Virgin Islands Agreement between Website Owner and Sponsor

Description

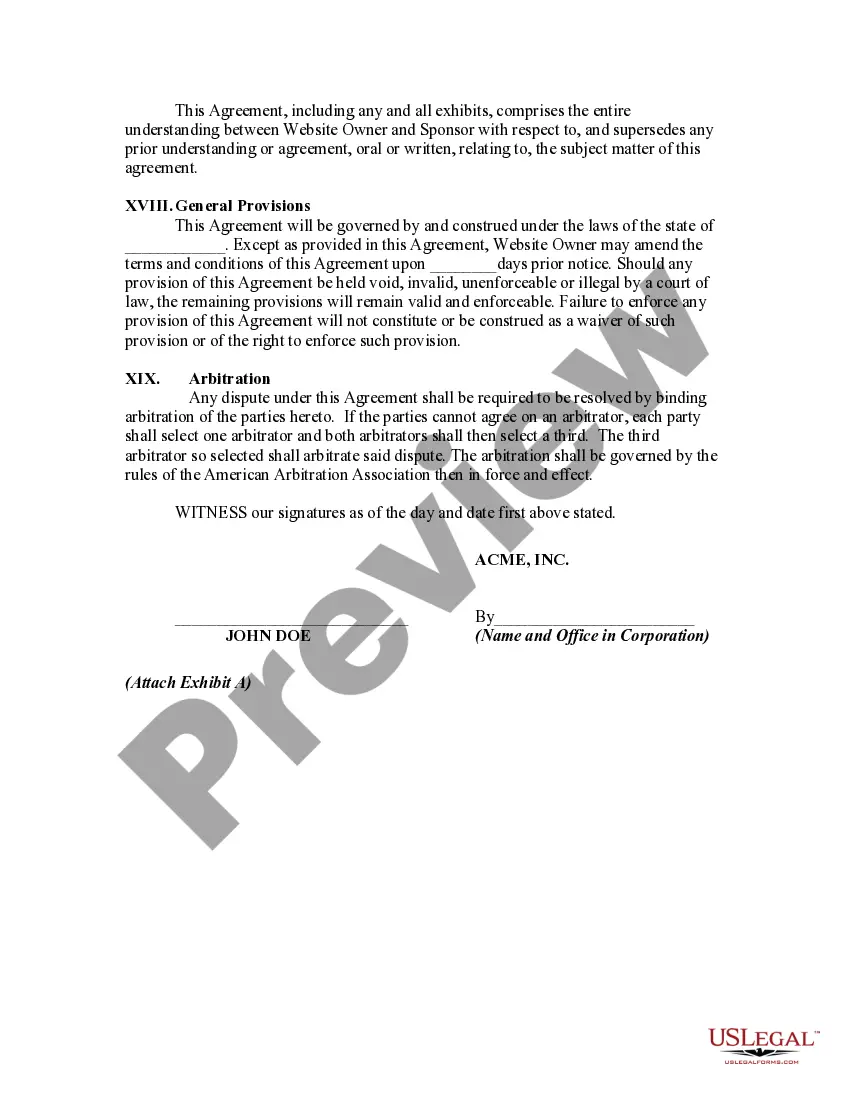

How to fill out Agreement Between Website Owner And Sponsor?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Virgin Islands Agreement between the Website Owner and Sponsor in just seconds.

If you already have an account, Log In and download the Virgin Islands Agreement between the Website Owner and Sponsor from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Every template you added to your account does not have an expiration date and is permanently yours. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require.

Access the Virgin Islands Agreement between the Website Owner and Sponsor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize numerous professional and state-specific templates that cater to your business or personal needs.

- Make sure you have selected the correct form for your city/state. Click the Review button to examine the form’s details. Review the form description to ensure you have selected the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Purchase now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

- Make edits. Fill in, modify, print, and sign the downloaded Virgin Islands Agreement between Website Owner and Sponsor.

Form popularity

FAQ

Yes, the Virgin Islands is recognized as a tax haven due to its favorable tax laws. The absence of capital gains tax and the potential for various tax benefits attract both individuals and businesses. When you explore the Virgin Islands Agreement between Website Owner and Sponsor, take advantage of the unique opportunities this environment provides.

Yes, the Virgin Islands is considered a tax haven for individuals and businesses. It offers attractive tax incentives to foreign investors and has a low corporate tax rate. As you navigate the Virgin Islands Agreement between Website Owner and Sponsor, consider the financial benefits that this tax environment presents.

Yes, the British Virgin Islands (BVI) participates in the Foreign Account Tax Compliance Act (FATCA). It has agreements with the U.S. to exchange financial information to combat tax evasion. If you are involved in the Virgin Islands Agreement between Website Owner and Sponsor, it is important to be aware of how FATCA affects financial reporting.

Yes, Americans can own property in the Virgin Islands without restrictions. Many choose to invest in vacation homes or rental properties there. When making property investments, it is vital to consult the Virgin Islands Agreement between Website Owner and Sponsor for relevant guidelines and legalities.

Yes, you need to file taxes in the Virgin Islands. The Virgin Islands has its own tax system, which mirrors the U.S. federal tax code to some extent. If you earn income there or are a resident, you are required to file a tax return. Understanding the Virgin Islands Agreement between Website Owner and Sponsor can help clarify tax obligations.

Indeed, the Virgin Islands are viewed as a tax haven by many investors and businesses. The combination of tax incentives and low tax rates creates a welcoming environment. If you are planning to navigate these waters, the Virgin Islands Agreement between Website Owner and Sponsor may assist you in understanding the potential benefits and responsibilities.

Yes, St. Thomas has its own tax system, distinct from the U.S. The territory imposes various taxes, including income and property taxes, which are important to consider when forming business agreements. Familiarizing yourself with the Virgin Islands Agreement between Website Owner and Sponsor ensures you are compliant with local tax obligations.

Yes, many consider the Virgin Islands a tax haven due to its favorable tax incentives for businesses. The tax structure encourages foreign investments and business operations, making it an attractive location. If you are exploring such opportunities, reviewing the Virgin Islands Agreement between Website Owner and Sponsor can provide valuable insights.

The Virgin Islands have a unique tax status. While they are a U.S. territory, they operate under their own tax laws separate from the mainland U.S. Therefore, understanding your tax obligations here is crucial, especially when dealing with agreements like the Virgin Islands Agreement between Website Owner and Sponsor.

To register your business in the Virgin Islands, you must first choose a suitable business name and identify your business structure. Next, file the necessary documents with the Department of Consumer Affairs or the appropriate local authority. Utilizing the Virgin Islands Agreement between Website Owner and Sponsor can simplify this process, ensuring you meet all legal requirements.