Virginia Yearly Expenses refer to the total costs incurred by individuals or households in the state of Virginia over the course of a year. These expenses encompass various financial obligations and necessities required to lead a comfortable lifestyle in the region. The cost of living in Virginia may vary depending on multiple factors such as location within the state, family size, lifestyle choices, and personal preferences. Some key expenses that individuals or households in Virginia commonly encounter throughout the year can include: 1. Housing Expenses: This category covers the costs associated with renting or owning a home in Virginia. It includes mortgage or rent payments, property taxes, insurance, maintenance, and utilities such as electricity, water, and heating. 2. Transportation Expenses: Virginia residents often incur significant expenses related to transportation. This includes the costs of owning a vehicle, such as car payments, fuel, insurance, registration, maintenance, and repairs. Additionally, public transportation costs or commuting expenses for those who use buses or trains should also be taken into account. 3. Food Expenses: This comprises the cost of groceries, dining out, and any other food-related expenditures. The amount spent on food will vary depending on individual dietary preferences, eating habits, and family size. 4. Healthcare Expenses: Virginia residents must budget for healthcare expenses, including health insurance premiums, co-pays, deductibles, prescriptions, and medical services not covered by insurance. It is essential to consider health insurance options and potential out-of-pocket costs when calculating yearly expenses. 5. Education Expenses: Those with dependent children or those pursuing higher education will need to account for educational expenses such as school fees, tuition fees, textbooks, and other related costs. Virginia has a variety of educational institutions that may affect the overall expenses. 6. Personal Expenses: These expenses include personal care items, clothing, entertainment, memberships, and recreational activities. The amount spent in this category will depend upon personal preferences, lifestyle choices, and social activities. 7. Taxes: Virginia residents need to consider state and federal taxes as part of their yearly expenses. This includes income tax, property tax, sales tax, and any other tax obligations specific to the state of Virginia. 8. Savings and Investments: Although not an expense in the traditional sense, saving for retirement, emergency funds, or other investments is an important financial consideration. Allocating a portion of yearly income towards savings is crucial for long-term financial stability and security. It is important to note that the above expenses are general categories, and the specific amounts allocated to each may vary greatly depending on individual circumstances. Costs are subject to change over time, and it is advisable to regularly review and update yearly expense budgets to accurately reflect personal financial goals and requirements.

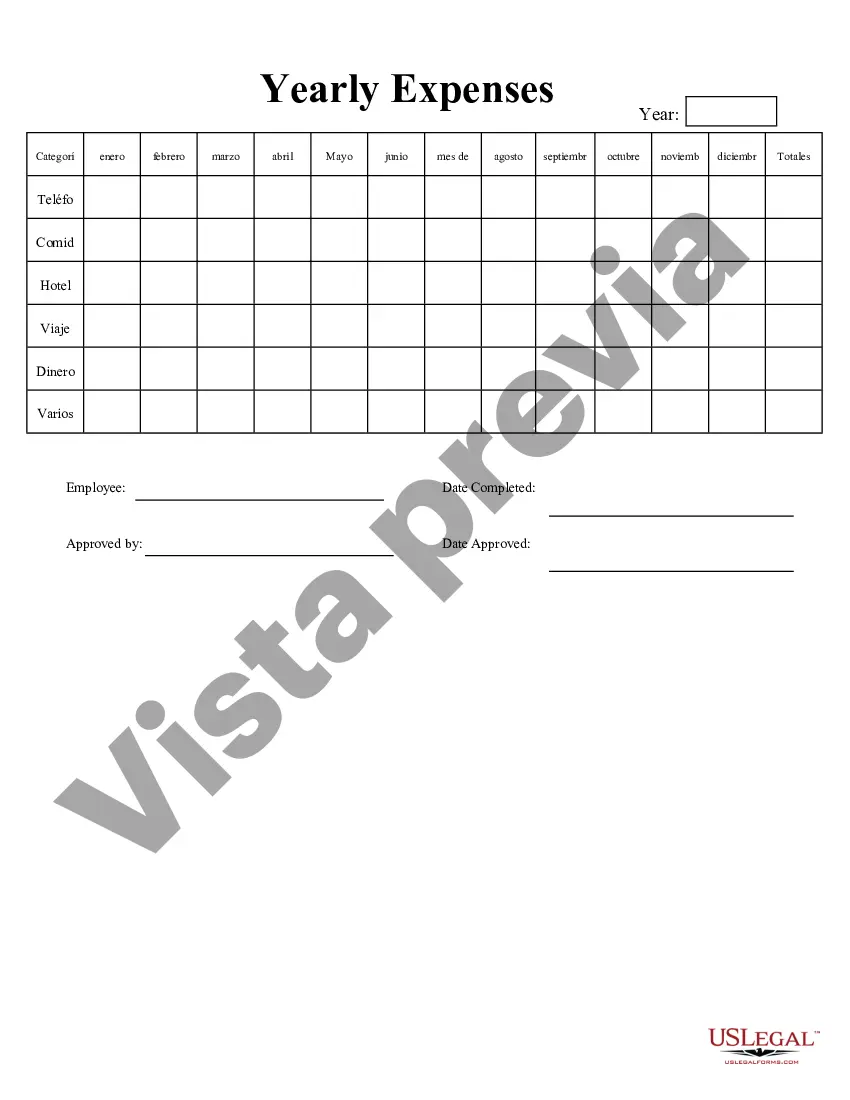

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Gastos Anuales - Yearly Expenses

Description

How to fill out Virginia Gastos Anuales?

It is possible to commit time online looking for the authorized record format which fits the state and federal requirements you need. US Legal Forms gives 1000s of authorized kinds that are analyzed by experts. You can easily down load or printing the Virginia Yearly Expenses from my service.

If you currently have a US Legal Forms profile, you are able to log in and then click the Down load button. Afterward, you are able to full, change, printing, or sign the Virginia Yearly Expenses. Each authorized record format you buy is your own property permanently. To obtain one more backup associated with a purchased kind, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms website the first time, follow the easy directions under:

- First, ensure that you have chosen the right record format for the county/metropolis of your choice. Read the kind explanation to ensure you have selected the correct kind. If accessible, utilize the Preview button to search with the record format also.

- If you wish to locate one more variation of the kind, utilize the Research area to discover the format that meets your requirements and requirements.

- Once you have discovered the format you desire, just click Buy now to continue.

- Select the pricing strategy you desire, type your credentials, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal profile to cover the authorized kind.

- Select the structure of the record and down load it to the gadget.

- Make changes to the record if necessary. It is possible to full, change and sign and printing Virginia Yearly Expenses.

Down load and printing 1000s of record themes while using US Legal Forms site, which provides the largest variety of authorized kinds. Use expert and state-particular themes to take on your organization or individual requirements.