- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

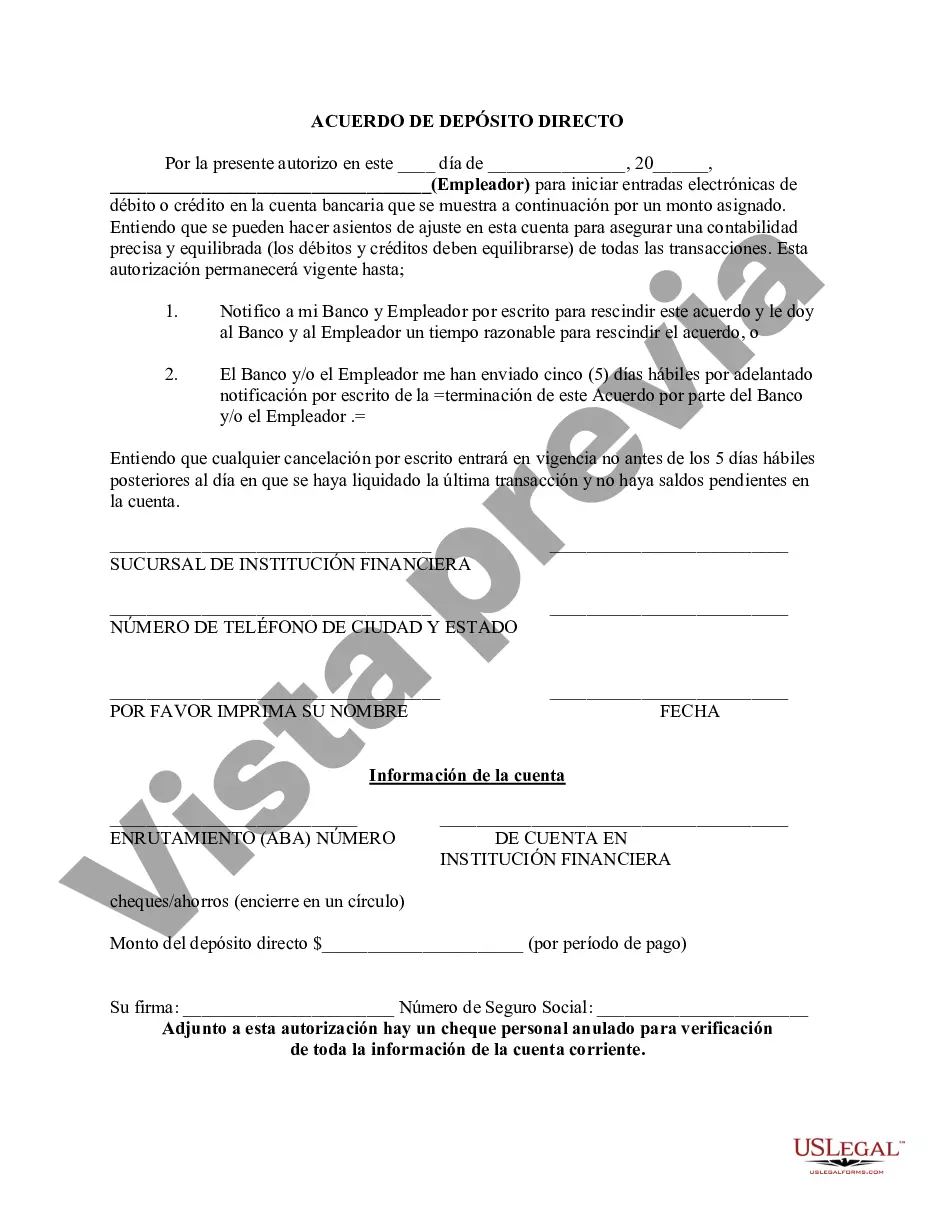

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Virgin Islands Direct Deposit Agreement is a contractual agreement between an individual or an entity and a financial institution operating in the U.S. Virgin Islands. This agreement enables the automatic transfer of funds from a payer, such as an employer or a government agency, directly into the recipient's bank account without the need for paper checks. One type of the Virgin Islands Direct Deposit Agreement is the Personal Direct Deposit Agreement, which allows an individual to authorize their employer to deposit their salary directly into their bank account. This agreement streamlines the payment process, eliminating the need for physical checks and reducing potential delays in receiving funds. It offers the convenience of immediate access to funds, as well as the security of transferring money electronically. Another type is the Business Direct Deposit Agreement, which allows businesses to receive payments from their customers or other entities directly into their banking accounts. This agreement benefits businesses by reducing administrative costs associated with check processing and manual reconciliations. It improves cash flow management, as funds are deposited directly, bypassing the time-consuming clearing process. Virgin Islands Direct Deposit Agreements adhere to strict security protocols, ensuring the safe transmission and storage of sensitive financial information. Encryption and authentication technologies are employed to protect data during its transmission and storage, safeguarding against potential unauthorized access or fraud. To enter into a Virgin Islands Direct Deposit Agreement, an individual or business must complete the necessary forms provided by their financial institution. These forms typically require the recipient's banking information, such as their account number and routing number, as well as their consent to authorize the direct deposit. Once the Virgin Islands Direct Deposit Agreement is in effect, the payer can initiate and schedule automatic deposits to the recipient's bank account electronically. The recipient can expect to receive their funds on the agreed-upon date, without the hassle of physically depositing a check or waiting for it to clear. In summary, Virgin Islands Direct Deposit Agreement allows individuals and businesses to receive funds directly into their bank accounts, offering convenience, efficiency, and enhanced security. The agreement includes various types, such as Personal Direct Deposit and Business Direct Deposit Agreements, tailored to meet the needs of different recipients. By eliminating the need for paper checks, these agreements streamline payment processes, enhance cash flow management, and reduce administrative costs.

Virgin Islands Direct Deposit Agreement is a contractual agreement between an individual or an entity and a financial institution operating in the U.S. Virgin Islands. This agreement enables the automatic transfer of funds from a payer, such as an employer or a government agency, directly into the recipient's bank account without the need for paper checks. One type of the Virgin Islands Direct Deposit Agreement is the Personal Direct Deposit Agreement, which allows an individual to authorize their employer to deposit their salary directly into their bank account. This agreement streamlines the payment process, eliminating the need for physical checks and reducing potential delays in receiving funds. It offers the convenience of immediate access to funds, as well as the security of transferring money electronically. Another type is the Business Direct Deposit Agreement, which allows businesses to receive payments from their customers or other entities directly into their banking accounts. This agreement benefits businesses by reducing administrative costs associated with check processing and manual reconciliations. It improves cash flow management, as funds are deposited directly, bypassing the time-consuming clearing process. Virgin Islands Direct Deposit Agreements adhere to strict security protocols, ensuring the safe transmission and storage of sensitive financial information. Encryption and authentication technologies are employed to protect data during its transmission and storage, safeguarding against potential unauthorized access or fraud. To enter into a Virgin Islands Direct Deposit Agreement, an individual or business must complete the necessary forms provided by their financial institution. These forms typically require the recipient's banking information, such as their account number and routing number, as well as their consent to authorize the direct deposit. Once the Virgin Islands Direct Deposit Agreement is in effect, the payer can initiate and schedule automatic deposits to the recipient's bank account electronically. The recipient can expect to receive their funds on the agreed-upon date, without the hassle of physically depositing a check or waiting for it to clear. In summary, Virgin Islands Direct Deposit Agreement allows individuals and businesses to receive funds directly into their bank accounts, offering convenience, efficiency, and enhanced security. The agreement includes various types, such as Personal Direct Deposit and Business Direct Deposit Agreements, tailored to meet the needs of different recipients. By eliminating the need for paper checks, these agreements streamline payment processes, enhance cash flow management, and reduce administrative costs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.