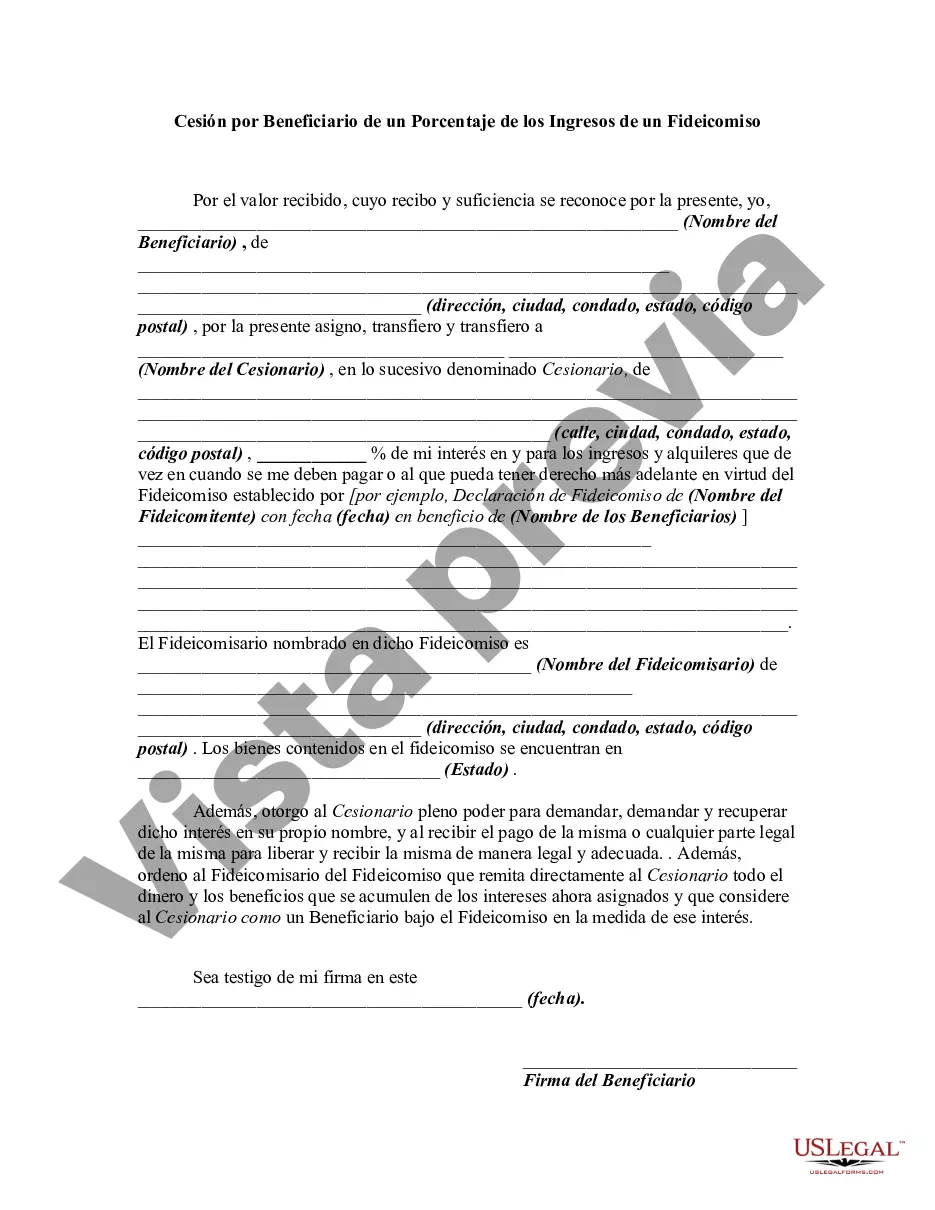

An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust (VISIT) is a legal arrangement that allows beneficiaries of a trust to assign a portion of the trust's income to a designated recipient. This provides flexibility for beneficiaries to distribute income according to their needs and financial goals. The Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust can be categorized into two types: 1. Fixed Percentage Assignment: Under this type, a specific percentage of the trust's income is assigned to the beneficiary. The designated percentage can remain fixed over time, ensuring a constant income stream for the beneficiary. 2. Adjustable Percentage Assignment: This type allows beneficiaries to adjust the assigned percentage of income based on their changing financial circumstances. They can increase or decrease the percentage as per their requirements, offering greater adaptability to their evolving needs. The Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust provides several benefits. Firstly, it enables beneficiaries to receive a regular income stream from the trust, ensuring financial stability. Secondly, it allows beneficiaries to tailor their income according to their lifestyle and financial goals. They can choose to receive a higher percentage of income during times of greater expense or lower the percentage during periods of financial abundance. Moreover, this arrangement offers tax advantages in the Virgin Islands jurisdiction. Beneficiaries who assign a percentage of income may be subject to reduced tax liabilities, enhancing their overall financial position. It is important to note that Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust requires proper legal documentation and adherence to local regulations. Consultation with a qualified attorney specializing in trust law is crucial to ensure compliance and maximize the benefits of this arrangement. In summary, Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to assign a portion of a trust's income to themselves or a designated recipient. It offers flexibility, tax advantages, and the ability to tailor income based on personal circumstances. The two types of assignments are fixed percentage assignment and adjustable percentage assignment. Seek professional legal advice to ensure compliance and optimal utilization of this arrangement.Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust (VISIT) is a legal arrangement that allows beneficiaries of a trust to assign a portion of the trust's income to a designated recipient. This provides flexibility for beneficiaries to distribute income according to their needs and financial goals. The Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust can be categorized into two types: 1. Fixed Percentage Assignment: Under this type, a specific percentage of the trust's income is assigned to the beneficiary. The designated percentage can remain fixed over time, ensuring a constant income stream for the beneficiary. 2. Adjustable Percentage Assignment: This type allows beneficiaries to adjust the assigned percentage of income based on their changing financial circumstances. They can increase or decrease the percentage as per their requirements, offering greater adaptability to their evolving needs. The Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust provides several benefits. Firstly, it enables beneficiaries to receive a regular income stream from the trust, ensuring financial stability. Secondly, it allows beneficiaries to tailor their income according to their lifestyle and financial goals. They can choose to receive a higher percentage of income during times of greater expense or lower the percentage during periods of financial abundance. Moreover, this arrangement offers tax advantages in the Virgin Islands jurisdiction. Beneficiaries who assign a percentage of income may be subject to reduced tax liabilities, enhancing their overall financial position. It is important to note that Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust requires proper legal documentation and adherence to local regulations. Consultation with a qualified attorney specializing in trust law is crucial to ensure compliance and maximize the benefits of this arrangement. In summary, Virgin Islands Assignment by Beneficiary of a Percentage of the Income of a Trust allows beneficiaries to assign a portion of a trust's income to themselves or a designated recipient. It offers flexibility, tax advantages, and the ability to tailor income based on personal circumstances. The two types of assignments are fixed percentage assignment and adjustable percentage assignment. Seek professional legal advice to ensure compliance and optimal utilization of this arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.