Virginia Applicant Comparison Form

Description

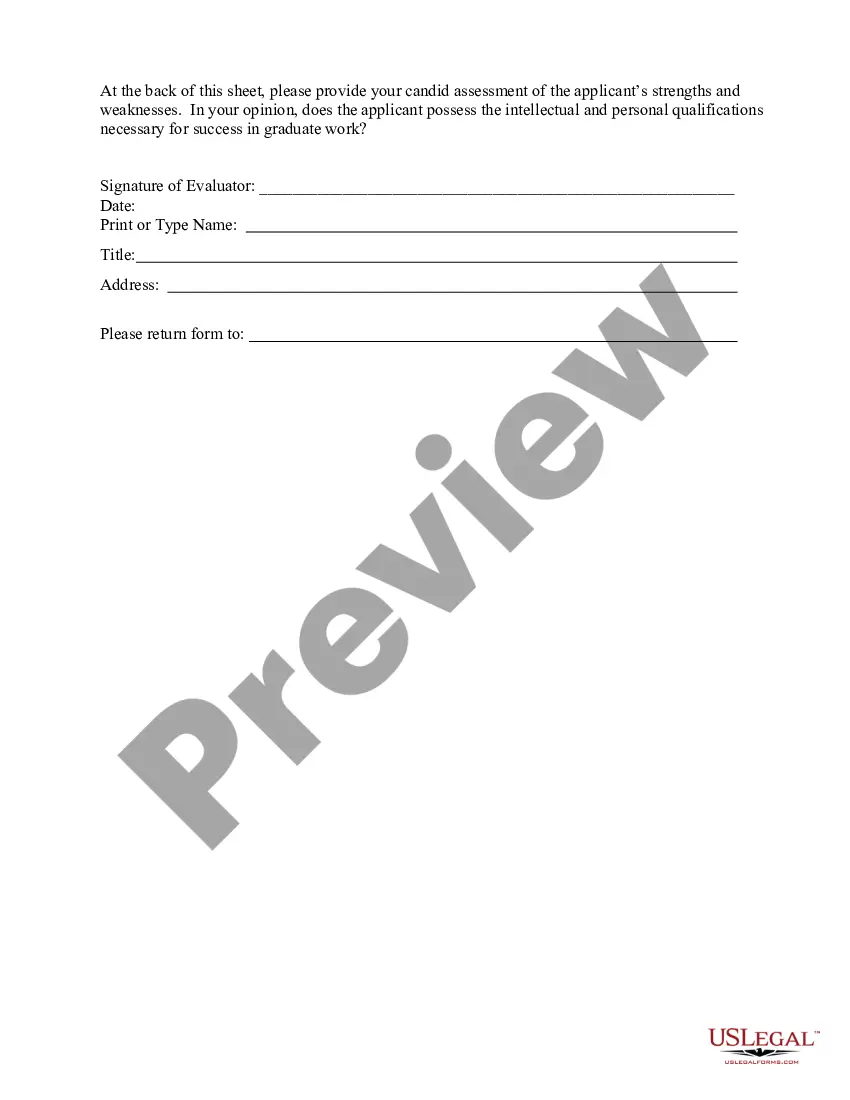

How to fill out Applicant Comparison Form?

You might spend hours online looking for the valid document template that meets the federal and state requirements you desire.

US Legal Forms provides a vast array of valid forms that are assessed by professionals.

You can easily download or print the Virginia Applicant Comparison Form from our platform.

If available, use the Review button to browse through the document template as well. If you wish to find another version of the form, use the Search field to locate the template that fits your requirements and needs. Once you find the template you need, click Get now to continue. Choose the pricing plan you require, enter your credentials, and register for an account on US Legal Forms. Complete the purchase using your credit card or PayPal account to pay for the valid form. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Virginia Applicant Comparison Form. Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Virginia Applicant Comparison Form.

- Every valid document template you obtain is yours permanently.

- To receive another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- Firstly, verify that you have selected the correct document template for your area/city of preference.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

The special education add-on endorsement in Virginia allows licensed teachers to work with students who have special needs. This endorsement requires additional coursework and assessments designed to prepare educators for this important role. The Virginia Applicant Comparison Form can help analyze the necessary qualifications and coursework needed for this endorsement, facilitating a smooth application process.

Here are some tips to make your offer stand out:Add a personalized letter.Offer above the asking price if you can.Put down more earnest money.Ask your loan officer to vouch for you.Be flexible.Get creative.Have your agent contact the seller's listing agent.

VA lenders are free to add their own guidelines on top of what the VA requires. Those additional requirements are known as "overlays." For example, the VA doesn't set a minimum credit score requirement, but most VA lenders do. That credit score benchmark is a lender overlay.

Here are some tips to make your offer stand out:Add a personalized letter.Offer above the asking price if you can.Put down more earnest money.Ask your loan officer to vouch for you.Be flexible.Get creative.Have your agent contact the seller's listing agent.

Veterans and active duty personnel who secure a VA loan have to certify that they intend to personally occupy the property as a primary residence. Essentially, homebuyers have 60 days, which the VA considers a reasonable time, to occupy the home after the loan closes.

The VA requires all mortgage applicants to furnish a form designating a "nearest living relative". It's not a standardized, official VA form but rather a letter or lender generated form stating who the veteran's family contact is in case the VA has lost touch with the borrower.

The lender must always verify that the Veteran is alive at the time of the loan closing, whether or not the Veteran is still in the military. We only require an Alive and Well certification from a Veteran when a POA is being used.

Are VA loans bad for sellers? Not necessarily. Accepting an offer from a buyer using a VA loan when selling your home can be just as difficult as a buyer using a conventional mortgage. There are many myths and misconceptions about the VA loan, but you as a seller should have nothing to worry about.

10 Ways To Get Your Offer Accepted In A Seller's MarketMake Your Offer As Clean As Possible.Avoid Asking For Personal Property.Offer Above-Asking.Put Down A Stronger Earnest Money Deposit (EMD)Waive The Appraisal Contingency.Make A Larger Down Payment In Your Loan Program.Add An Escalation Clause To Your Offer.More items...?

For one, VA loans do not require a down payment and have lower credit requirements to secure the loan. This makes them extremely attractive to eligible buyers, especially first-time home buyers. Also, they are guaranteed by the government, meaning lenders won't take a loss if a buyer defaults on their mortgage.