Internacional De Bienes Con Garantía Mobiliaria Del Dinero De Compra?

Have you been within a situation that you require files for both organization or individual functions nearly every time? There are tons of lawful document themes accessible on the Internet, but discovering kinds you can depend on is not straightforward. US Legal Forms gives 1000s of type themes, like the Virginia Contract for the International Sale of Goods with Purchase Money Security Interest, which can be created to satisfy federal and state specifications.

When you are already familiar with US Legal Forms internet site and also have an account, just log in. Following that, it is possible to download the Virginia Contract for the International Sale of Goods with Purchase Money Security Interest web template.

Unless you have an bank account and need to start using US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for your correct metropolis/state.

- Make use of the Review key to review the shape.

- See the description to ensure that you have selected the correct type.

- In case the type is not what you are looking for, use the Look for area to obtain the type that fits your needs and specifications.

- If you obtain the correct type, just click Buy now.

- Select the rates strategy you want, fill out the desired information to make your bank account, and buy the order making use of your PayPal or Visa or Mastercard.

- Choose a handy file structure and download your duplicate.

Discover all of the document themes you have bought in the My Forms food list. You can get a more duplicate of Virginia Contract for the International Sale of Goods with Purchase Money Security Interest at any time, if needed. Just go through the needed type to download or print the document web template.

Use US Legal Forms, probably the most substantial assortment of lawful types, to save some time and avoid blunders. The support gives appropriately produced lawful document themes which can be used for a variety of functions. Create an account on US Legal Forms and commence making your way of life a little easier.