This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Release by Trustee to Beneficiary and Receipt from Beneficiary are legal documents that govern the transfer of trust property or assets from the trustee to the beneficiary in the Virgin Islands jurisdiction. These documents aim to provide a complete and secure process for the distribution of trust assets and ensure that both parties fully understand the terms and conditions of the release and receipt. The Virgin Islands jurisdiction recognizes different types of releases and receipts based on specific circumstances and requirements. Some different types include: 1. Full Release: This type of release signifies the complete transfer of all trust assets from the trustee to the beneficiary. It is typically used when the trust has come to an end, either due to fulfillment of its purpose or expiration of its term. 2. Partial Release: When only a portion of the trust assets is transferred to the beneficiary, a partial release is utilized. This may be due to specific conditions outlined in the trust agreement or upon the occurrence of certain events. 3. Conditional Release: In certain cases, the release of trust assets may be subject to specific conditions. A conditional release outlines the terms and criteria that the beneficiary must meet before receiving the assets. This type of release provides a mechanism to protect the interests of both the trustee and beneficiary. 4. Interim Release: An interim release occurs when there is a need to distribute trust assets before the final termination of the trust. This type of release allows for the transfer of assets to the beneficiary while the trust remains ongoing. The Virgin Islands Release by Trustee to Beneficiary and Receipt from Beneficiary typically include several key elements. These elements may include: 1. Identification of the Trust Agreement: The document should clearly state the name of the trust, the date it was established, and any amendments or modifications made. 2. Parties Involved: The names and addresses of both the trustee and the beneficiary should be clearly stated. Additional information, such as contact details or tax identification numbers, may also be included for identification purposes. 3. Description of Trust Assets: A detailed list of the assets being released should be included. This may encompass real estate, financial accounts, investments, or any other assets held within the trust. 4. Release Terms: The terms and conditions governing the release should be explicitly stated. These may include the date of release, any conditions or restrictions, and any required paperwork or signatures. 5. Receipt and Acceptance: The document should include a section where the beneficiary acknowledges the receipt of the trust assets and confirms their acceptance and understanding of the terms outlined in the release. 6. Governing Law: It is essential to specify that the release and receipt are subject to the laws of the Virgin Islands jurisdiction. 7. Confidentiality Clause: In some cases, a confidentiality clause may be included to ensure the privacy and non-disclosure of the trust details or the terms of the release. It is crucial to consult with legal professionals experienced in Virgin Islands trust law to ensure the accurate and lawful drafting, execution, and recording of the Release by Trustee to Beneficiary and Receipt from Beneficiary document appropriate for a specific trust situation.Virgin Islands Release by Trustee to Beneficiary and Receipt from Beneficiary are legal documents that govern the transfer of trust property or assets from the trustee to the beneficiary in the Virgin Islands jurisdiction. These documents aim to provide a complete and secure process for the distribution of trust assets and ensure that both parties fully understand the terms and conditions of the release and receipt. The Virgin Islands jurisdiction recognizes different types of releases and receipts based on specific circumstances and requirements. Some different types include: 1. Full Release: This type of release signifies the complete transfer of all trust assets from the trustee to the beneficiary. It is typically used when the trust has come to an end, either due to fulfillment of its purpose or expiration of its term. 2. Partial Release: When only a portion of the trust assets is transferred to the beneficiary, a partial release is utilized. This may be due to specific conditions outlined in the trust agreement or upon the occurrence of certain events. 3. Conditional Release: In certain cases, the release of trust assets may be subject to specific conditions. A conditional release outlines the terms and criteria that the beneficiary must meet before receiving the assets. This type of release provides a mechanism to protect the interests of both the trustee and beneficiary. 4. Interim Release: An interim release occurs when there is a need to distribute trust assets before the final termination of the trust. This type of release allows for the transfer of assets to the beneficiary while the trust remains ongoing. The Virgin Islands Release by Trustee to Beneficiary and Receipt from Beneficiary typically include several key elements. These elements may include: 1. Identification of the Trust Agreement: The document should clearly state the name of the trust, the date it was established, and any amendments or modifications made. 2. Parties Involved: The names and addresses of both the trustee and the beneficiary should be clearly stated. Additional information, such as contact details or tax identification numbers, may also be included for identification purposes. 3. Description of Trust Assets: A detailed list of the assets being released should be included. This may encompass real estate, financial accounts, investments, or any other assets held within the trust. 4. Release Terms: The terms and conditions governing the release should be explicitly stated. These may include the date of release, any conditions or restrictions, and any required paperwork or signatures. 5. Receipt and Acceptance: The document should include a section where the beneficiary acknowledges the receipt of the trust assets and confirms their acceptance and understanding of the terms outlined in the release. 6. Governing Law: It is essential to specify that the release and receipt are subject to the laws of the Virgin Islands jurisdiction. 7. Confidentiality Clause: In some cases, a confidentiality clause may be included to ensure the privacy and non-disclosure of the trust details or the terms of the release. It is crucial to consult with legal professionals experienced in Virgin Islands trust law to ensure the accurate and lawful drafting, execution, and recording of the Release by Trustee to Beneficiary and Receipt from Beneficiary document appropriate for a specific trust situation.

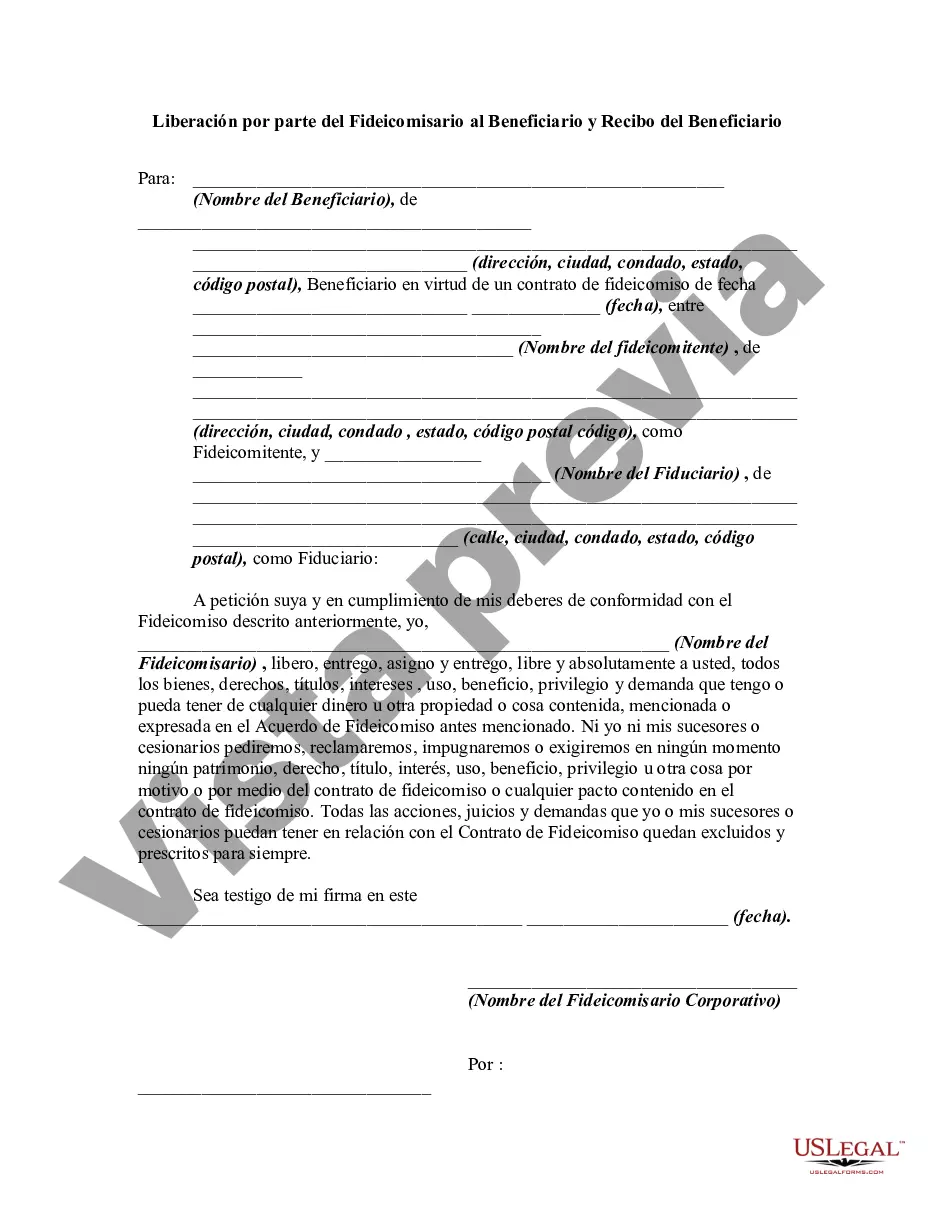

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.