Virgin Islands Secured Promissory Note

Description

How to fill out Secured Promissory Note?

You might spend numerous hours online attempting to locate the official document template that aligns with the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily obtain or print the Virgin Islands Secured Promissory Note from the platform.

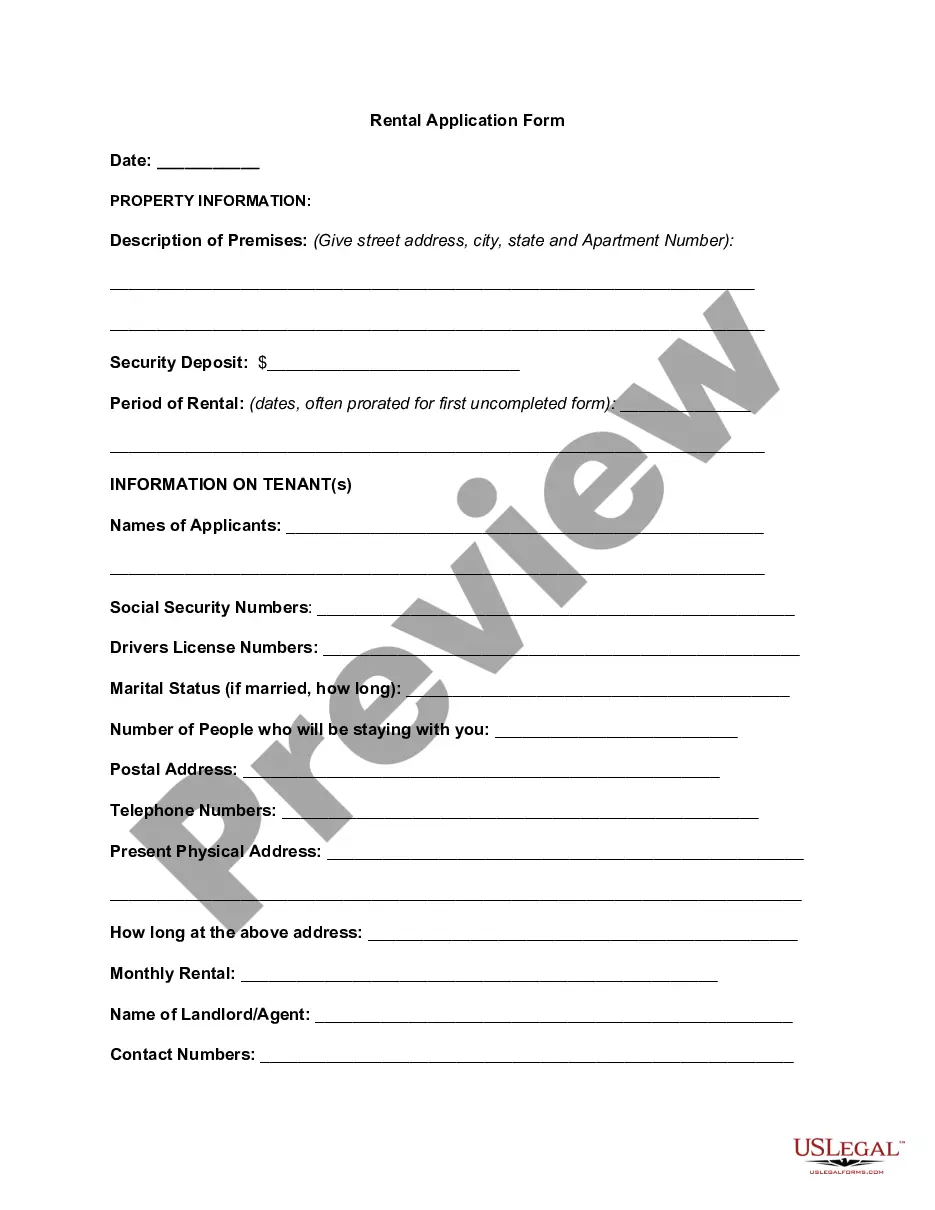

If available, utilize the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Thereafter, you can complete, modify, print, or sign the Virgin Islands Secured Promissory Note.

- Every legal document template you obtain becomes your property indefinitely.

- To find another version of any purchased form, go to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward steps outlined below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

- Review the form details to confirm that you have selected the correct template.

Form popularity

FAQ

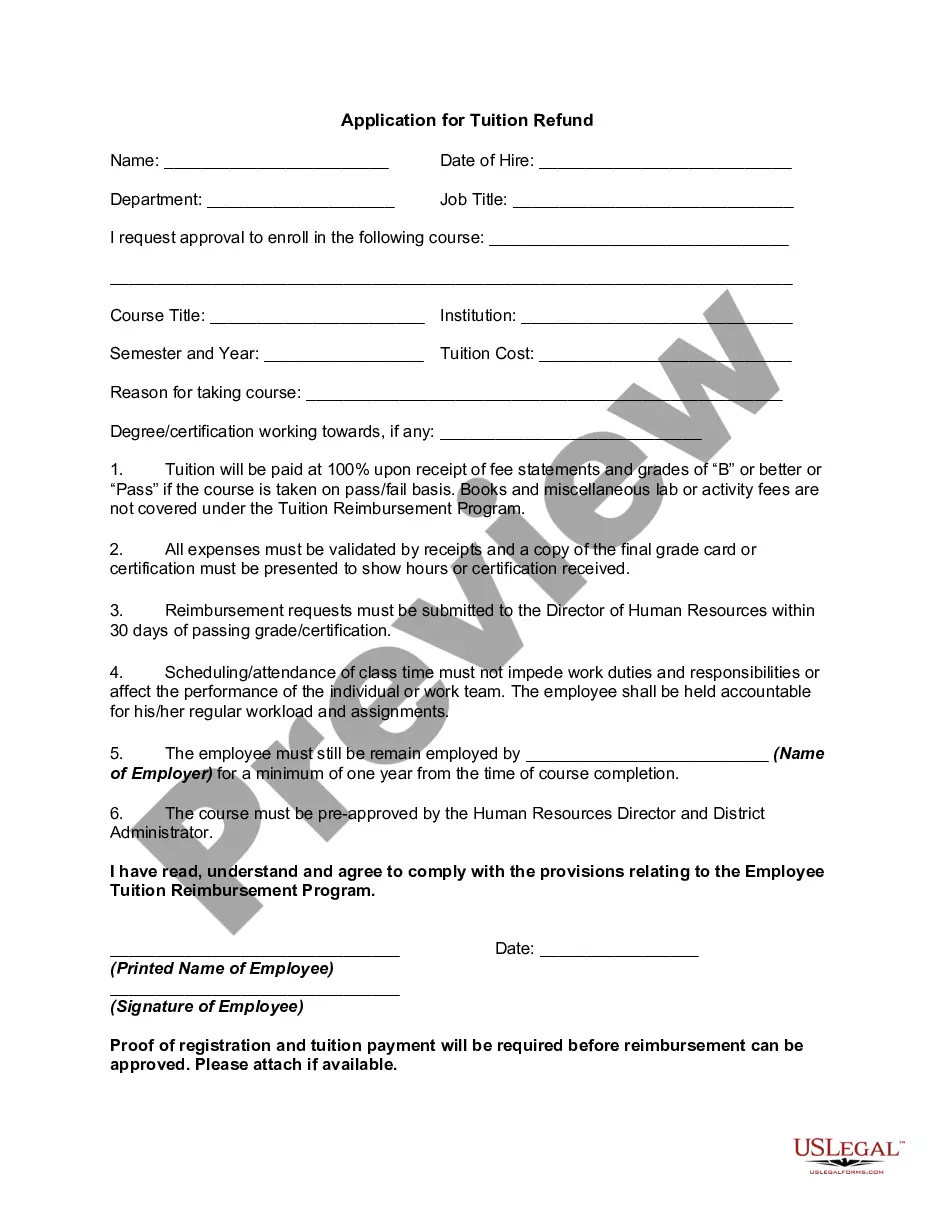

Writing a promissory note requires you to state the date, the names of the parties involved, the amount borrowed, and the repayment plan. Include details about interest and any collateral if applicable. A concise and accurate Virgin Islands secured promissory note enhances understanding and ensures legal enforceability.

Filling out a promissory demand note involves including the date at the top, the amount being borrowed, the borrower's information, and the lender's details. Next, clearly state that repayment is due on demand and define any applicable interest rates. Properly drafting this document will result in a comprehensive Virgin Islands secured promissory note.

To fill a demand promissory note, start by entering the date, the names of both the borrower and lender, and the amount borrowed. Next, specify the demand terms, indicating that repayment is due upon request. By following this structure, you can create a robust Virgin Islands secured promissory note that ensures clarity and protection for both parties.

The format of a promissory note typically includes the title, date, borrower and lender's details, the principal amount, interest rate, repayment terms, and signature lines. Ensuring these elements are present is crucial in creating a legally enforceable document. A well-structured Virgin Islands secured promissory note upholds both parties' rights.

A secured promissory note is a legally binding document that specifies the borrower's commitment to repay a debt, with the added assurance of collateral. This collateral can include real estate, vehicles, or other valuable assets. In the Virgin Islands, utilizing a secured promissory note can effectively enhance trust between lenders and borrowers.

A secured promissory note is backed by collateral, which provides the lender with a claim on a specific asset if the borrower defaults. In contrast, an unsecured promissory note is not backed by any collateral, presenting a higher risk to lenders. Many individuals seeking financial solutions in the Virgin Islands might find secured promissory notes to be a safer option.

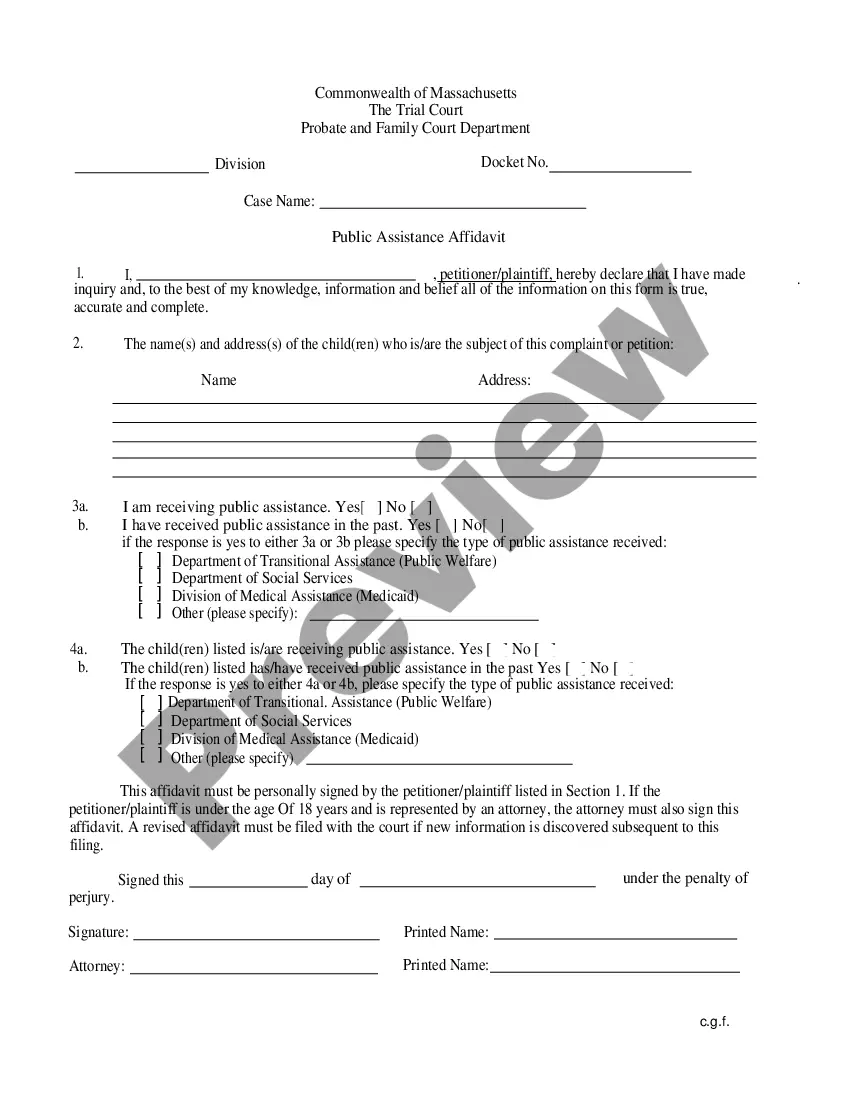

Yes, US laws do apply to the Virgin Islands, but there are specific local regulations that govern financial transactions, including the use of a Virgin Islands Secured Promissory Note. These local regulations can differ from those in the mainland United States. It’s crucial to consult legal resources or professionals familiar with both sets of laws to ensure compliance. Resources like USLegalForms can help you navigate these complexities.

To be a valid instrument, a Virgin Islands Secured Promissory Note must include a clear transaction intent, specific payment details, and the mutual agreement of the involved parties. Signatures from both the lender and the borrower affirm their commitment to the terms. Using a structured template from resources like uslegalforms can help you ensure that your note meets all these legal criteria.

An invalid Virgin Islands Secured Promissory Note may lack the essential elements required for a valid note, such as a clear repayment promise or necessary signatures. Other factors may include vague terms or disputes over the authenticity of signatures. Recognizing these pitfalls can save you from potential legal issues down the line.

Generally, a Virgin Islands Secured Promissory Note does not need to be notarized to be valid. However, notarization can add an extra layer of security and proof of the signing parties' identities. For those looking for added assurance, using a notary can be a good practice, especially in significant transactions.