Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Demand for Accounting from a Fiduciary: A Comprehensive Overview Introduction: The Virgin Islands Demand for Accounting from a Fiduciary is a legal action that can be initiated by interested parties seeking a transparent and accurate account of a fiduciary's financial activities. This demand ensures accountability and safeguards the best interests of beneficiaries or stakeholders involved. In the Virgin Islands, there are various types of demand for accounting that can be made, depending on the specific fiduciary relationship. This article aims to provide a detailed description of what constitutes a Virgin Islands Demand for Accounting from a Fiduciary, along with the different types that can arise. 1. Virgin Islands Demand for Accounting: — In the Virgin Islands, a Demand for Accounting refers to a legal request made by beneficiaries or stakeholders of a trust, estate, or any other fiduciary relationship, aiming to obtain a comprehensive and accurate report on financial transactions and management. — This demand ensures transparency, prevents mismanagement or fraud, and allows beneficiaries to assess their rights and interests. 2. Types of Virgin Islands Demand for Accounting: a. Demand for Accounting from a Trustee: — This type of demand can be filed against a trustee responsible for managing a trust. It includes seeking a detailed account of income, expenses, investments, distributions, and other financial activities. — Beneficiaries may invoke this demand when they suspect mismanagement, breach of fiduciary duties, or lack of transparency in trust administration. b. Demand for Accounting from an Executor or Personal Representative: — Executors or personal representatives are individuals responsible for managing and distributing assets of an estate after someone's death. — Beneficiaries can demand an accounting to ensure fair and honest handling of estate matters, including inventory of assets, payment of debts, disbursements, and other financial transactions related to estate administration. c. Demand for Accounting from a Guardian or Conservator: — In cases where an individual is unable to manage their own affairs due to age, disability, or incapacity, a guardian or conservator may be appointed by the court to protect their interests. — Interested parties, such as family members or concerned individuals, can demand an accounting from the guardian or conservator to ensure the responsible handling of the person's financial affairs, investments, and general well-being. d. Demand for Accounting from a Business Fiduciary: — In the context of partnerships, corporations, or other business entities, a fiduciary can be an individual or entity responsible for managing financial affairs on behalf of others. — Shareholders or stakeholders may demand an accounting to validate corporate transactions, identify conflicts of interest, or uncover potential financial mismanagement. Conclusion: A Virgin Islands Demand for Accounting from a Fiduciary is a crucial legal tool that empowers beneficiaries or interested parties to have transparent insight into a fiduciary's financial activities, ensuring accountability and safeguarding their best interests. The various types of demands concerning trusts, estates, guardianship, and business entities serve to uphold ethical practices and prevent financial abuse or mismanagement by fiduciaries.Virgin Islands Demand for Accounting from a Fiduciary: A Comprehensive Overview Introduction: The Virgin Islands Demand for Accounting from a Fiduciary is a legal action that can be initiated by interested parties seeking a transparent and accurate account of a fiduciary's financial activities. This demand ensures accountability and safeguards the best interests of beneficiaries or stakeholders involved. In the Virgin Islands, there are various types of demand for accounting that can be made, depending on the specific fiduciary relationship. This article aims to provide a detailed description of what constitutes a Virgin Islands Demand for Accounting from a Fiduciary, along with the different types that can arise. 1. Virgin Islands Demand for Accounting: — In the Virgin Islands, a Demand for Accounting refers to a legal request made by beneficiaries or stakeholders of a trust, estate, or any other fiduciary relationship, aiming to obtain a comprehensive and accurate report on financial transactions and management. — This demand ensures transparency, prevents mismanagement or fraud, and allows beneficiaries to assess their rights and interests. 2. Types of Virgin Islands Demand for Accounting: a. Demand for Accounting from a Trustee: — This type of demand can be filed against a trustee responsible for managing a trust. It includes seeking a detailed account of income, expenses, investments, distributions, and other financial activities. — Beneficiaries may invoke this demand when they suspect mismanagement, breach of fiduciary duties, or lack of transparency in trust administration. b. Demand for Accounting from an Executor or Personal Representative: — Executors or personal representatives are individuals responsible for managing and distributing assets of an estate after someone's death. — Beneficiaries can demand an accounting to ensure fair and honest handling of estate matters, including inventory of assets, payment of debts, disbursements, and other financial transactions related to estate administration. c. Demand for Accounting from a Guardian or Conservator: — In cases where an individual is unable to manage their own affairs due to age, disability, or incapacity, a guardian or conservator may be appointed by the court to protect their interests. — Interested parties, such as family members or concerned individuals, can demand an accounting from the guardian or conservator to ensure the responsible handling of the person's financial affairs, investments, and general well-being. d. Demand for Accounting from a Business Fiduciary: — In the context of partnerships, corporations, or other business entities, a fiduciary can be an individual or entity responsible for managing financial affairs on behalf of others. — Shareholders or stakeholders may demand an accounting to validate corporate transactions, identify conflicts of interest, or uncover potential financial mismanagement. Conclusion: A Virgin Islands Demand for Accounting from a Fiduciary is a crucial legal tool that empowers beneficiaries or interested parties to have transparent insight into a fiduciary's financial activities, ensuring accountability and safeguarding their best interests. The various types of demands concerning trusts, estates, guardianship, and business entities serve to uphold ethical practices and prevent financial abuse or mismanagement by fiduciaries.

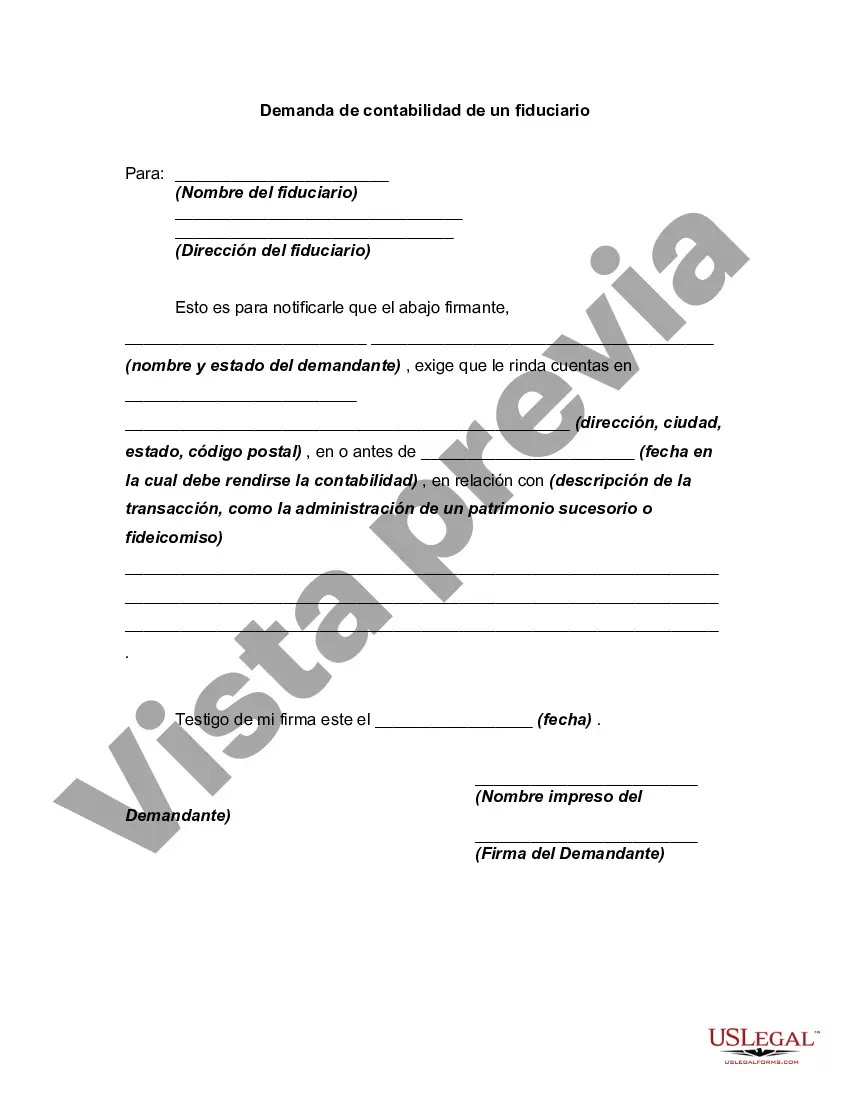

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.