Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the latest versions of forms like the Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction in moments.

If you already have a subscription, Log In to download the Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction from the US Legal Forms database. The Download button will show on each form you view. You have access to all previously downloaded forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction. Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Virgin Islands Sale of Business - Promissory Note - Asset Purchase Transaction with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

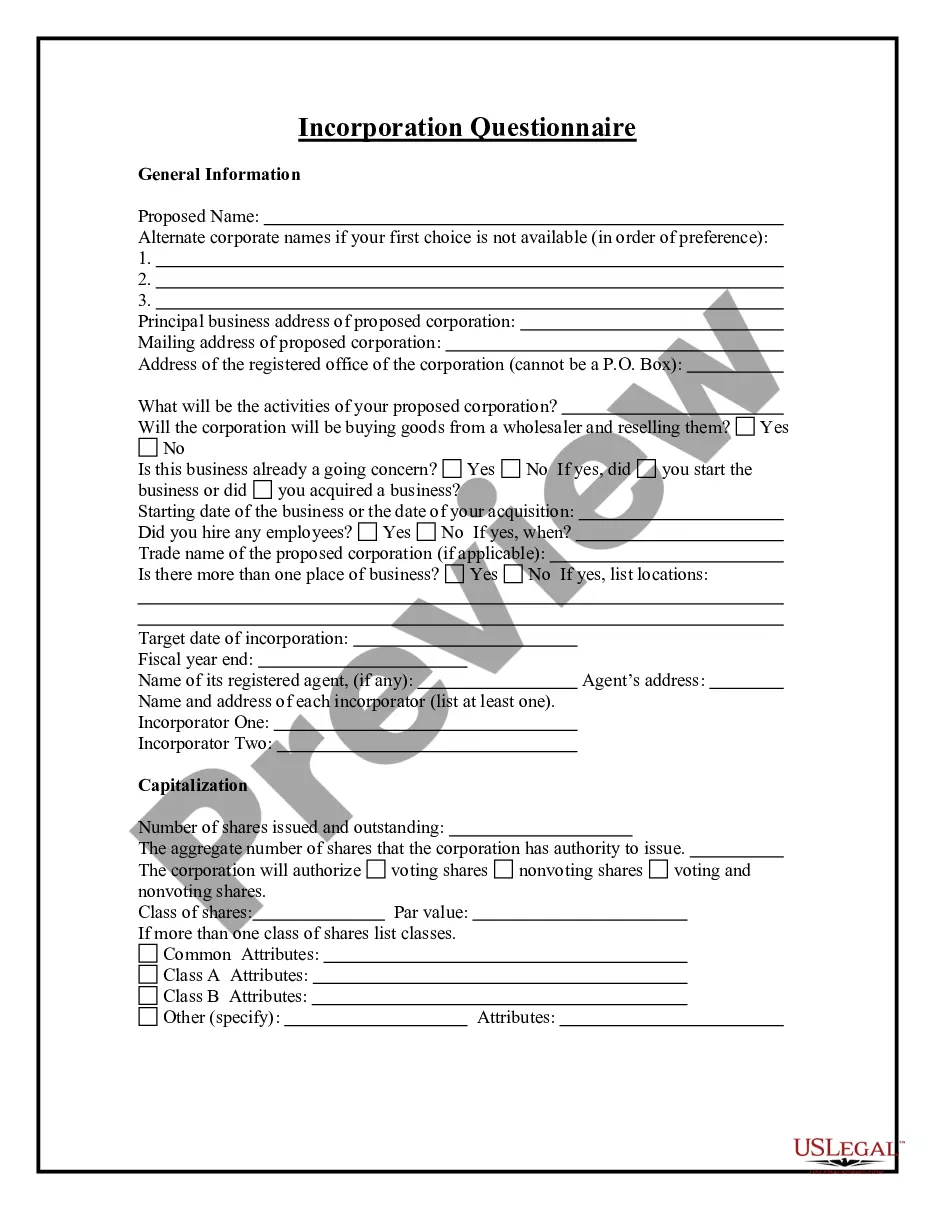

- Ensure that you have selected the correct form for your area/region.

- Click on the Preview button to review the contents of the form.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

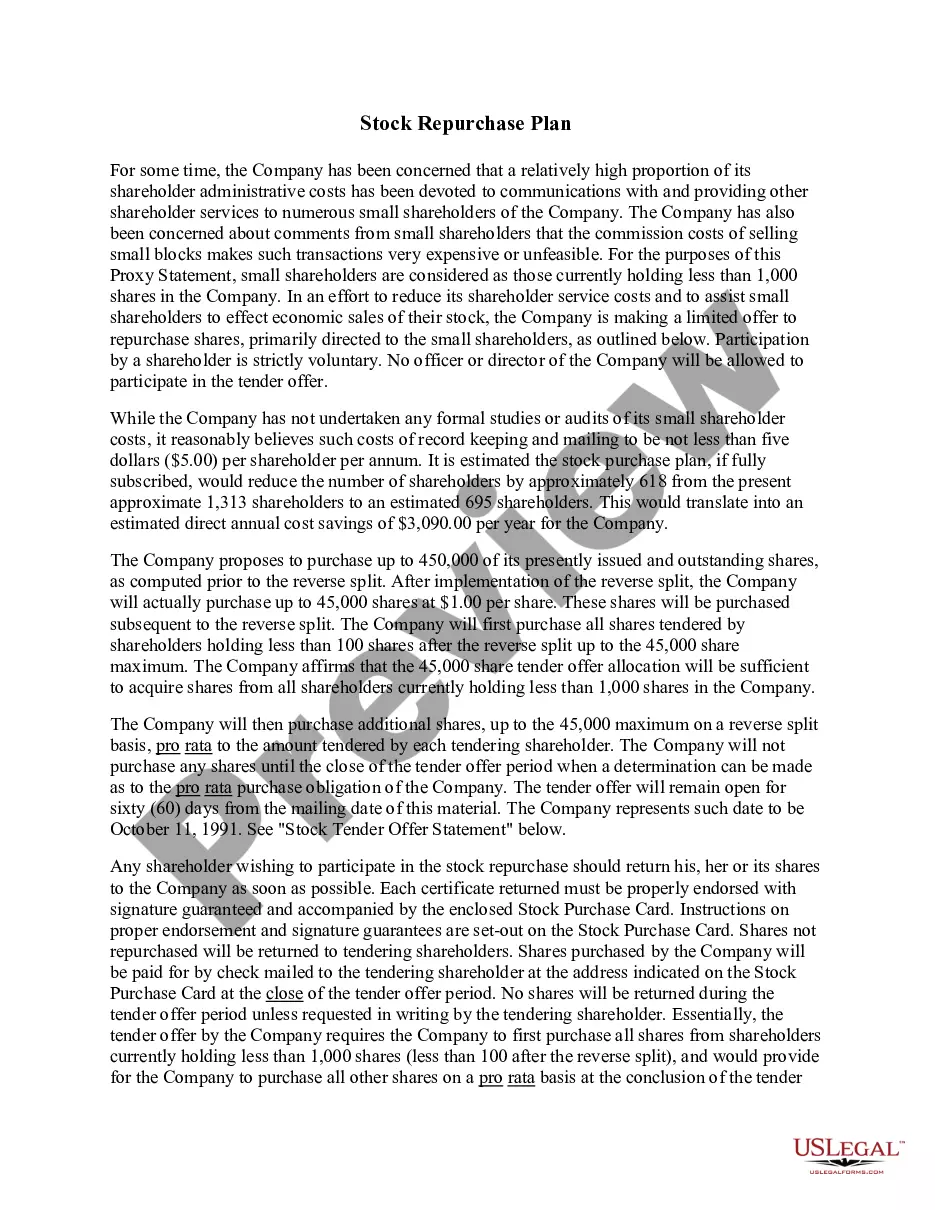

A sales agreement is a contract between a buyer and a seller that details the terms of an exchange. It is also known as a sales agreement contract, sale of goods agreement, sales agreement form, purchase agreement, or sales contract.

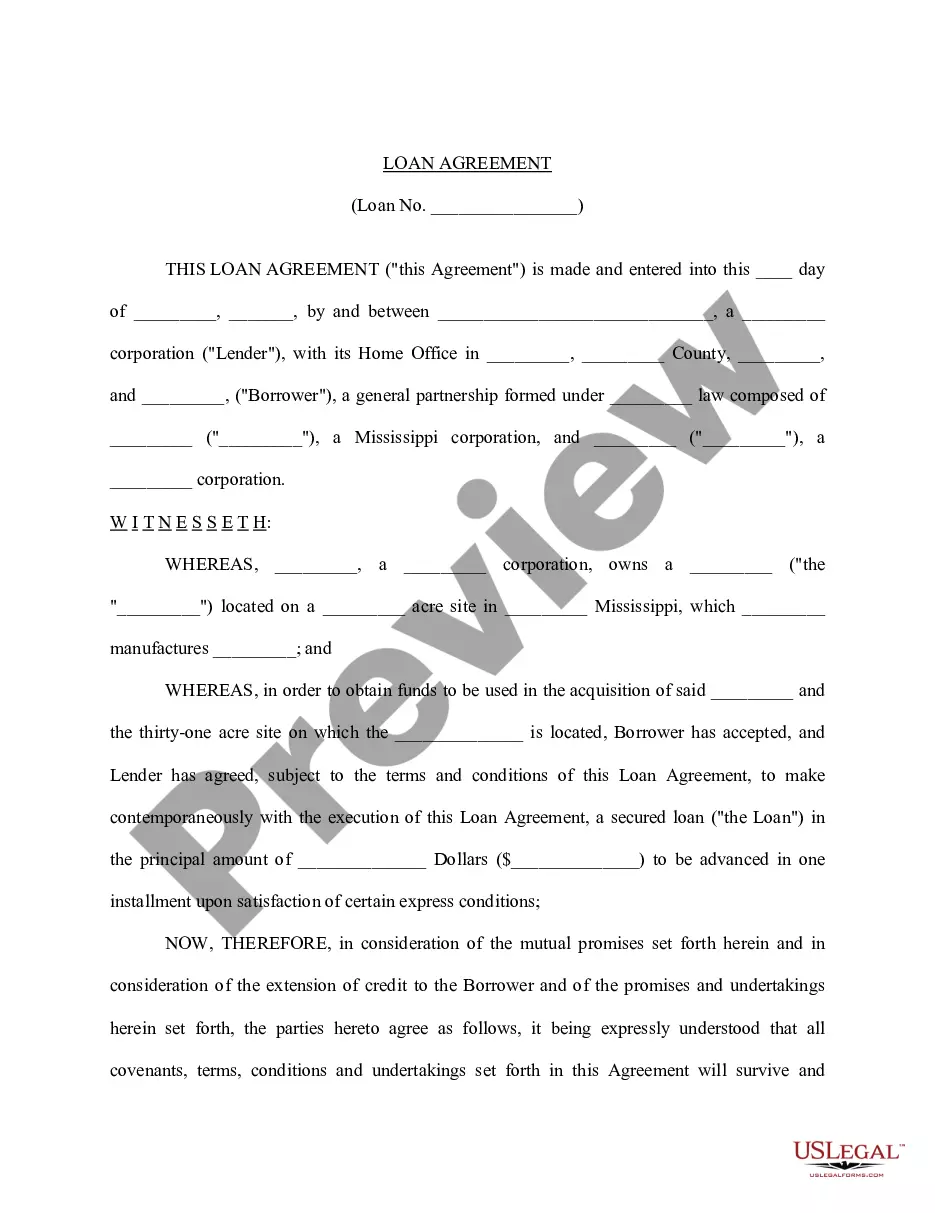

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A business asset purchase agreement (APA) is a standard merger & acquisition contract that contains the terms for transferring an asset between parties. The terms in an APA provide key logistics about the deal (e.g., purchase price, closing date, payment, etc.) along with the rights and obligations of the parties.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

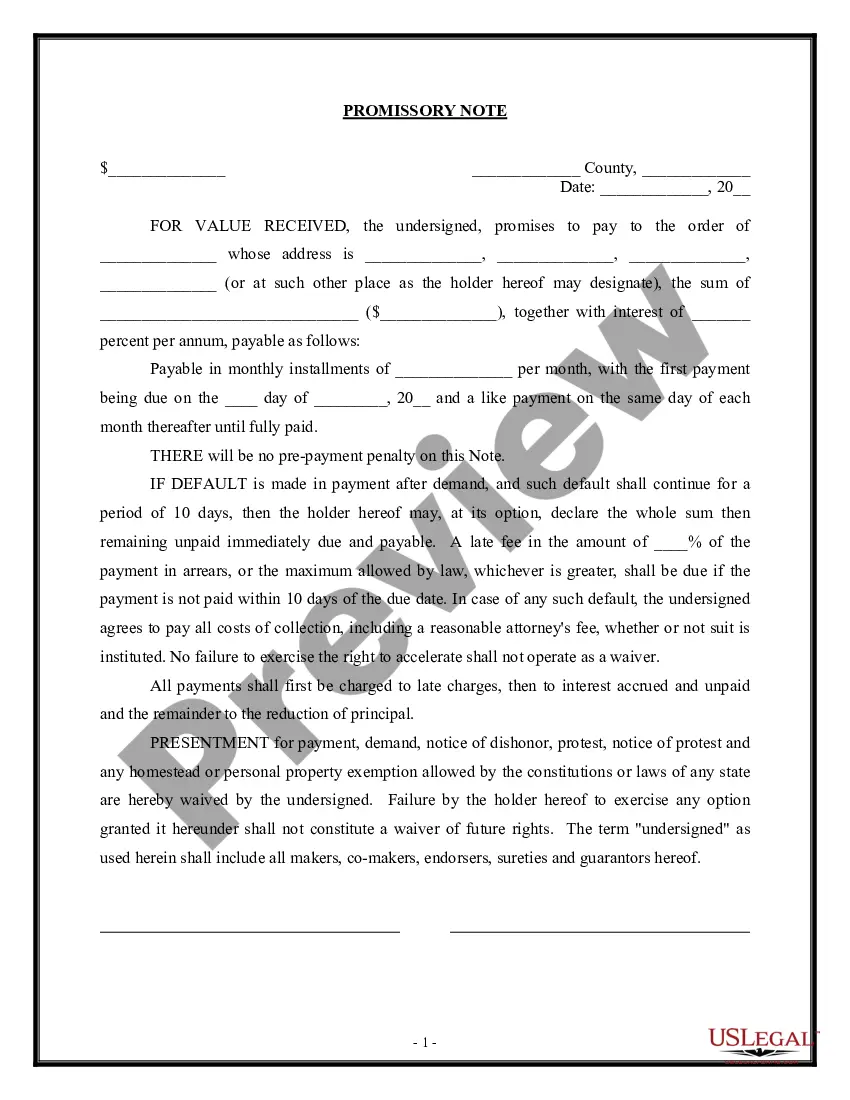

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

Otherwise known as the escape clause, the cash out clause gives the seller the right to cancel a sale and purchase agreement if they receive a better offer.