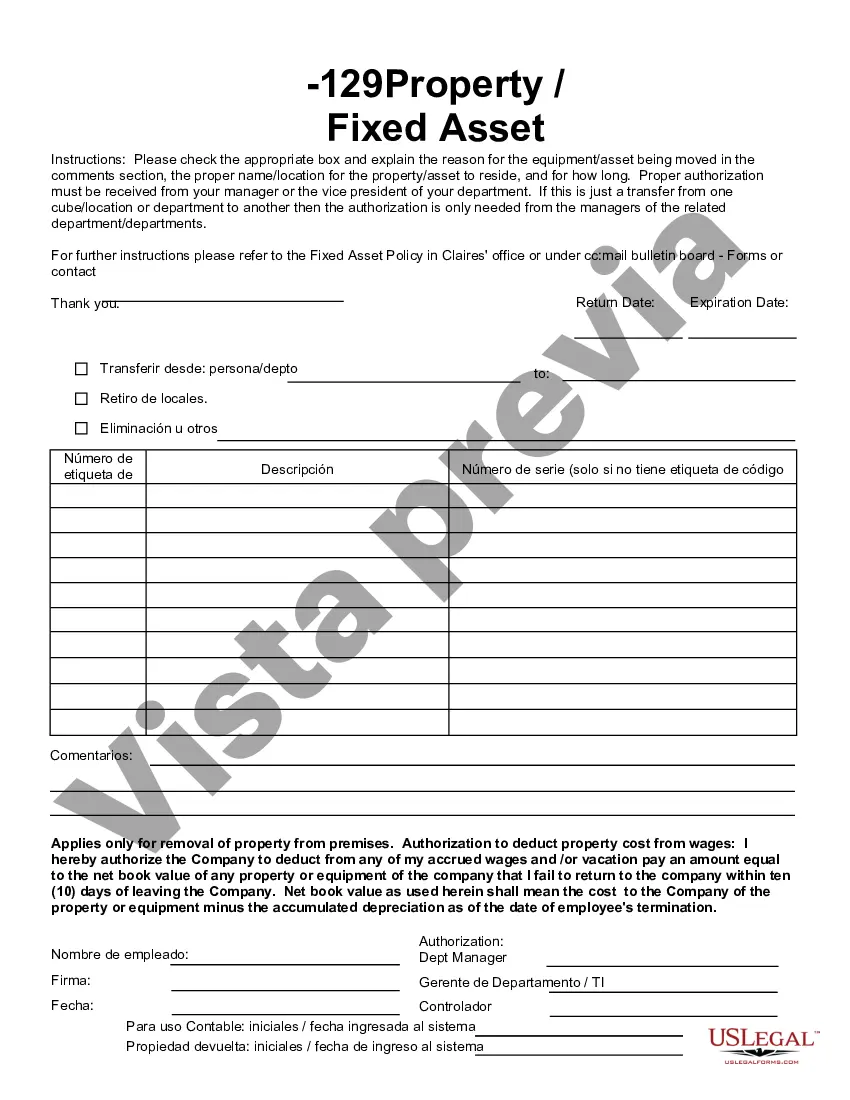

Description: Virginia Fixed Asset Removal Form is a document that enables individuals or organizations in Virginia to remove fixed assets from their inventory or asset register. This form is used when a fixed asset becomes obsolete, damaged beyond repair, or is sold or disposed of. Keywords: Virginia Fixed Asset Removal Form, fixed assets, inventory, asset register, obsolete, damaged, repaired, sold, disposed of. Different Types of Virginia Fixed Asset Removal Forms: 1. Virginia Fixed Asset Removal Form for Obsolete Assets: This type of form is used when a fixed asset is no longer functional or usable due to technological advancements or changes in business operations. 2. Virginia Fixed Asset Removal Form for Damaged Assets: This form is used when a fixed asset becomes damaged beyond repair and needs to be removed from inventory. 3. Virginia Fixed Asset Removal Form for Sold Assets: When a fixed asset is sold to another party, this form is used to remove it from the asset register and update the inventory accordingly. 4. Virginia Fixed Asset Removal Form for Disposed Assets: This form is utilized when a fixed asset is discarded or disposed of due to various reasons such as legal requirements, environmental concerns, or space constraints. The Virginia Fixed Asset Removal Form serves as a crucial tool for maintaining accurate records of fixed assets within an organization. It ensures that the asset register is up-to-date, enabling efficient financial reporting, asset tracking, and decision-making processes. By using this form, individuals and businesses can streamline their fixed asset management and comply with state regulations regarding the removal and disposal of assets in Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Formulario de retiro de activos fijos - Fixed Asset Removal Form

Description

How to fill out Virginia Formulario De Retiro De Activos Fijos?

Are you in the placement that you need documents for sometimes organization or person functions nearly every day? There are tons of lawful record themes available on the net, but finding ones you can depend on isn`t easy. US Legal Forms offers a huge number of type themes, much like the Virginia Fixed Asset Removal Form, which can be published to satisfy state and federal specifications.

When you are presently acquainted with US Legal Forms internet site and have your account, just log in. After that, it is possible to download the Virginia Fixed Asset Removal Form template.

Unless you come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is to the right town/state.

- Use the Preview option to analyze the form.

- See the outline to ensure that you have selected the right type.

- When the type isn`t what you are looking for, take advantage of the Look for discipline to get the type that meets your needs and specifications.

- If you get the right type, simply click Acquire now.

- Choose the prices prepare you desire, fill in the desired information to produce your bank account, and purchase an order making use of your PayPal or bank card.

- Choose a practical document file format and download your backup.

Find every one of the record themes you might have purchased in the My Forms menus. You can obtain a further backup of Virginia Fixed Asset Removal Form anytime, if needed. Just go through the required type to download or printing the record template.

Use US Legal Forms, by far the most comprehensive variety of lawful forms, to save lots of time and prevent errors. The assistance offers professionally created lawful record themes which can be used for an array of functions. Generate your account on US Legal Forms and initiate making your lifestyle a little easier.