Title: Virginia Debt Adjustment Agreement with Creditor: Understanding the Types and Benefits Introduction: Virginia Debt Adjustment Agreement with Creditor is a legal agreement that allows individuals overwhelmed by debt to negotiate new terms with their creditors. This agreement offers significant relief to debtors by enabling them to repay their debts in an affordable and structured manner. In this article, we will delve into the various types of Virginia Debt Adjustment Agreement with Creditor and explore their benefits. 1. Chapter 13 Bankruptcy: Chapter 13 bankruptcy is a type of Virginia Debt Adjustment Agreement with Creditor that allows individuals with a steady income to reorganize their finances and repay their debts over a three to five-year period. This agreement provides debtors with an opportunity to keep their assets while developing a reasonable repayment plan based on their income and expenses. 2. Debt Settlement Agreement: A Debt Settlement Agreement is another type of Virginia Debt Adjustment Agreement with Creditor that allows debtors to negotiate a reduced payoff amount with their creditors. With this agreement, debtors can reduce the overall principal balance owed and settle the debt for a lower lump sum payment. Debt settlement can help individuals resolve their debts faster and avoid the long-term effects of bankruptcy. 3. Consumer Credit Counseling Agreement: Consumer Credit Counseling Agreement is a popular Virginia Debt Adjustment Agreement with Creditor, whereby debtors work with credit counseling agencies to establish a debt management plan. Under this agreement, debtors make consolidated payments to the agency, which then disburses the funds to creditors on their behalf. The key benefit of this agreement is that it helps individuals develop responsible financial habits and gain control over their debt. 4. Loan Modification Agreement: A Loan Modification Agreement is a specific type of Virginia Debt Adjustment Agreement with Creditor that applies to individuals struggling with mortgage payments. Through this agreement, homeowners can negotiate new loan terms, such as a lower interest rate, extended repayment period, or even forgiveness of a portion of the principal balance. Loan modification agreements prevent foreclosure and allow debtors to retain their properties. Benefits of Virginia Debt Adjustment Agreement with Creditor: — Reduced stress and anxiety associated with unmanageable debt. — Avoidance of legal actions, such as lawsuits, wage garnishment, and property repossession. — Structured repayment plans tailored to debtor's income and affordability. — Potential reduction of interest rates or principal balance owed. — Preservation of personal assets, including homes and vehicles. — Rebuilding of creditworthiness over time. Conclusion: Virginia Debt Adjustment Agreement with Creditor provides a lifeline for individuals struggling with overwhelming debt. Whether through Chapter 13 bankruptcy, debt settlement, consumer credit counseling, or loan modification, debtors can find relief and regain control of their financial well-being. By exploring the various types of agreements available, debtors can choose the best-fitting solution that aligns with their specific needs and goals.

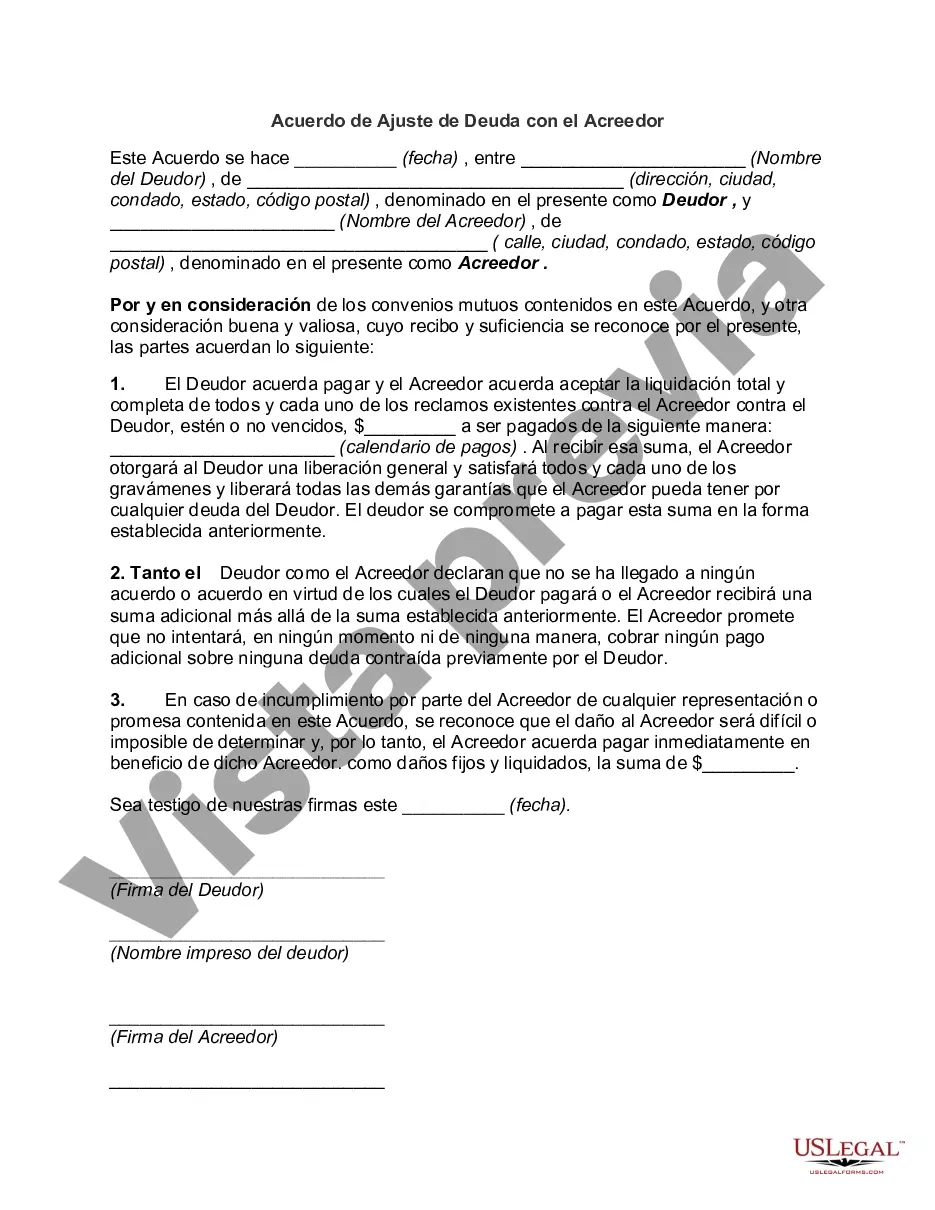

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Virginia Acuerdo De Ajuste De Deuda Con El Acreedor?

You may spend hrs on-line attempting to find the legal papers design that suits the state and federal demands you want. US Legal Forms gives thousands of legal types which are reviewed by specialists. You can easily down load or print out the Virginia Debt Adjustment Agreement with Creditor from your services.

If you already possess a US Legal Forms profile, it is possible to log in and click the Down load switch. Afterward, it is possible to total, modify, print out, or signal the Virginia Debt Adjustment Agreement with Creditor. Every legal papers design you acquire is the one you have eternally. To get an additional copy of the bought kind, check out the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site the first time, follow the straightforward guidelines listed below:

- First, be sure that you have chosen the right papers design for your region/metropolis of your choosing. Browse the kind outline to ensure you have selected the right kind. If offered, make use of the Review switch to search through the papers design as well.

- If you would like find an additional model in the kind, make use of the Lookup discipline to discover the design that meets your requirements and demands.

- After you have discovered the design you would like, click on Get now to carry on.

- Select the pricing prepare you would like, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the transaction. You should use your Visa or Mastercard or PayPal profile to pay for the legal kind.

- Select the file format in the papers and down load it to your gadget.

- Make adjustments to your papers if necessary. You may total, modify and signal and print out Virginia Debt Adjustment Agreement with Creditor.

Down load and print out thousands of papers templates making use of the US Legal Forms web site, that offers the biggest assortment of legal types. Use specialist and status-particular templates to handle your business or specific demands.