Virgin Islands Triple Net Lease for Commercial Real Estate is a type of lease agreement commonly used in the U.S. Virgin Islands that requires commercial tenants to bear additional expenses in addition to the rent. This lease structure is commonly favored by landlords as it offloads many of the property's operating costs onto the tenant, reducing the property owner's financial burden. Under a Virgin Islands Triple Net Lease, the tenant is responsible for paying property taxes, insurance premiums, and maintenance costs in addition to the base rent. This arrangement ensures that the tenant assumes a significant share of the property's expenses, making it an attractive option for many commercial real estate landlords. There are different types of the Virgin Islands Triple Net Leases available depending on the specifics of the agreement. Some variations include: 1. Single-Net Lease: In this type of lease, the tenant is responsible for paying only one additional expense, typically property taxes. 2. Double-Net Lease: This lease structure requires the tenant to cover property taxes as well as insurance premiums. The property owner is usually responsible for maintenance expenses. 3. Triple-Net Lease: The most comprehensive type of the Virgin Islands Triple Net Lease, it requires the tenant to pay for property taxes, insurance premiums, and maintenance costs. This lease places the majority of the financial burden on the tenant, making it a favorable option for many landlords. 4. Absolute Triple-Net Lease: This lease form is similar to a traditional triple-net lease, but it requires the tenant to assume even more responsibilities. In addition to property taxes, insurance premiums, and maintenance costs, the tenant may also pay for other expenses like structural repairs or capital improvements. Virgin Islands Triple Net Leases for commercial real estate can provide numerous benefits for both landlords and tenants. For landlords, these leases can reduce the financial risks associated with property ownership and provide a steady source of income. Tenants, on the other hand, have more control over their rental space and may be able to negotiate lower base rents in exchange for assuming additional expenses. Before entering into a Virgin Islands Triple Net Lease agreement, it is crucial for both parties to thoroughly review the lease terms and seek legal advice to ensure a clear understanding of the responsibilities and obligations associated with the lease.

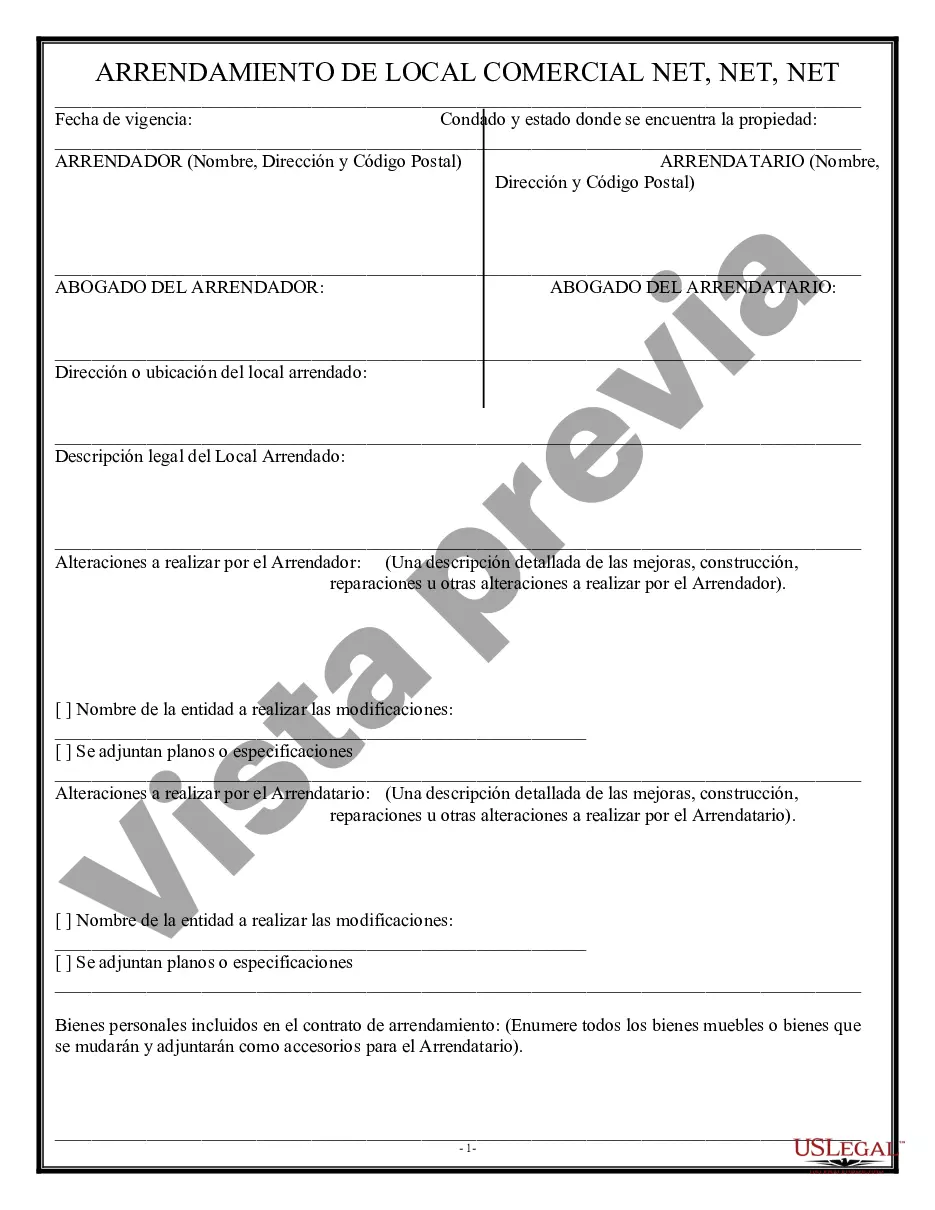

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Virgin Islands Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Finding the right lawful record design can be quite a struggle. Obviously, there are a lot of templates available on the net, but how will you discover the lawful develop you require? Make use of the US Legal Forms internet site. The support delivers a huge number of templates, including the Virgin Islands Triple Net Lease for Commercial Real Estate, which you can use for enterprise and private needs. Each of the types are checked by experts and meet up with state and federal demands.

Should you be previously authorized, log in in your account and click the Down load switch to get the Virgin Islands Triple Net Lease for Commercial Real Estate. Use your account to check through the lawful types you have acquired earlier. Go to the My Forms tab of your respective account and get yet another copy of your record you require.

Should you be a fresh end user of US Legal Forms, here are straightforward instructions that you can comply with:

- First, make certain you have selected the correct develop for the metropolis/area. You can check out the form making use of the Preview switch and study the form description to guarantee it will be the best for you.

- When the develop is not going to meet up with your preferences, take advantage of the Seach industry to find the appropriate develop.

- Once you are positive that the form is suitable, click the Get now switch to get the develop.

- Select the prices strategy you desire and enter in the required info. Design your account and pay money for an order making use of your PayPal account or bank card.

- Pick the data file file format and download the lawful record design in your system.

- Complete, edit and print and sign the received Virgin Islands Triple Net Lease for Commercial Real Estate.

US Legal Forms is the greatest local library of lawful types that you can find various record templates. Make use of the company to download appropriately-produced papers that comply with status demands.