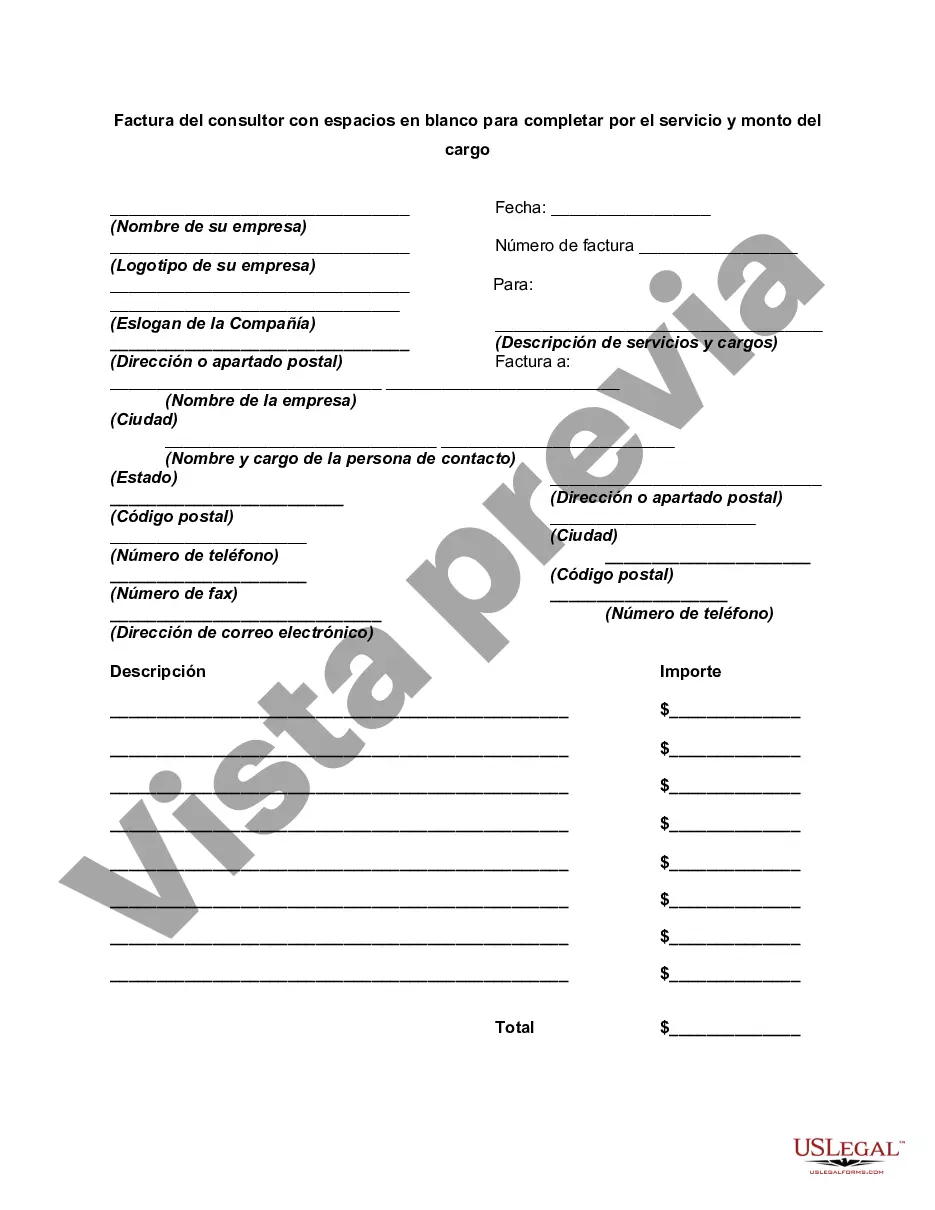

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

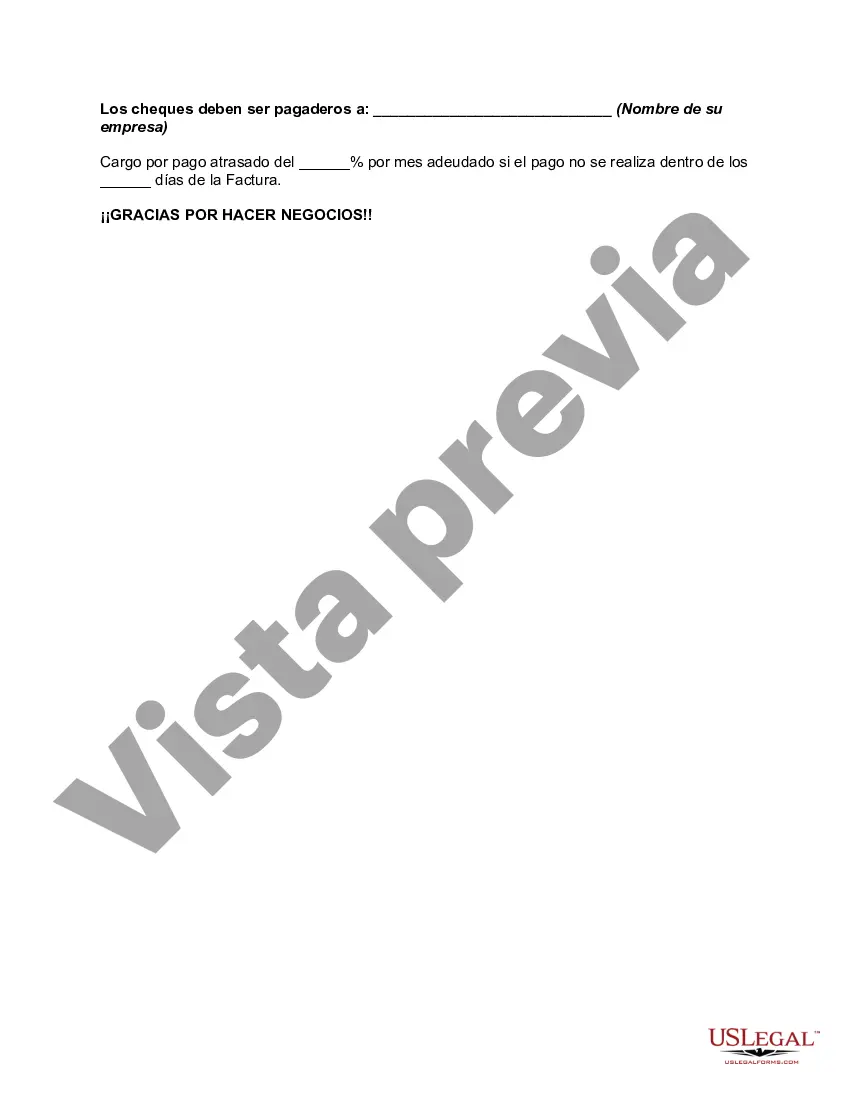

Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge: A Comprehensive Guide Introduction: In the Virgin Islands, consultants play a vital role in various industries, providing valuable expertise and support to businesses and organizations. To maintain a transparent and professional relationship, it is essential for consultants to issue invoices that accurately reflect the services provided and the corresponding charges. The Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a customizable document that ensures proper documentation and enables efficient payment processing. This article will delve into the details of this invoice, its importance, and its various types relevant to the Virgin Islands. 1. Basic Components of a Virgin Islands Invoice of Consultant: — Heading and Contact Information: The consultant's business name, address, email, and phone number should be clearly mentioned at the invoice's top. Likewise, the client's information, including their name, contact details, and postal address, should be listed as well. — Invoice Number: Each invoice should have a unique identifier, such as an invoice number or reference code, allowing for easy tracking and record-keeping. — Invoice Date: The date on which the invoice is issued should be specified to establish a clear timeline for payment. — Service Description: Detailed description of the services provided, specifying the scope, duration, and any specific tasks performed. — Amount and Currency: The total charge for the services rendered, including any applicable taxes, should be clearly mentioned. The currency used (e.g., USD) must be specified to avoid any confusion. — Payment Terms: The expected payment deadline, acceptable modes of payment, and any late payment penalties or discounts should be clearly stated, promoting clarity and adherence to payment deadlines. — Terms and Conditions: A section dedicated to outlining the agreed-upon terms and conditions, such as refund policies, dispute resolution, and intellectual property rights. 2. Types of the Virgin Islands Invoice of Consultant: a) Hourly Rate Invoice: This type of invoice is used when the consultant charges an hourly rate for their services. It includes the number of hours worked, the hourly rate, and the total charge. b) Fixed Fee Invoice: Consultants may issue this type of invoice when providing services for a fixed fee, without charging by the hour. The total amount is stated directly on the invoice, without any breakdown of hours worked. c) Retainer-Based Invoice: In cases where consultants are hired on retainer, this invoice type is used. It outlines the agreed-upon retainer amount, the scope of services covered by the retainer, and any additional charges incurred beyond the retainer terms. Conclusion: Issuing an accurate and comprehensive invoice is crucial for both consultants and their clients in the Virgin Islands. The Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge provides a standardized framework that can be tailored to the specific needs of different consulting engagements. By utilizing the appropriate type of invoice, consultants can ensure transparent billing, facilitate smooth payment processes, and maintain positive business relationships with their clients. Keywords: Virgin Islands, Invoice of Consultant, Blanks to be Filled in, Service, Amount of Charge, Hourly Rate Invoice, Fixed Fee Invoice, Retainer-Based Invoice.Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge: A Comprehensive Guide Introduction: In the Virgin Islands, consultants play a vital role in various industries, providing valuable expertise and support to businesses and organizations. To maintain a transparent and professional relationship, it is essential for consultants to issue invoices that accurately reflect the services provided and the corresponding charges. The Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a customizable document that ensures proper documentation and enables efficient payment processing. This article will delve into the details of this invoice, its importance, and its various types relevant to the Virgin Islands. 1. Basic Components of a Virgin Islands Invoice of Consultant: — Heading and Contact Information: The consultant's business name, address, email, and phone number should be clearly mentioned at the invoice's top. Likewise, the client's information, including their name, contact details, and postal address, should be listed as well. — Invoice Number: Each invoice should have a unique identifier, such as an invoice number or reference code, allowing for easy tracking and record-keeping. — Invoice Date: The date on which the invoice is issued should be specified to establish a clear timeline for payment. — Service Description: Detailed description of the services provided, specifying the scope, duration, and any specific tasks performed. — Amount and Currency: The total charge for the services rendered, including any applicable taxes, should be clearly mentioned. The currency used (e.g., USD) must be specified to avoid any confusion. — Payment Terms: The expected payment deadline, acceptable modes of payment, and any late payment penalties or discounts should be clearly stated, promoting clarity and adherence to payment deadlines. — Terms and Conditions: A section dedicated to outlining the agreed-upon terms and conditions, such as refund policies, dispute resolution, and intellectual property rights. 2. Types of the Virgin Islands Invoice of Consultant: a) Hourly Rate Invoice: This type of invoice is used when the consultant charges an hourly rate for their services. It includes the number of hours worked, the hourly rate, and the total charge. b) Fixed Fee Invoice: Consultants may issue this type of invoice when providing services for a fixed fee, without charging by the hour. The total amount is stated directly on the invoice, without any breakdown of hours worked. c) Retainer-Based Invoice: In cases where consultants are hired on retainer, this invoice type is used. It outlines the agreed-upon retainer amount, the scope of services covered by the retainer, and any additional charges incurred beyond the retainer terms. Conclusion: Issuing an accurate and comprehensive invoice is crucial for both consultants and their clients in the Virgin Islands. The Virgin Islands Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge provides a standardized framework that can be tailored to the specific needs of different consulting engagements. By utilizing the appropriate type of invoice, consultants can ensure transparent billing, facilitate smooth payment processes, and maintain positive business relationships with their clients. Keywords: Virgin Islands, Invoice of Consultant, Blanks to be Filled in, Service, Amount of Charge, Hourly Rate Invoice, Fixed Fee Invoice, Retainer-Based Invoice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.