Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment is a legal agreement that acts as a safeguard for corporations in Virginia against potential financial risks arising from distributorship funds. This agreement is specifically designed to protect corporations from losses incurred when a distributor assigns their rights and responsibilities to another party. When a distributor assigns their distributorship to another entity, it becomes crucial for the corporation to ensure that the assigned party will fulfill their financial obligations and payment responsibilities. To mitigate the risks involved, the Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment comes into play. This agreement outlines the terms and conditions under which the distributor guarantees the payment of distributorship funds by the assignee. The distributor acts as a guarantor, assuring the corporation of payment from the assignee in case of default or non-payment. Keywords: Virginia Guaranty, distributorship funds, assignee, assignment, corporation, payment, guarantee, financial risks, safeguard, legal agreement. Different Types of Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment: 1. Limited Guaranty: In this type, the distributor's guarantee is limited to a specified amount or timeframe. The corporation and distributor mutually agree upon the limitations to ensure a balanced approach that protects both parties' interests. 2. Absolute Guaranty: This type of guaranty holds the distributor fully responsible for the payment of distributorship funds by the assignee without any limitations. The distributor assumes complete liability, ensuring the corporation's peace of mind. 3. Conditional Guaranty: In a conditional guaranty, certain conditions must be met by the assignee for the distributor's guarantee to come into effect. These conditions could include timely payments, adherence to contractual obligations, or maintaining specific performance standards. 4. Joint Guaranty: This form of guaranty involves multiple distributors jointly guaranteeing the payment of distributorship funds by the assignee. By collectively assuming liability, the risk is shared among all the guarantors. It is important for both the distributor and the corporation to carefully consider the terms and type of Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment to ensure a fair and secure contractual relationship. Seeking legal advice is always recommended ensuring compliance with relevant laws and regulations in Virginia.

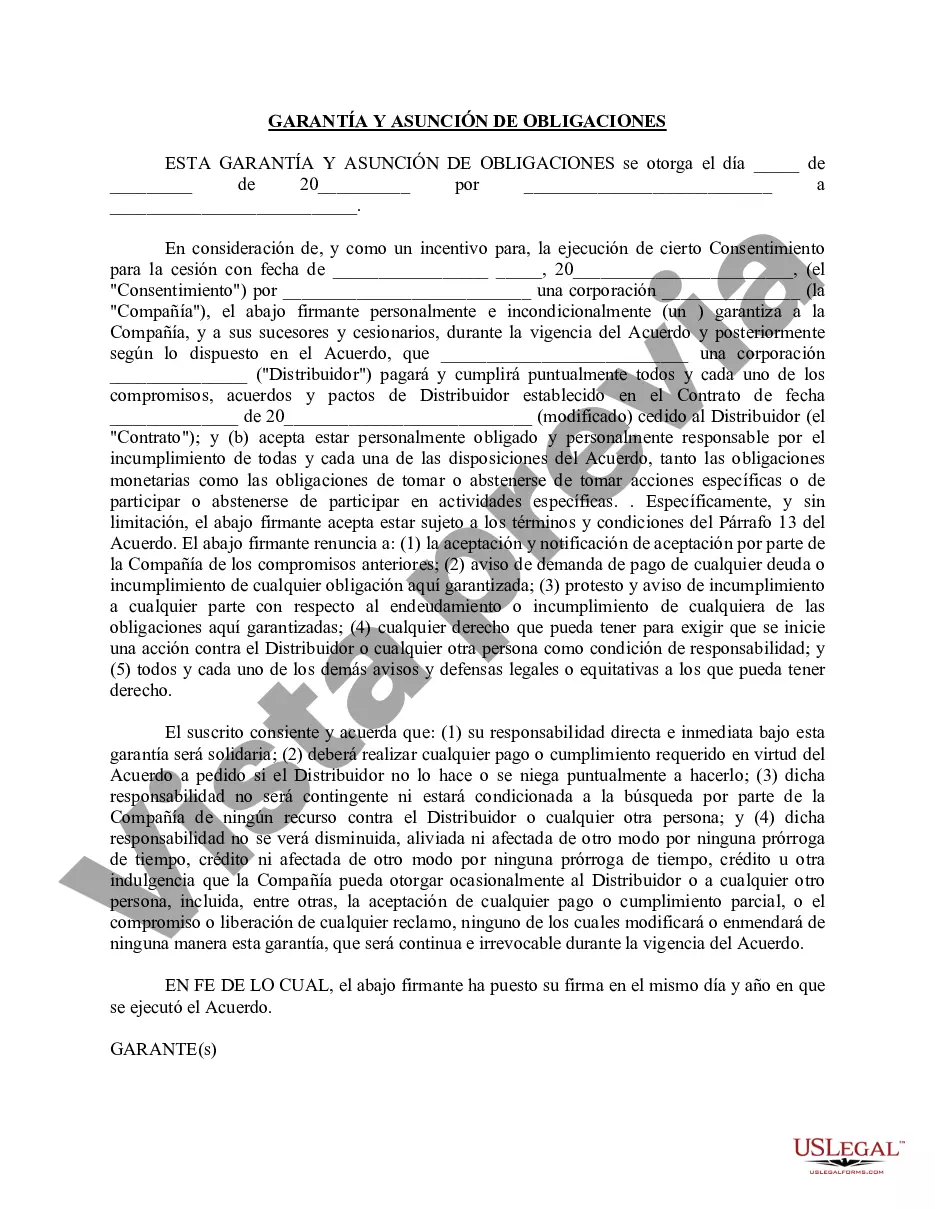

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Garantía del Distribuidor a la Corporación del Pago de los Fondos de Distribución por parte del Cesionario Debido a la Cesión - Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment

Description

How to fill out Virginia Garantía Del Distribuidor A La Corporación Del Pago De Los Fondos De Distribución Por Parte Del Cesionario Debido A La Cesión?

You may commit time online trying to find the lawful record format which fits the federal and state needs you require. US Legal Forms offers a huge number of lawful types which are analyzed by pros. It is possible to down load or print the Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment from the support.

If you have a US Legal Forms accounts, you may log in and click the Acquire key. Following that, you may full, change, print, or signal the Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment. Every single lawful record format you purchase is the one you have permanently. To have another backup associated with a purchased type, check out the My Forms tab and click the related key.

If you are using the US Legal Forms website initially, stick to the easy guidelines listed below:

- Initial, ensure that you have selected the proper record format for your county/metropolis of your choosing. See the type information to make sure you have chosen the correct type. If accessible, use the Preview key to check throughout the record format also.

- In order to locate another variation of your type, use the Lookup discipline to discover the format that meets your requirements and needs.

- After you have discovered the format you would like, just click Get now to move forward.

- Pick the pricing prepare you would like, enter your credentials, and register for a free account on US Legal Forms.

- Complete the purchase. You can utilize your Visa or Mastercard or PayPal accounts to cover the lawful type.

- Pick the formatting of your record and down load it to the product.

- Make changes to the record if needed. You may full, change and signal and print Virginia Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment.

Acquire and print a huge number of record web templates while using US Legal Forms site, that offers the most important collection of lawful types. Use expert and status-distinct web templates to tackle your business or personal requirements.