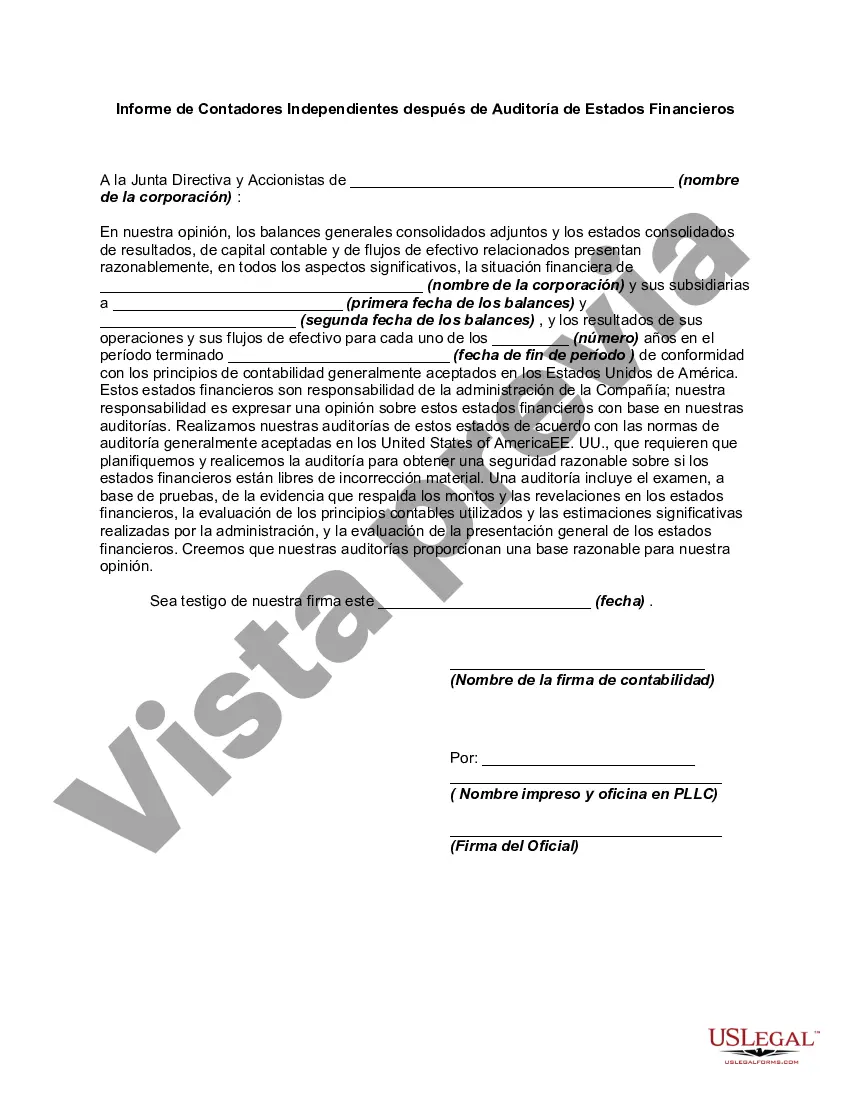

As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Virgin Islands Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides a comprehensive evaluation of the financial health and performance of an organization or entity based in the Virgin Islands. This report plays a vital role in ensuring transparency, accountability, and credibility in financial reporting. The Virgin Islands Report of Independent Accountants after Audit of Financial Statements is generally prepared by certified public accountants or auditing firms who perform an in-depth examination of the company's financial statements. These financial statements include the balance sheet, income statement, statement of cash flows, and statement of equity. The report begins with a detailed introduction, disclosing the purpose and scope of the audit. It explains that the independent accountants' responsibility is to express an opinion on the accuracy and fairness of the financial statements, as well as the compliance with applicable accounting principles and regulations. The first type of Virgin Islands Report of Independent Accountants after Audit of Financial Statements is the Unqualified Opinion. This type of report indicates that the financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) and that they present a true and fair view of the entity's financial position and performance. It provides assurance to stakeholders, such as investors, lenders, and governing bodies, that the financial statements are reliable and can be used for decision-making purposes. The second type of report is the Qualified Opinion. This opinion is given when the auditors encounter certain limitations or exceptions during the audit process, which may result in material misstatements or uncertainties in the financial statements. The auditors will disclose these limitations or exceptions in their report, providing an explanation for their qualified opinion. The third type is the Adverse Opinion, which is given when the auditors determine that the financial statements are materially misstated, misleading, or not in accordance with prescribed accounting principles. This opinion raises significant concerns and highlights potential financial risks or irregularities that stakeholders should carefully consider. Lastly, the Disclaimer of Opinion is the fourth type of report. This opinion is issued when the auditors are unable to express an opinion on the financial statements due to significant limitations or lack of sufficient evidence. It may occur when the entity's records or documentation are incomplete, or when the auditors are restricted from accessing necessary information. In conclusion, the Virgin Islands Report of Independent Accountants after Audit of Financial Statements is an essential tool for assessing the accuracy, reliability, and compliance of an organization's financial statements. The report provides different opinions based on the auditors' findings, namely Unqualified Opinion, Qualified Opinion, Adverse Opinion, and Disclaimer of Opinion. Stakeholders rely on this report to make informed decisions and gain confidence in the financial health of the entity.Virgin Islands Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides a comprehensive evaluation of the financial health and performance of an organization or entity based in the Virgin Islands. This report plays a vital role in ensuring transparency, accountability, and credibility in financial reporting. The Virgin Islands Report of Independent Accountants after Audit of Financial Statements is generally prepared by certified public accountants or auditing firms who perform an in-depth examination of the company's financial statements. These financial statements include the balance sheet, income statement, statement of cash flows, and statement of equity. The report begins with a detailed introduction, disclosing the purpose and scope of the audit. It explains that the independent accountants' responsibility is to express an opinion on the accuracy and fairness of the financial statements, as well as the compliance with applicable accounting principles and regulations. The first type of Virgin Islands Report of Independent Accountants after Audit of Financial Statements is the Unqualified Opinion. This type of report indicates that the financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) and that they present a true and fair view of the entity's financial position and performance. It provides assurance to stakeholders, such as investors, lenders, and governing bodies, that the financial statements are reliable and can be used for decision-making purposes. The second type of report is the Qualified Opinion. This opinion is given when the auditors encounter certain limitations or exceptions during the audit process, which may result in material misstatements or uncertainties in the financial statements. The auditors will disclose these limitations or exceptions in their report, providing an explanation for their qualified opinion. The third type is the Adverse Opinion, which is given when the auditors determine that the financial statements are materially misstated, misleading, or not in accordance with prescribed accounting principles. This opinion raises significant concerns and highlights potential financial risks or irregularities that stakeholders should carefully consider. Lastly, the Disclaimer of Opinion is the fourth type of report. This opinion is issued when the auditors are unable to express an opinion on the financial statements due to significant limitations or lack of sufficient evidence. It may occur when the entity's records or documentation are incomplete, or when the auditors are restricted from accessing necessary information. In conclusion, the Virgin Islands Report of Independent Accountants after Audit of Financial Statements is an essential tool for assessing the accuracy, reliability, and compliance of an organization's financial statements. The report provides different opinions based on the auditors' findings, namely Unqualified Opinion, Qualified Opinion, Adverse Opinion, and Disclaimer of Opinion. Stakeholders rely on this report to make informed decisions and gain confidence in the financial health of the entity.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.