Virgin Islands Revocable Trust for Minors

Description

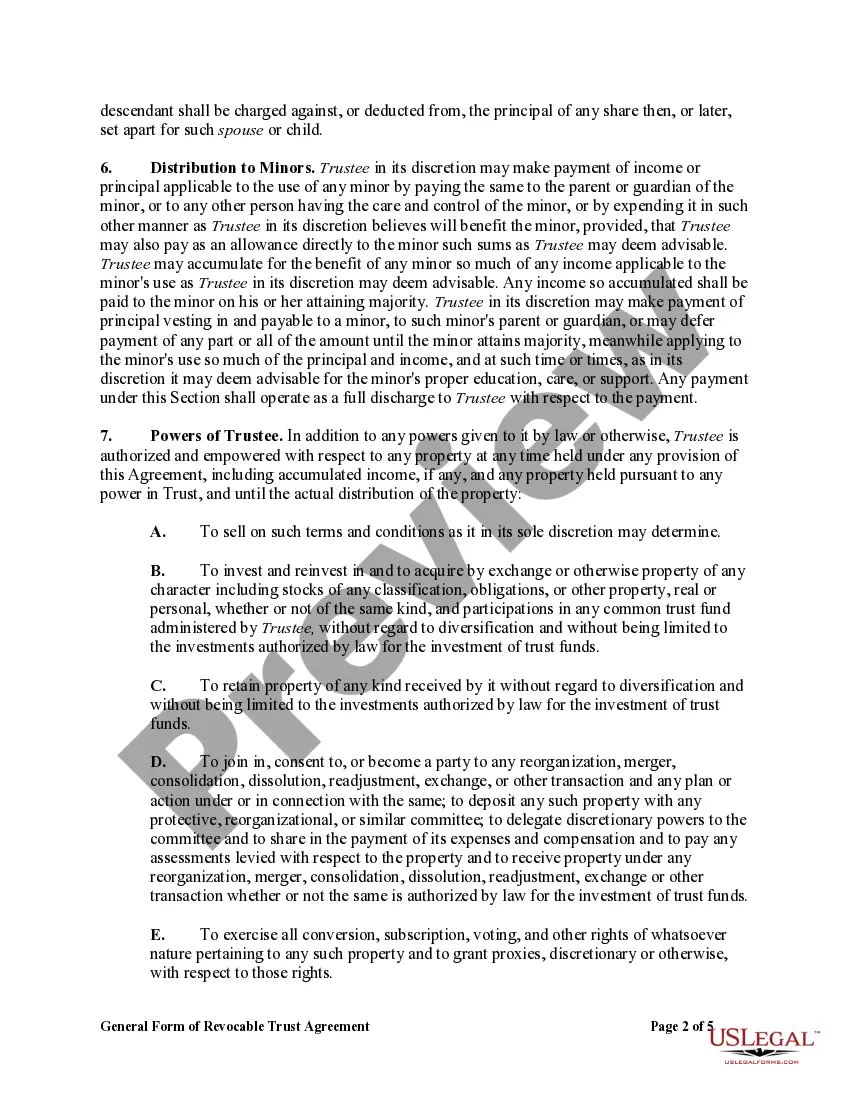

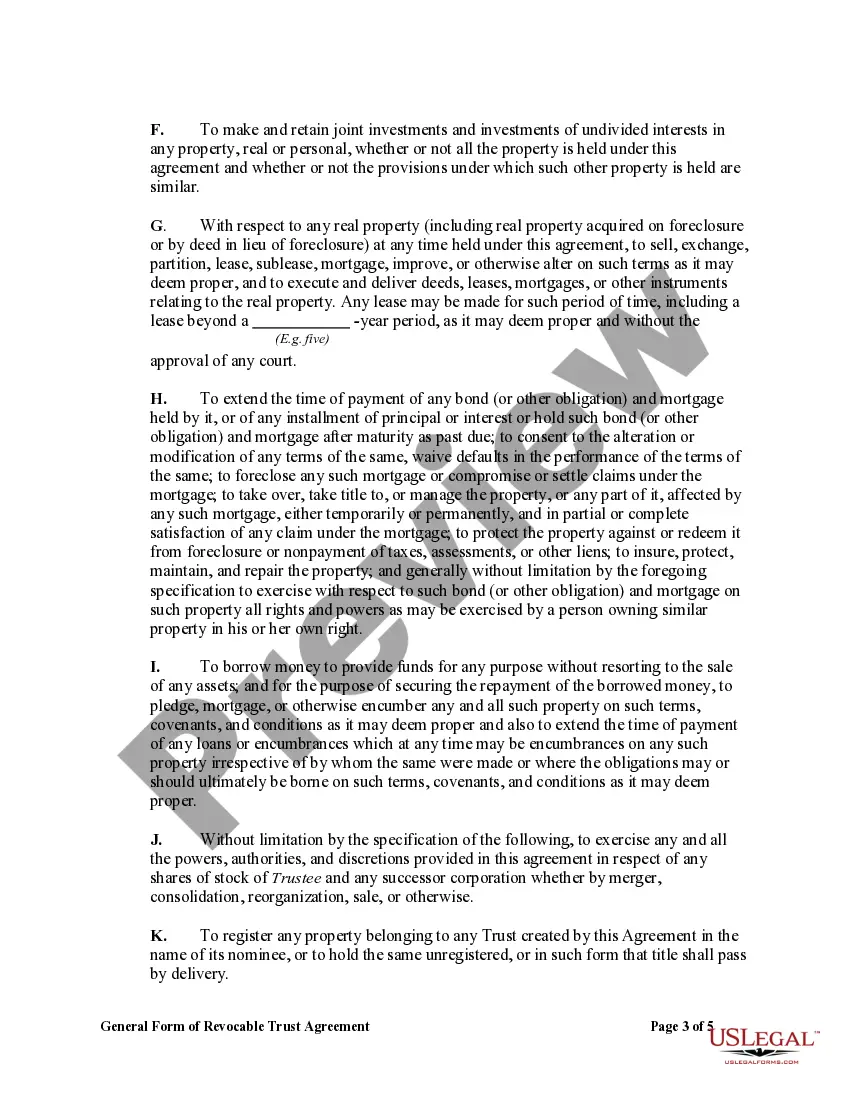

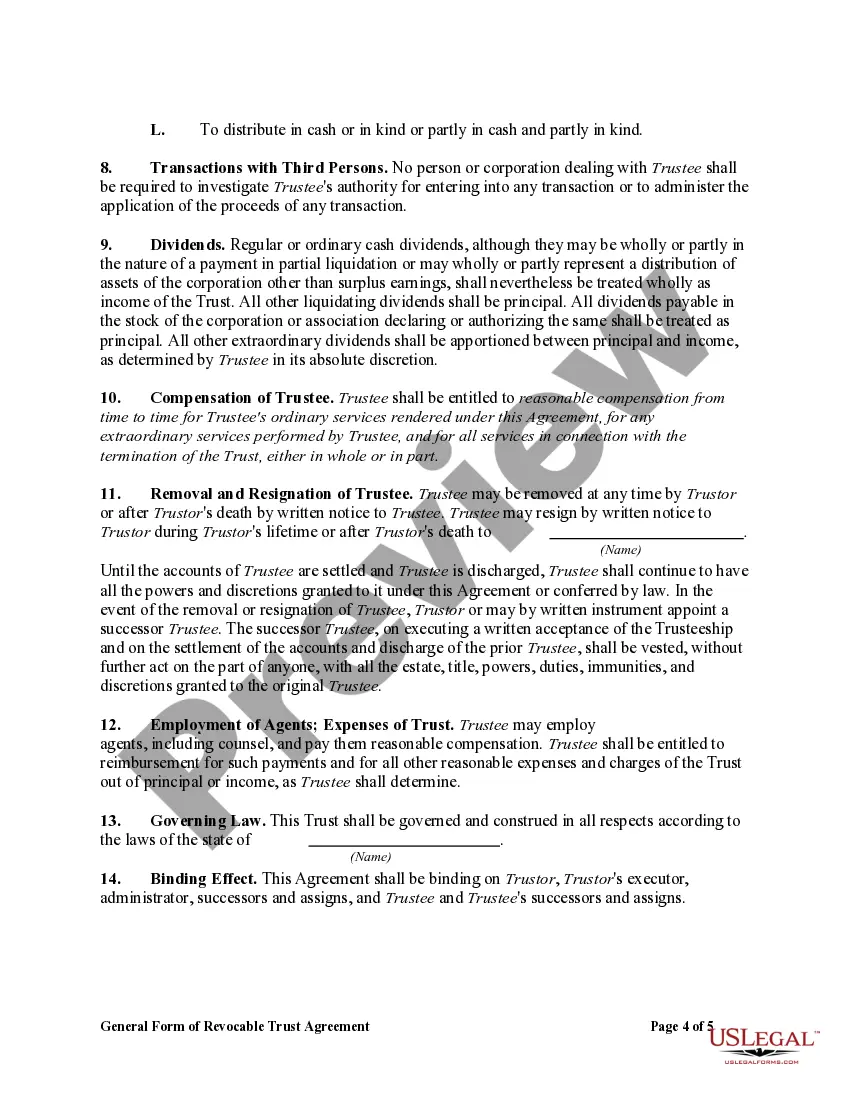

How to fill out Revocable Trust For Minors?

Are you in a scenario where you frequently require documents for both professional or personal purposes? There are numerous legal document options available online, but finding trustworthy ones is challenging.

US Legal Forms offers thousands of document templates, including the Virgin Islands Revocable Trust for Minors, tailored to comply with state and federal regulations.

If you are already aware of the US Legal Forms website and possess an account, simply Log In. After that, you can download the Virgin Islands Revocable Trust for Minors template.

Select a convenient file format and download your copy.

Access all the document templates you have purchased from the My documents section. You can obtain an additional copy of the Virgin Islands Revocable Trust for Minors anytime if needed. Just click on the desired document to download or print the template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Create an account if you do not have one and wish to start using US Legal Forms.

- Select the template you need, ensuring it corresponds to the right city/state.

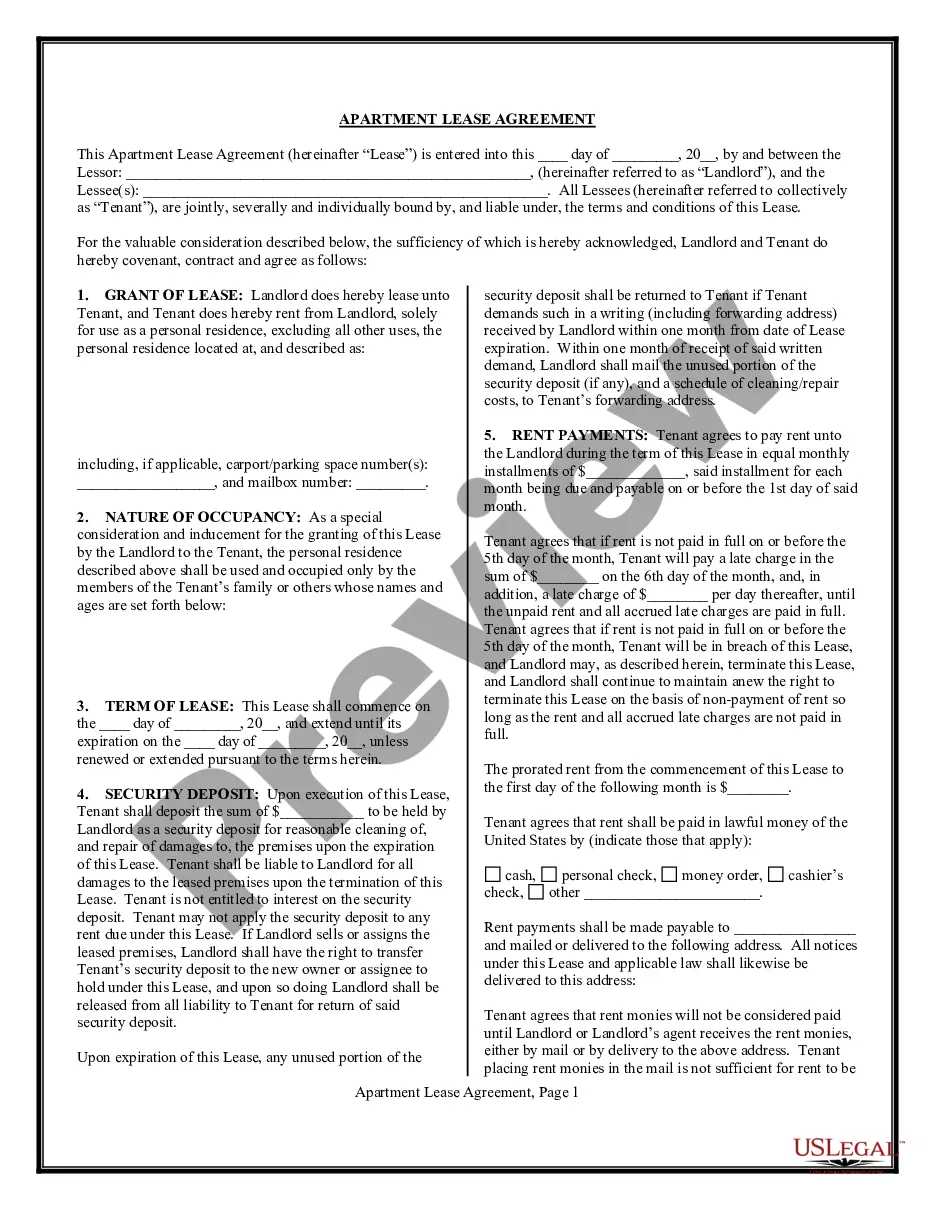

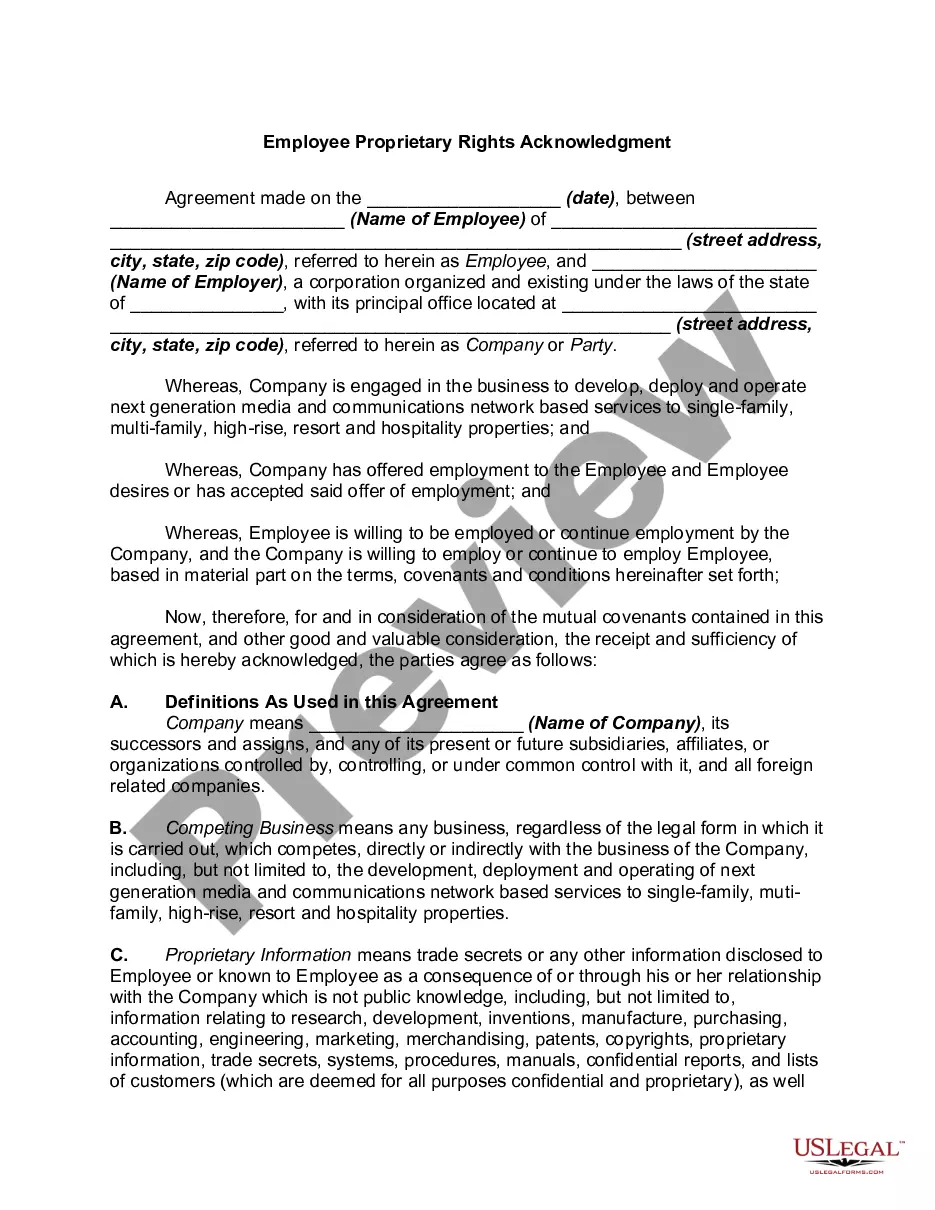

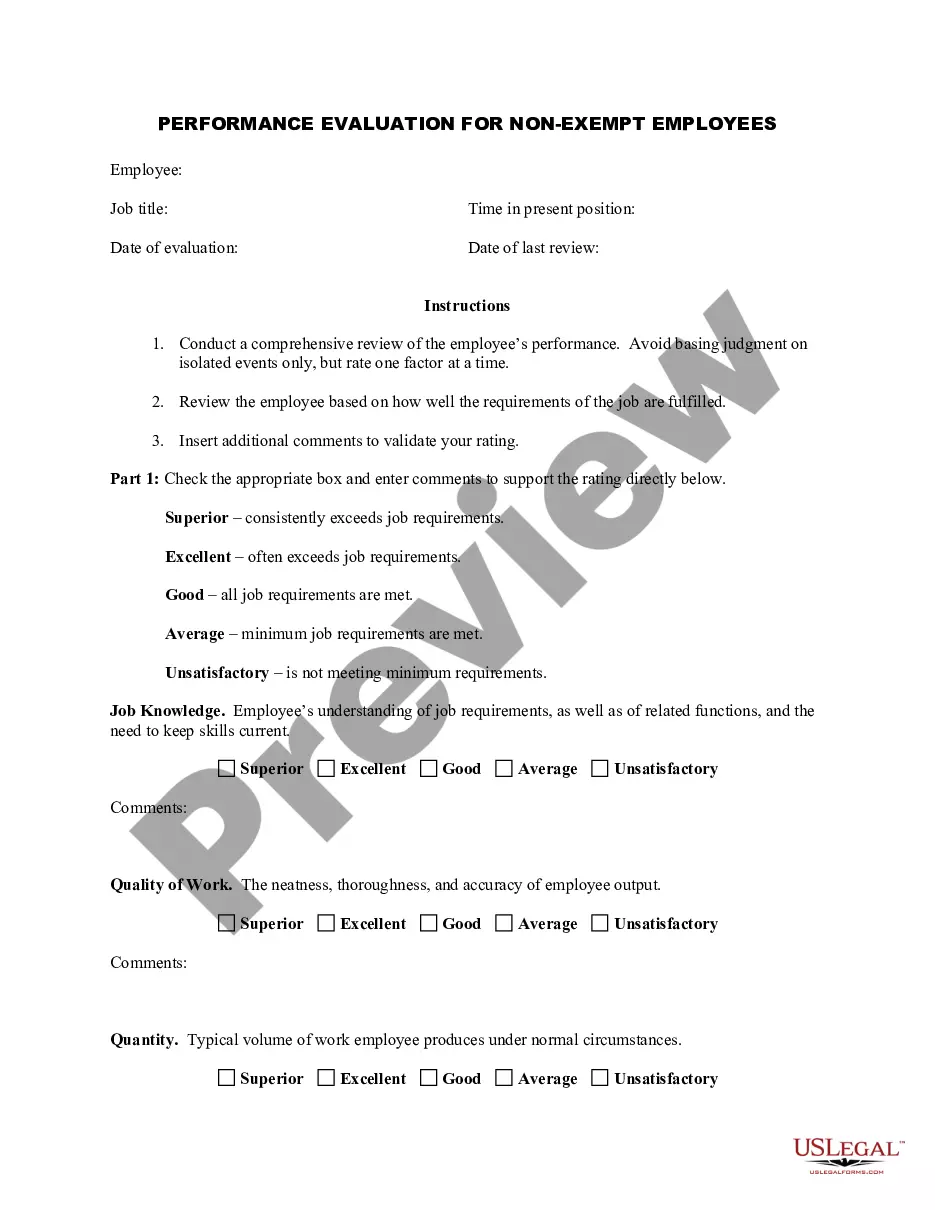

- Use the Preview button to review the document.

- Read the description to confirm that you have chosen the correct form.

- If the document is not what you are looking for, use the Search box to find a template that fits your needs and requirements.

- Once you find the appropriate template, click on Purchase now.

- Choose the pricing plan you want, fill in the required details to set up your account, and complete the purchase using PayPal or a credit card.

Form popularity

FAQ

Contract law in the British Islands is based on common law principles, providing clear guidelines for agreements and obligations. When establishing a Virgin Islands Revocable Trust for Minors, understanding these legal provisions is key to ensuring that the trust operates smoothly. Contracts are enforceable and must meet certain criteria to be valid, protecting both the trust and its beneficiaries. Consulting legal expertise can help you navigate these laws effectively.

The Islands Special Trusts Act provides a unique trust structure that allows for the management of family assets while protecting them from being transferred outside the family. This act is especially relevant when creating a Virgin Islands Revocable Trust for Minors, allowing for innovative solutions in wealth management. It enables family assets to be preserved and managed without the traditional concerns of beneficiary rights. Implementing this act can safeguard your family legacy.

The legal jurisdiction of the British Islands includes a well-established framework that governs trusts, property, and contracts. The British Virgin Islands operates under a common law system, providing a structured environment for trust creation, such as a Virgin Islands Revocable Trust for Minors. This jurisdiction offers legal stability and clarity, making it an attractive option for estate planning. When considering trusts, understanding the local laws is crucial.

A purpose trust in the BVI serves to fulfill a specific purpose, rather than just to benefit individual beneficiaries. It can be particularly useful for holding assets and ensuring they are used to meet a designated aim, such as educational funds for minors. When considering a Virgin Islands Revocable Trust for Minors, a purpose trust can align with educational or recreational objectives, providing a flexible option for managing assets. This structure can offer peace of mind in asset distribution.

A British Virgin Islands (BVI) trust can last for a significant period, often up to 120 years, depending on its specific terms. These trusts are flexible and can be tailored according to your needs, especially in a Virgin Islands Revocable Trust for Minors. This long duration allows for careful planning of wealth distribution to heirs while ensuring that the trust meets legal requirements. Utilizing a trust structure can effectively handle generational wealth.

A minor trust is designed to hold and manage assets for a child until they reach a specified age. In the context of a Virgin Islands Revocable Trust for Minors, the trust can provide benefits such as asset protection and controlled distribution. It allows the trustee to manage the assets responsibly while making sure the child's future needs are met. Establishing a trust ensures that the child's financial affairs are handled correctly.

Another downside to a revocable trust is the potential complexity involved in managing it. While a Virgin Islands Revocable Trust for Minors enables precise control, it requires ongoing management and can involve legal fees for its creation and administration. Additionally, if not set up correctly, it may fail to effectively guide asset distribution in the event of the grantor's death. Using resources like uslegalforms can simplify this process.

One downside of a revocable trust, including a Virgin Islands Revocable Trust for Minors, is that assets in the trust may be counted in relation to estate taxes or creditor claims. While it provides flexibility and control, the grantor retains ownership of the assets, meaning they do not enjoy the same level of protection as irrevocable trusts. It’s important to weigh these factors against your financial goals.

Yes, a minor can have a revocable trust, such as a Virgin Islands Revocable Trust for Minors. Establishing this trust allows parents to manage assets on behalf of their children until they reach the age of majority. The revocable nature of the trust gives parents the flexibility to modify or dissolve it as circumstances change. This adaptability is often beneficial in ensuring the trust effectively meets the child's needs.

A Virgin Islands Revocable Trust for Minors often proves to be the best option for protecting and managing assets. This type of trust allows parents to maintain control over the assets while providing for their children’s future needs. It can also be tailored to meet specific familial circumstances. Consulting with experts or platforms like uslegalforms can help you choose the best trust structure for your child.