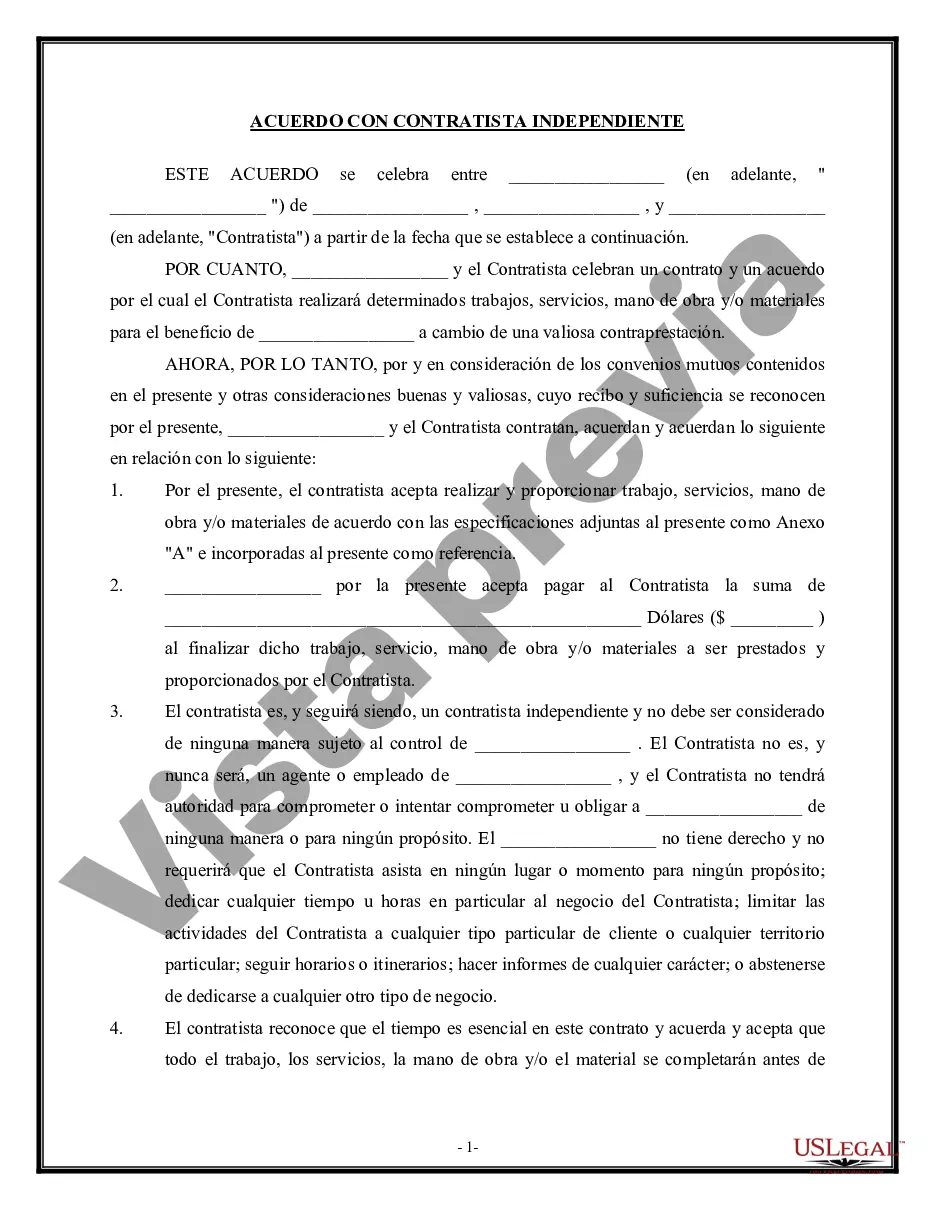

A Virginia Self-Employed Independent Contractor Employment Agreement is a legal document that outlines the terms and conditions of a working relationship between a self-employed individual or an independent contractor and a client or company. This agreement is used when the contractor provides specific work, services, and/or materials to the client and operates as an independent entity rather than an employee. The agreement typically includes various sections that describe the nature of the work or services to be performed, payment details, ownership of materials or intellectual property, confidentiality obligations, termination provisions, and any additional terms that both parties agree upon. It is crucial to have a written contract to clarify the rights and responsibilities of both parties and to avoid potential disputes in the future. There can be different types of Self-Employed Independent Contractor Employment Agreements based on the nature of the work, services, and materials involved: 1. Service Agreement: This type of agreement is used when the contractor is providing professional services to the client, such as consulting, coaching, or project management. It outlines the scope of services, project timelines, deliverables, and payment terms. 2. Work Agreement: A work-specific agreement is used when the contractor is engaged in a specific project or assignment, such as construction, repair, or artistic creation. It details the specific work to be performed, deadlines, materials required, and compensation arrangements. 3. Material Supply Agreement: This agreement is suitable when the contractor is supplying goods or materials to the client, either as a manufacturer, distributor, or supplier. It includes details about the products, specifications, shipping arrangements, pricing, and payment terms. 4. Licensing Agreement: In some cases, a self-employed contractor may grant a license to a client to use their intellectual property, such as software, trademarks, or copyrighted materials. This agreement outlines the terms of use, limitations, royalties, and any restrictions or conditions. It is important to note that these agreements may vary depending on the specific requirements and circumstances of each independent contractor engagement. Legal advice is highly recommended ensuring compliance with Virginia state laws and to protect the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virginia Contrato de Trabajo de Contratista Independiente para Trabajadores por Cuenta Propia - trabajo, servicios y/o materiales - Self-Employed Independent Contractor Employment Agreement - work, services and / or materials

Description

How to fill out Virginia Contrato De Trabajo De Contratista Independiente Para Trabajadores Por Cuenta Propia - Trabajo, Servicios Y/o Materiales?

Are you within a place where you will need paperwork for either organization or personal reasons just about every day time? There are tons of authorized record layouts accessible on the Internet, but getting versions you can trust isn`t simple. US Legal Forms gives 1000s of develop layouts, much like the Virginia Self-Employed Independent Contractor Employment Agreement - work, services and / or materials, that are created to satisfy state and federal specifications.

When you are currently informed about US Legal Forms website and possess a free account, merely log in. Next, you may download the Virginia Self-Employed Independent Contractor Employment Agreement - work, services and / or materials design.

Should you not offer an profile and would like to begin using US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for your right area/county.

- Utilize the Review switch to analyze the shape.

- See the description to ensure that you have selected the right develop.

- In the event the develop isn`t what you are looking for, utilize the Lookup area to find the develop that meets your needs and specifications.

- When you obtain the right develop, click Acquire now.

- Choose the prices program you would like, complete the desired information to produce your bank account, and pay money for the order utilizing your PayPal or bank card.

- Select a practical data file format and download your version.

Get all the record layouts you might have purchased in the My Forms food list. You can obtain a additional version of Virginia Self-Employed Independent Contractor Employment Agreement - work, services and / or materials whenever, if necessary. Just click on the needed develop to download or print out the record design.

Use US Legal Forms, one of the most substantial variety of authorized forms, to save lots of efforts and steer clear of faults. The services gives appropriately made authorized record layouts that can be used for an array of reasons. Create a free account on US Legal Forms and commence making your daily life a little easier.