Virginia Release from Liability under Guaranty: A Detailed Description A Virginia Release from Liability under Guaranty is a legal document that relieves a guarantor from any future claims or liabilities arising from a guaranty agreement. This release is an essential tool in the field of contract law and is commonly used in various financial transactions, such as loans, leases, and other arrangements where a party guarantees the performance of another party's obligations. Under Virginia law, a guarantor is an individual or entity that assumes responsibility for the debts, obligations, or performance of another party, known as the principal debtor or obliged. The guarantor's role is to provide an added layer of security to the creditor, ensuring repayment or fulfillment of the obligations in the event that the principal debtor fails to do so. The Virginia Release from Liability under Guaranty serves as a legal instrument that allows the guarantor to be released from any further liability once certain conditions are met. These conditions may include the full and timely repayment of the underlying debt or completion of the obligations by the principal debtor. Additionally, the guarantor may seek release from liability if there is a material change in the terms of the original agreement, such as modifications to the payment schedule, interest rates, or collateral provided. It is important to note that there may be different types of Virginia Releases from Liability under Guaranty, depending on the specific circumstances and parties involved. For instance: 1. Full Release: This type of release absolves the guarantor from all obligations and liabilities arising from the guaranty agreement. It provides a complete discharge from any potential claims or actions that may be brought against the guarantor in the future. 2. Partial Release: In some cases, the guarantor may seek a partial release, whereby they are released from a portion of the liability while still being responsible for a portion of the obligations. This type of release is typically negotiated between the parties and is commonly used when the principal debtor has made partial payments or fulfilled part of their obligations. 3. Conditional Release: A conditional release under guaranty involves the satisfaction of specific conditions agreed upon by the parties. These conditions may include the principal debtor meeting certain performance milestones or providing additional collateral, ensuring the creditor's continued protection before releasing the guarantor from liability. It is crucial to consult with a qualified attorney when drafting or executing a Virginia Release from Liability under Guaranty. A legal professional can ensure that the document complies with applicable state laws and accurately reflects the parties' intentions and agreements. It is also important to consider reviewing the release with all involved parties to ensure mutual understanding and consent. In conclusion, a Virginia Release from Liability under Guaranty is a critical legal document that allows a guarantor to be released from further liability once certain conditions are met. This document ensures the smooth resolution of financial transactions and provides protection for both the creditor and the guarantor. Careful consideration should be given to the specific circumstances and types of releases available to ensure the release accurately captures the intended terms and conditions.

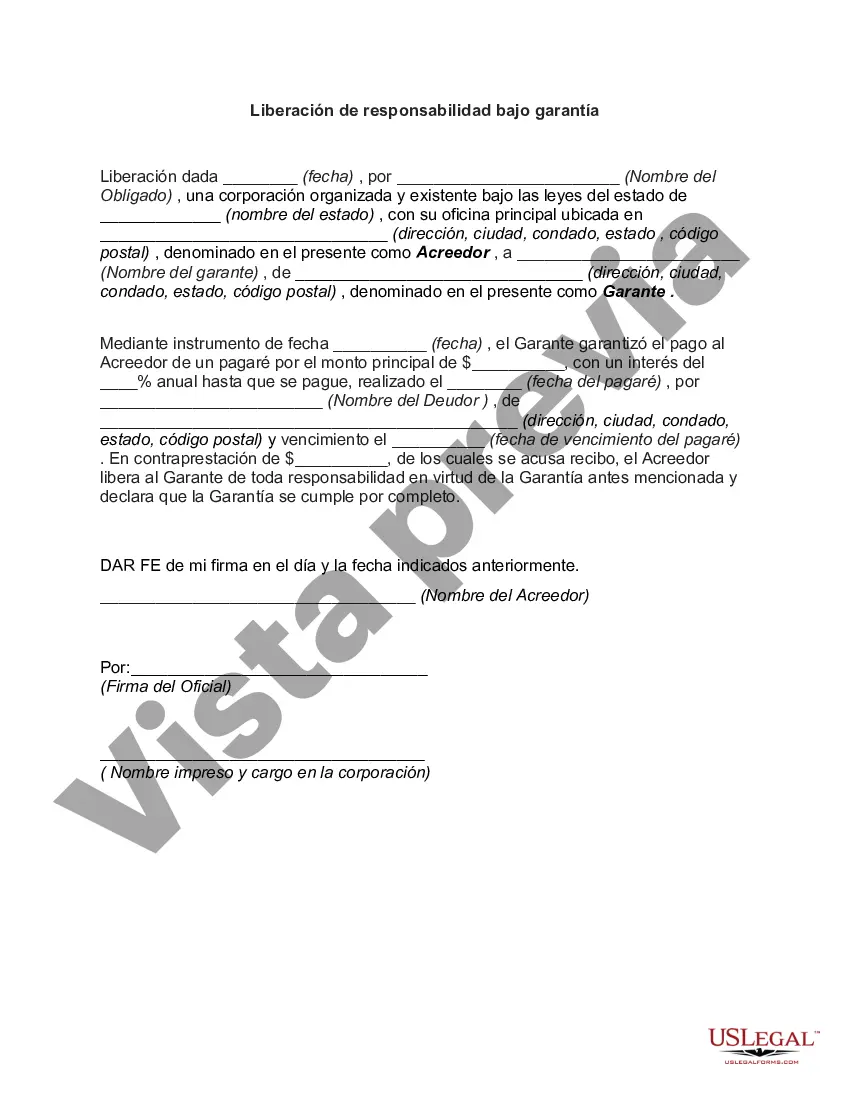

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Liberación de responsabilidad bajo garantía - Release from Liability under Guaranty

Description

How to fill out Virginia Liberación De Responsabilidad Bajo Garantía?

It is possible to commit several hours on-line searching for the authorized document design which fits the state and federal demands you need. US Legal Forms offers thousands of authorized varieties which can be evaluated by professionals. It is simple to obtain or print the Virginia Release from Liability under Guaranty from the support.

If you already have a US Legal Forms accounts, you are able to log in and click on the Download key. After that, you are able to full, edit, print, or sign the Virginia Release from Liability under Guaranty. Each authorized document design you get is your own forever. To have one more version associated with a acquired form, proceed to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site the very first time, keep to the easy guidelines beneath:

- Initially, ensure that you have selected the right document design for the region/city of your liking. See the form explanation to make sure you have selected the proper form. If available, make use of the Preview key to appear throughout the document design as well.

- If you want to find one more version in the form, make use of the Search discipline to get the design that suits you and demands.

- When you have found the design you desire, click Acquire now to continue.

- Select the pricing plan you desire, type your accreditations, and register for an account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal accounts to purchase the authorized form.

- Select the file format in the document and obtain it to the gadget.

- Make alterations to the document if possible. It is possible to full, edit and sign and print Virginia Release from Liability under Guaranty.

Download and print thousands of document web templates making use of the US Legal Forms web site, which offers the greatest variety of authorized varieties. Use expert and condition-distinct web templates to handle your small business or personal needs.