Virginia Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

How to fill out Provisions For Testamentary Charitable Remainder Unitrust For One Life?

Locating the correct authorized document format can be quite challenging.

Of course, there are numerous templates available online, but how can you pinpoint the official form you need.

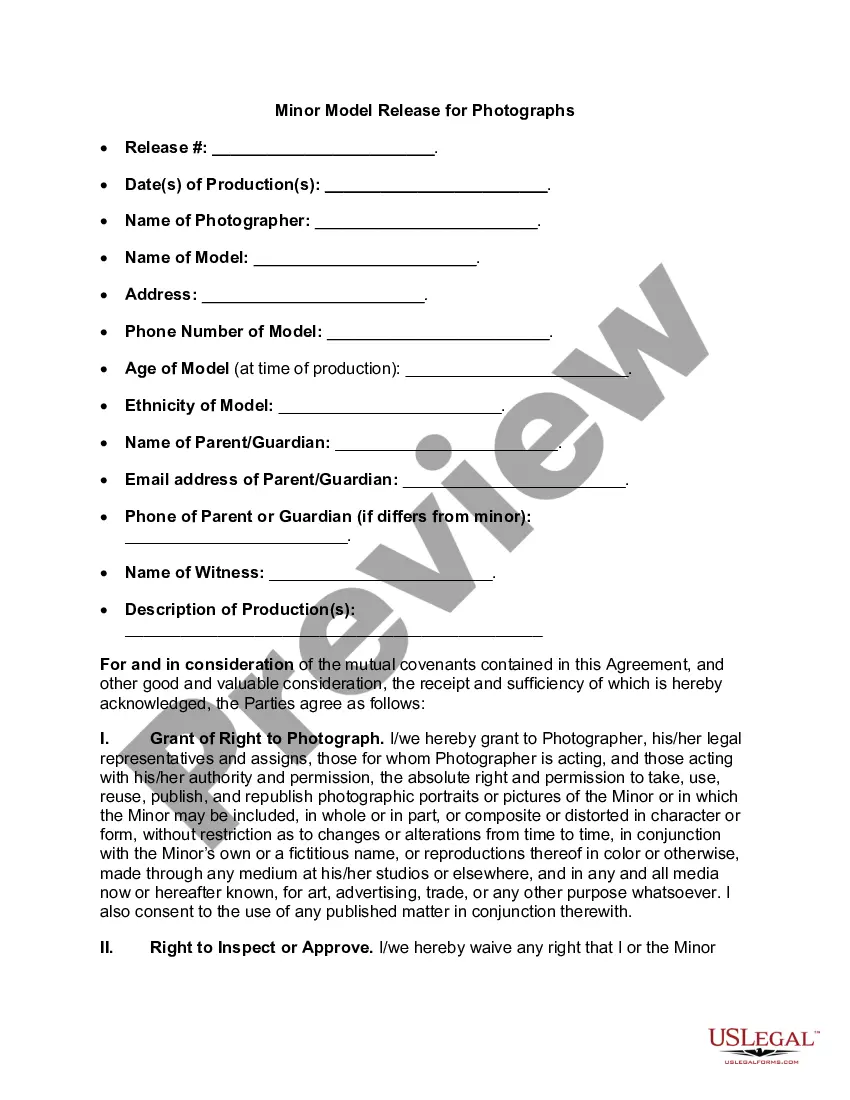

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Virginia Provisions for Testamentary Charitable Remainder Unitrust for One Life, suitable for both business and personal purposes.

If the form does not meet your needs, use the Search section to find the correct form.

- All forms are vetted by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Download button to access the Virginia Provisions for Testamentary Charitable Remainder Unitrust for One Life.

- Use your account to browse the legal forms you have obtained previously.

- Go to the My documents tab in your account and get another copy of the document you need.

- If you are a new user of US Legal Forms, here are easy steps you can follow.

- First, ensure you have selected the correct form for your city/state. You can view the form using the Review button and read the form details to ensure it is suitable for you.

Form popularity

FAQ

The 10% rule stipulates that in a charitable remainder trust, at least 10% of the trust's assets must be allocated to charity after the beneficiaries have received their income. This rule ensures that the charitable purpose of the trust is fulfilled while providing income to the grantor or other beneficiaries. Understanding the specifics of the Virginia Provisions for Testamentary Charitable Remainder Unitrust for One Life can help you create a compliant and effective trust.

To qualify as an ESBT, a trust must meet only three requirements: All of the trust's beneficiaries must be individuals or estates eligible to be S shareholders. Note that, for 1997, certain charitable organizations may hold only contingent remainder interests and cannot be beneficiaries.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

CRUT lie in what the trust pays out on a yearly basis and whether additional contributions are permitted once the trust has been created. With a CRAT, the annuity amount paid each year is fixed. Once you establish a CRAT and make the initial contribution, no further contributions are allowed.

Benefits of CRUTsimmediate income tax deduction for a portion of the contribution to the trust. no upfront capital gains tax on appreciated assets you donate to the trust. steady income stream for life or many years. federal and possible state income tax charitable deduction, and.

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.