This document is a checklist for a venture capital term sheet. It addresses each component of a venture capital term sheet and discusses the requirements of each. Among the topics covered are: type of securities to be issued, dividends and distributions, liquidation preference, conversion features, and redemption features.

Virginia Venture Capital Term Sheet Guidelines Checklist is a comprehensive document that outlines the essential components and terms to be included in a venture capital term sheet for companies seeking investment in the state of Virginia. This checklist serves as a guide for both venture capitalists and entrepreneurs, ensuring that all crucial aspects are considered and properly addressed during the negotiation process. By following these guidelines, both parties can establish a mutually beneficial agreement and avoid any potential misunderstandings or conflicts. The checklist covers various key areas, including: 1. Valuation and Investment Amount: This section outlines the proposed valuation of the company and the amount of investment to be made by the venture capital firm. 2. Preferred Stock: It specifies the terms of the preferred stock that will be issued to the investors, including the liquidation preference, dividend rights, voting rights, and conversion rights. 3. Board Representation: The checklist provides guidelines regarding the composition and representation of the board of directors, including the number of seats allocated to the venture capital firm. 4. Protective Provisions: This section covers the protective provisions that the venture capital firm may require to safeguard its investment, such as veto rights over certain decisions or protective covenants. 5. Anti-Dilution Protections: It outlines the mechanisms to protect the investors' ownership percentage in case of future stock issuance sat a lower valuation. 6. Preemptive Rights: The checklist details the conditions under which the venture capital firm may have the option to participate in future fundraising rounds to maintain its ownership stake. 7. Information Rights: It includes provisions regarding the frequency and type of financial and operational information that the company is required to provide to the venture capital firm. 8. Exit Strategies: This section focuses on outlining the potential exit options for the venture capital firm, such as initial public offering (IPO), acquisition, or merger. 9. Governing Law and Jurisdiction: The checklist specifies the legal framework and jurisdiction (in this case, Virginia) that will govern any disputes arising from the term sheet or the investment agreement. Some variations or types of Virginia Venture Capital Term Sheet Guidelines Checklists may exist based on specific industries, stages of the company's growth, or the preferences of various venture capital firms operating in Virginia. These variations may address additional aspects such as milestone-based funding, non-compete agreements, intellectual property rights, or specific industry regulations. In conclusion, the Virginia Venture Capital Term Sheet Guidelines Checklist serves as a valuable resource for companies and investors alike, ensuring that the negotiation process is efficient, transparent, and in line with the best practices within the venture capital industry.

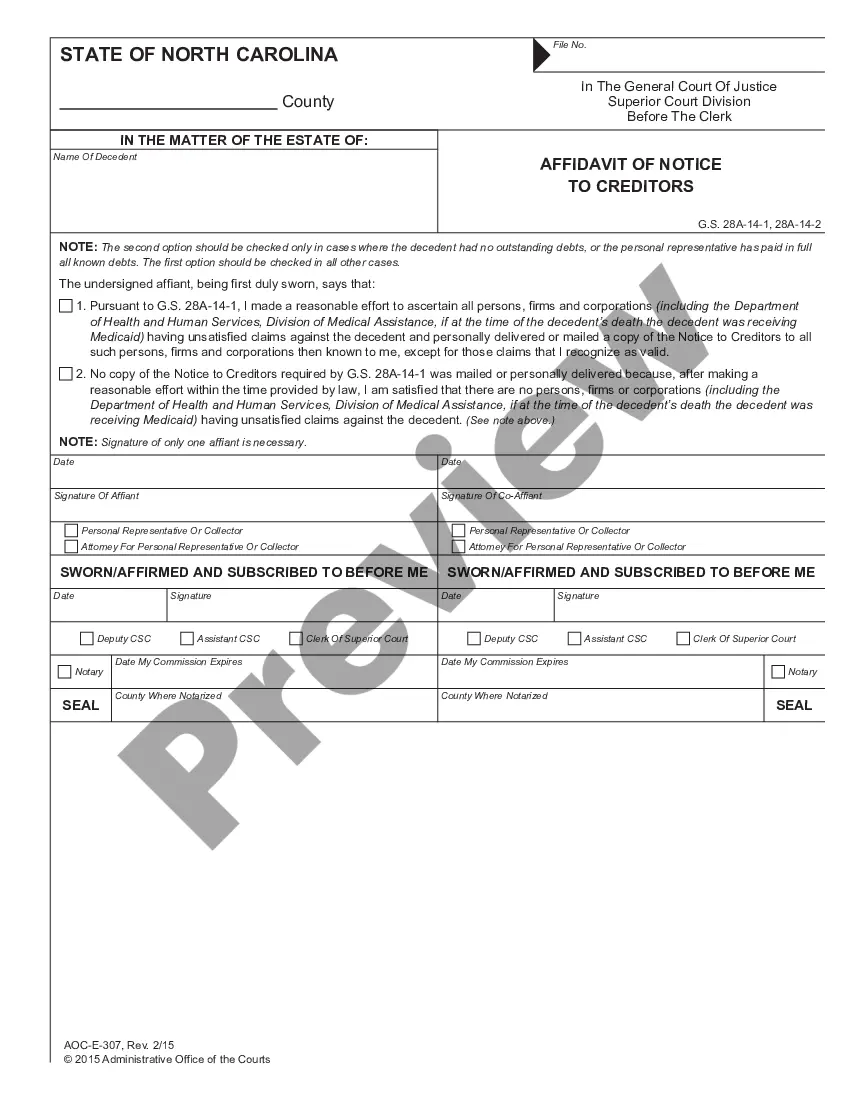

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.