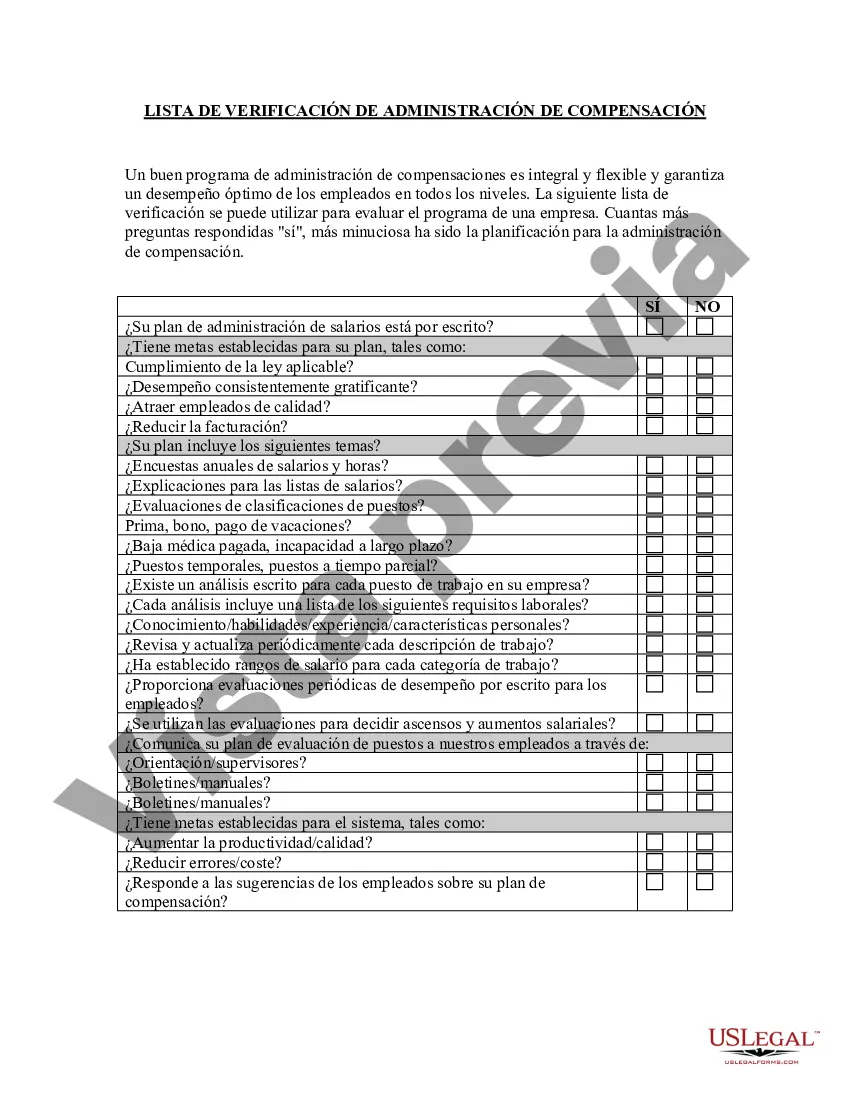

The Virginia Compensation Administration Checklist is a comprehensive document that outlines the necessary steps and considerations for administering compensation within the state of Virginia. It serves as a guide for employers to ensure compliance with Virginia labor laws and regulations while effectively managing their compensation practices. This checklist acts as a valuable resource for human resource professionals, payroll administrators, and business owners who are responsible for compensating their employees accurately and fairly. The checklist covers various critical aspects of compensation administration, including but not limited to: 1. Compensation Structure: This section details the development and implementation of a structured compensation system that aligns with both legal requirements and organizational goals. It includes determining job classifications, salary ranges, and pay grades. 2. Wage and Hour Laws: This part focuses on understanding and adhering to Virginia's specific wage and hour laws, such as minimum wage requirements, overtime pay regulations, and rules regarding breaks and meal periods. 3. Payroll Practices: Here, employers will find guidance on essential payroll practices, including proper record-keeping, accurate pay calculations, paycheck distribution methods, and withholding taxes in accordance with Virginia state laws. 4. Employee Benefits and Perquisites: This section covers various employee benefits and perquisites, such as health insurance, retirement plans, vacation and sick leave policies, and other forms of compensation, ensuring employers are compliant with applicable state laws and regulations. 5. Pay Equity: This segment emphasizes the importance of pay equity, providing guidelines on conducting periodic pay equity reviews to ensure fair and nondiscriminatory compensation practices across gender, race, ethnicity, and other protected classes. 6. Compliance with Anti-Discrimination Laws: Employers must closely follow Virginia's anti-discrimination laws when determining compensation. This section provides an overview of these laws and offers guidance on avoiding discriminatory practices in compensation administration. 7. Documentation and Communication: Proper documentation and communication are crucial in compensation administration. This part offers suggestions on maintaining accurate records, documenting compensation decisions, and communicating salary-related information effectively to employees. Different types of Virginia Compensation Administration Checklists may include specific industry or sector-oriented checklists, such as: 1. Public Sector Compensation Administration Checklist: This checklist caters specifically to public sector employers, addressing unique compensation considerations and guidelines for complying with regulations specific to government entities. 2. Small Business Compensation Administration Checklist: This checklist is designed specifically for small businesses, providing guidance tailored to their needs and limited resources. 3. Nonprofit Organization Compensation Administration Checklist: Nonprofit organizations face distinct challenges in compensation administration. This checklist addresses these challenges, ensuring compliance while considering the organization's mission and charitable goals. In conclusion, the Virginia Compensation Administration Checklist is an indispensable tool for employers operating within Virginia. By following the checklist's guidelines, employers can effectively manage compensation administration, promote fair and compliant practices, and maintain positive employee relations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Lista de verificación de administración de compensación - Compensation Administration Checklist

Description

How to fill out Virginia Lista De Verificación De Administración De Compensación?

Have you been inside a position in which you will need files for sometimes organization or specific functions nearly every time? There are plenty of lawful record templates available on the net, but finding kinds you can trust is not easy. US Legal Forms offers a large number of kind templates, much like the Virginia Compensation Administration Checklist, that are composed to meet federal and state specifications.

If you are already knowledgeable about US Legal Forms internet site and possess a merchant account, basically log in. Afterward, you may download the Virginia Compensation Administration Checklist design.

Should you not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is for that appropriate metropolis/state.

- Utilize the Review button to check the shape.

- See the description to ensure that you have selected the proper kind.

- If the kind is not what you`re looking for, utilize the Search discipline to find the kind that meets your requirements and specifications.

- Whenever you discover the appropriate kind, click on Get now.

- Select the rates program you desire, fill out the necessary info to make your account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Select a hassle-free data file format and download your backup.

Discover every one of the record templates you have bought in the My Forms food list. You may get a more backup of Virginia Compensation Administration Checklist anytime, if possible. Just click on the necessary kind to download or print the record design.

Use US Legal Forms, by far the most substantial selection of lawful types, to conserve some time and avoid errors. The services offers skillfully manufactured lawful record templates that can be used for a variety of functions. Generate a merchant account on US Legal Forms and begin creating your daily life easier.