The Virgin Islands Charitable Remainder Inter Vivos Unit rust Agreement is a legal document specific to the U.S. Virgin Islands that enables individuals to establish charitable trusts during their lifetime. This agreement allows donors, also known as granters, to transfer assets into a trust to benefit both charitable organizations and beneficiaries. The Charitable Remainder Inter Vivos Unit rust Agreement provides various benefits, including tax advantages and the ability to support charitable causes in the Virgin Islands. With this agreement, the granter can make a significant impact on their community while also ensuring financial security for themselves or their chosen beneficiaries. There are different types of Charitable Remainder Inter Vivos Unit rust Agreements available, each designed to meet specific donor preferences and needs. These include: 1. Standard Unit rust: This is the most common type of unit rust agreement, where a fixed percentage of the trust's net fair market value is distributed annually to the designated income beneficiaries. The income beneficiaries can be the granter, other individuals, or even a combination of both. 2. Flip Unit rust: In a Flip Unit rust, the distribution of income to the beneficiaries begins once a specific event triggers the trust. This event could be the sale of a particular asset, such as real estate or a business, or reaching a specific age milestone by the granter. 3. Net Income with Makeup Unit rust: This type of unit rust allows the trustee to distribute the least of either the net income generated by the trust or a fixed percentage of the net fair market value. Any shortfall in income distribution from previous years can be made up in subsequent years when there is excess income. 4. Net Income Unit rust: Unlike the previously mentioned unit rusts, the Net Income Unit rust only distributes the net income generated by the trust each year. Although this may limit distributions in some years, it allows the trust to accumulate income for future years. These different types of Charitable Remainder Inter Vivos Unit rust Agreements provide flexibility for individuals to tailor their charitable giving while utilizing various income distribution strategies. It is crucial to seek legal and financial advice when considering establishing a unit rust agreement in the Virgin Islands, as the laws and regulations may vary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Remanente Caritativo Acuerdo Unitrust Inter Vivos - Charitable Remainder Inter Vivos Unitrust Agreement

Description

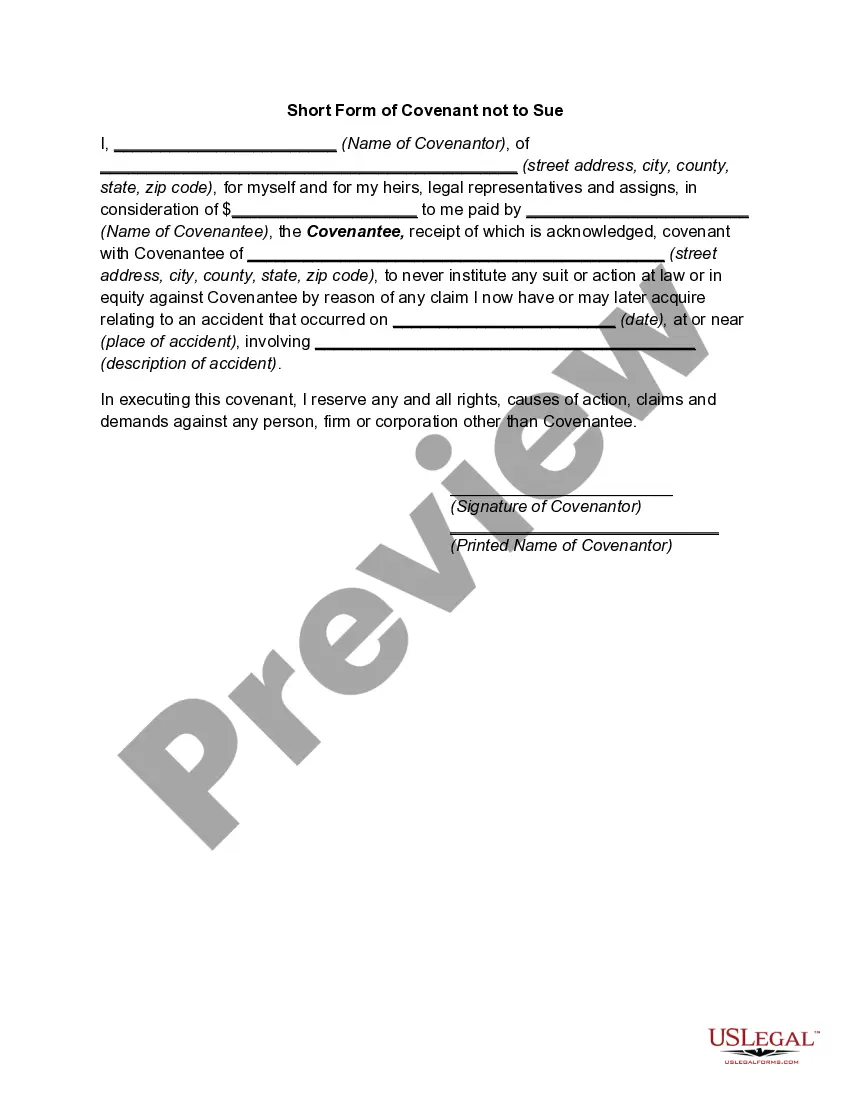

How to fill out Virgin Islands Remanente Caritativo Acuerdo Unitrust Inter Vivos?

US Legal Forms - one of several most significant libraries of legitimate varieties in the States - delivers an array of legitimate file web templates you may down load or printing. While using site, you can find 1000s of varieties for enterprise and personal reasons, categorized by groups, claims, or search phrases.You will find the newest variations of varieties such as the Virgin Islands Charitable Remainder Inter Vivos Unitrust Agreement in seconds.

If you have a subscription, log in and down load Virgin Islands Charitable Remainder Inter Vivos Unitrust Agreement from your US Legal Forms local library. The Obtain switch will show up on each and every form you perspective. You get access to all in the past saved varieties in the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed here are simple instructions to help you began:

- Be sure to have picked out the right form for your city/area. Click on the Review switch to examine the form`s information. Read the form explanation to ensure that you have chosen the appropriate form.

- When the form doesn`t fit your specifications, utilize the Research field near the top of the monitor to get the one who does.

- Should you be content with the form, validate your choice by clicking on the Purchase now switch. Then, select the rates strategy you prefer and give your qualifications to register for an profile.

- Method the financial transaction. Make use of your credit card or PayPal profile to accomplish the financial transaction.

- Pick the format and down load the form on your own system.

- Make changes. Fill up, revise and printing and sign the saved Virgin Islands Charitable Remainder Inter Vivos Unitrust Agreement.

Each template you included with your bank account does not have an expiration time which is yours for a long time. So, if you wish to down load or printing an additional copy, just check out the My Forms section and then click on the form you want.

Obtain access to the Virgin Islands Charitable Remainder Inter Vivos Unitrust Agreement with US Legal Forms, by far the most substantial local library of legitimate file web templates. Use 1000s of specialist and express-certain web templates that satisfy your organization or personal demands and specifications.