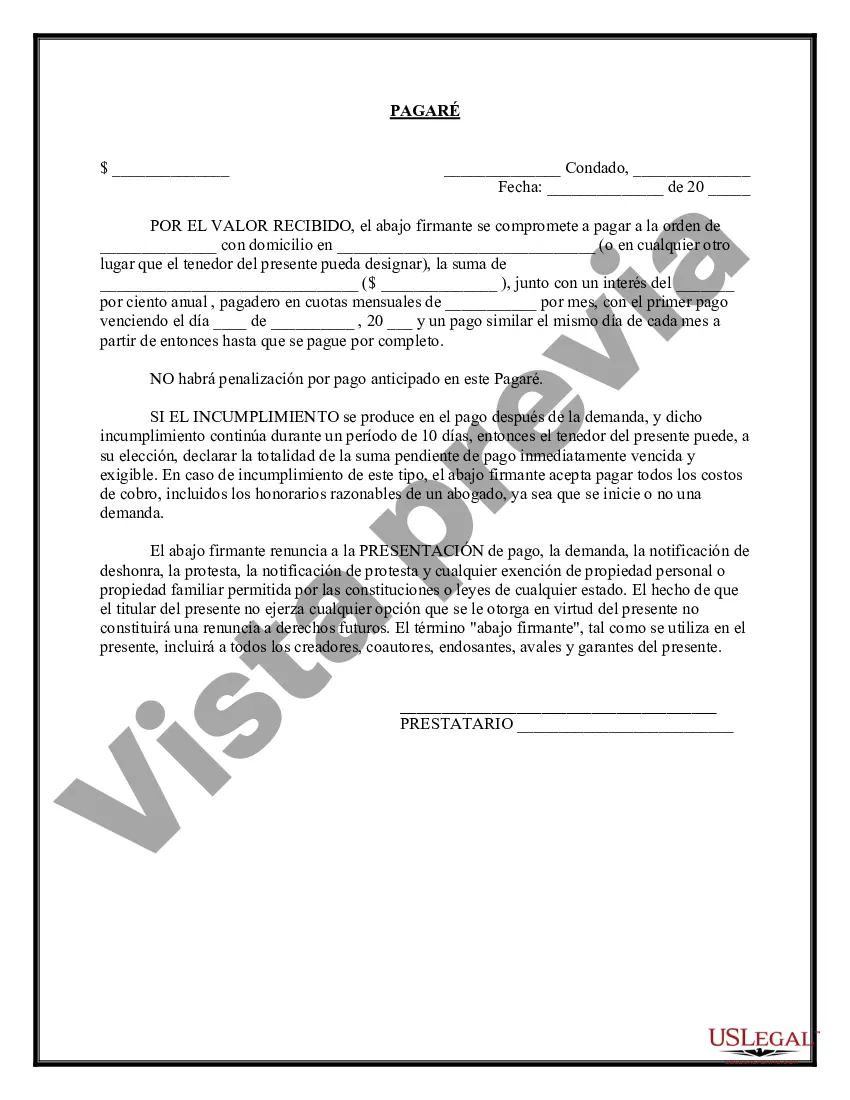

A Virgin Islands Promissory Note with Installment Payments is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower residing in the Virgin Islands. This type of promissory note specifies the repayment method in the form of installment payments, providing flexibility and convenience for both parties involved. The key elements of a Virgin Islands Promissory Note with Installment Payments include the names and contact details of the lender and borrower, the loan amount, the interest rate applied, the repayment period, and the frequency and amount of each installment payment. There are different types of the Virgin Islands Promissory Notes with Installment Payments, including: 1. Fixed Installment Promissory Note: This type of promissory note entails predetermined, equal installment payments over the repayment period. The borrower and lender agree upon the installments' amount and interval, ensuring consistent and predictable payments. 2. Variable Installment Promissory Note: Unlike the fixed installment promissory note, this variation allows for fluctuating installment payments. The amount and frequency of payments may vary, depending on factors such as the borrower's financial situation or changes in the interest rate. 3. Balloon Payment Promissory Note: In this type of promissory note, the borrower agrees to make smaller regular installments during the repayment period, with a large lump sum payment (the balloon payment) due at the end. This mechanism can be useful for borrowers who expect a significant influx of cash or plan to refinance the loan before the balloon payment is due. 4. Amortizing Promissory Note: An amortizing promissory note requires the borrower to make periodic installment payments that gradually decrease both the principal amount and the accrued interest. This ensures a systematic repayment over time, allowing the borrower to ultimately pay off the entire loan. It is important to note that a Virgin Islands Promissory Note with Installment Payments is a legally binding agreement, and failure to adhere to the terms may result in penalties or legal consequences. It is advisable for both the lender and borrower to seek legal advice before entering into such an agreement to ensure clarity and protection of their rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Virgin Islands Pagaré Con Pagos A Plazos?

If you want to full, download, or printing legal papers layouts, use US Legal Forms, the most important variety of legal kinds, which can be found on the web. Utilize the site`s simple and easy practical search to find the files you require. Different layouts for organization and specific functions are categorized by classes and states, or key phrases. Use US Legal Forms to find the Virgin Islands Promissory Note with Installment Payments with a number of click throughs.

Should you be previously a US Legal Forms customer, log in in your account and click on the Acquire option to find the Virgin Islands Promissory Note with Installment Payments. You can even accessibility kinds you formerly delivered electronically from the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for the appropriate town/land.

- Step 2. Utilize the Review choice to check out the form`s articles. Do not overlook to learn the outline.

- Step 3. Should you be not satisfied with all the develop, make use of the Lookup industry on top of the monitor to get other versions of the legal develop format.

- Step 4. When you have located the shape you require, click the Get now option. Opt for the prices plan you prefer and add your credentials to register for an account.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Choose the formatting of the legal develop and download it in your device.

- Step 7. Comprehensive, change and printing or signal the Virgin Islands Promissory Note with Installment Payments.

Every legal papers format you buy is your own property forever. You have acces to each develop you delivered electronically in your acccount. Click on the My Forms area and pick a develop to printing or download again.

Remain competitive and download, and printing the Virgin Islands Promissory Note with Installment Payments with US Legal Forms. There are millions of specialist and status-specific kinds you can utilize for your personal organization or specific requires.