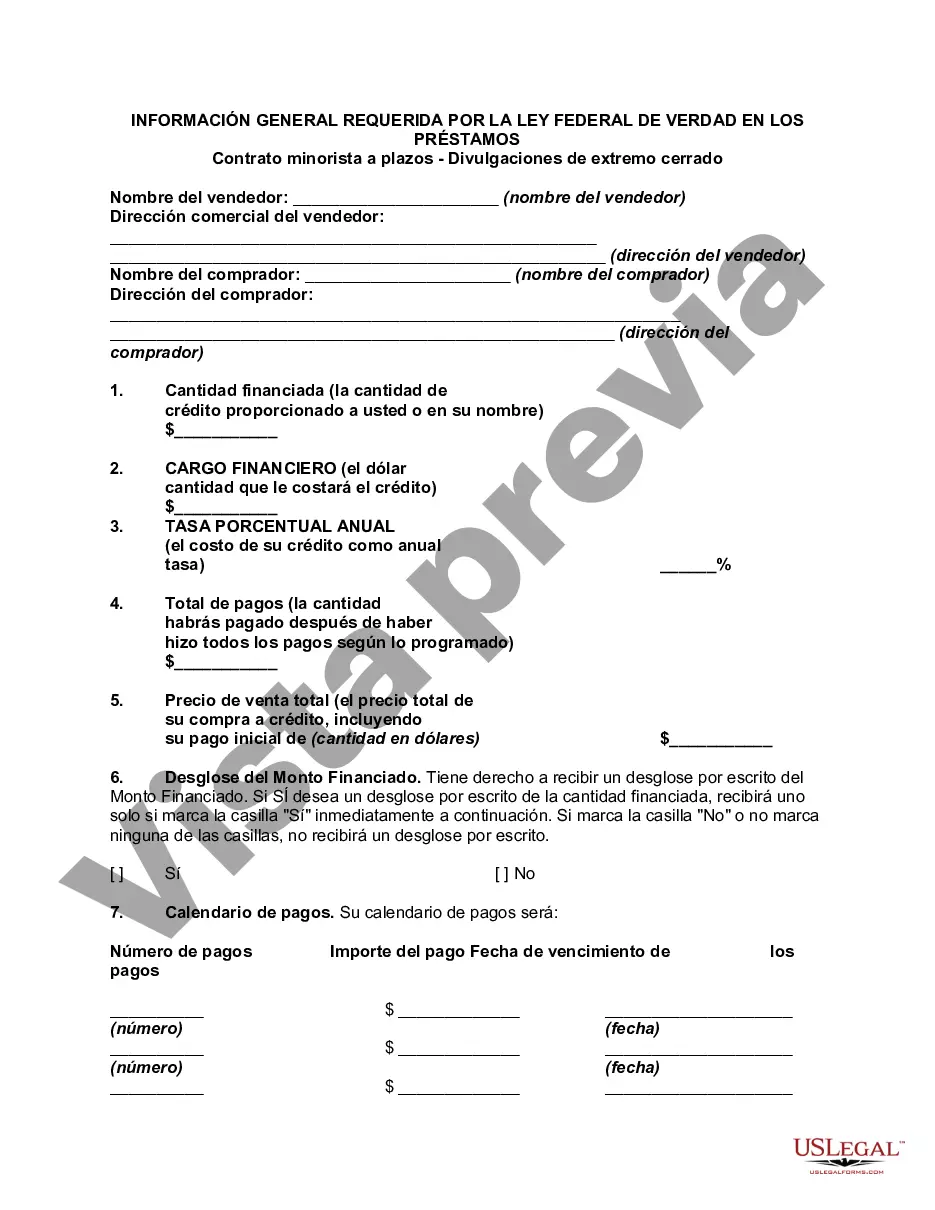

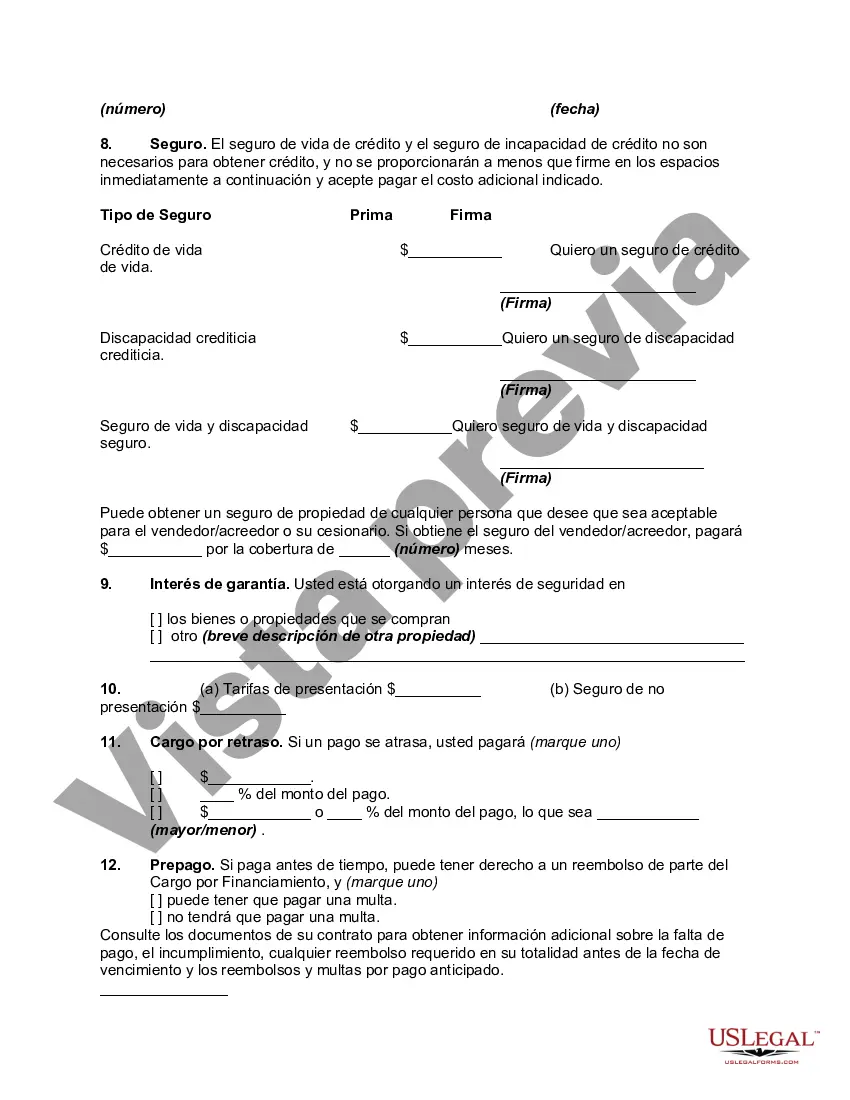

Title: Understanding Virgin Islands General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures Keywords: Virgin Islands, General Disclosures, Federal Truth In Lending Act, Retail Installment Contract, Closed End Disclosures Introduction: The Federal Truth in Lending Act (TILL) is a federal law that aims to protect consumers by ensuring they receive accurate information about the terms and costs of credit. In the Virgin Islands, TILL requires certain general disclosures to be included in retail installment contracts, specifically in closed-end transactions. Let's explore the details of these disclosures and understand their significance in protecting consumers' rights. 1. Annual Percentage Rate (APR): The APR is a crucial disclosure under TILL. It represents the true cost of credit as an annualized percentage, including both the interest rate and other finance charges. In the Virgin Islands retail installment contracts, the APR must be clearly provided to the consumer. 2. Finance Charge: The finance charge includes all costs associated with the loan, such as interest, service charges, and any other fees. These charges must be disclosed to the consumer in a concise and prominent manner to ensure transparency regarding the total cost of the credit. 3. Amount Financed: This disclosure refers to the total amount borrowed by the consumer. It excludes any prepaid finance charges or other costs financed as part of the loan. 4. Total Sale Price: The total sale price encompasses the amount financed plus the finance charges. It represents the sum total that the consumer will pay over the course of the loan. 5. Debt Cancellation or Suspension Agreement: In certain cases, a creditor may offer debt cancellation or suspension agreements to consumers. If such agreements are included in a retail installment contract, they must be disclosed to the consumer, along with any relevant fees or charges. 6. Payment Schedule: Consumers have the right to understand how payments will be structured and when they are due. The TILL requires the retail installment contract to include a clear payment schedule detailing the amount, frequency, and due date of each payment. 7. Prepayment Penalty Disclosure (if applicable): If a prepayment penalty is imposed by the creditor, it must be explicitly disclosed in the contract. However, it is important to note that prepayment penalties are generally not allowed in consumer loans. Conclusion: Understanding the general disclosures required by the Federal Truth in Lending Act is crucial for both consumers and creditors in the Virgin Islands. These disclosures ensure transparency, promote fair lending practices, and protect consumers from potential exploitation. By clearly communicating the terms and costs of credit, consumers can make informed decisions and lenders can maintain compliance with the law.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Virgin Islands Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

US Legal Forms - one of the most significant libraries of lawful forms in America - delivers a wide range of lawful document templates you are able to download or print out. While using website, you will get thousands of forms for enterprise and individual uses, sorted by groups, suggests, or search phrases.You will discover the newest versions of forms much like the Virgin Islands General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in seconds.

If you already possess a monthly subscription, log in and download Virgin Islands General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures through the US Legal Forms collection. The Acquire key can look on each type you view. You have access to all previously saved forms from the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed below are simple directions to get you started out:

- Make sure you have picked the correct type for your personal city/county. Click on the Review key to examine the form`s information. Look at the type information to actually have chosen the appropriate type.

- When the type does not fit your requirements, use the Lookup discipline towards the top of the monitor to discover the one who does.

- If you are happy with the shape, confirm your selection by visiting the Buy now key. Then, select the prices prepare you favor and give your credentials to sign up on an profile.

- Approach the purchase. Use your bank card or PayPal profile to accomplish the purchase.

- Choose the file format and download the shape on your gadget.

- Make adjustments. Complete, modify and print out and signal the saved Virgin Islands General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Each template you included with your account does not have an expiry time and is your own forever. So, if you want to download or print out an additional duplicate, just check out the My Forms section and click on on the type you require.

Obtain access to the Virgin Islands General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with US Legal Forms, one of the most considerable collection of lawful document templates. Use thousands of expert and status-specific templates that meet up with your company or individual requires and requirements.