Virgin Islands Sales Receipt: A Comprehensive Overview A sales receipt is an essential document in the retail industry that serves as proof of a transaction between a buyer and a seller. In the Virgin Islands, sales receipts play a crucial role in maintaining transparent business practices and ensuring accurate record-keeping. This article provides a detailed description of what a Virgin Islands Sales Receipt is, along with relevant keywords and an overview of different types of receipts. Keywords: Virgin Islands, Sales Receipt, Transaction, Retail, Proof, Buyer, Seller, Business Practices, Record-keeping. What is a Virgin Islands Sales Receipt? A Virgin Islands Sales Receipt is a legal document provided to a customer by a seller or business entity after a successful transaction. It serves as evidence of the purchase and includes crucial details such as the date of the transaction, the items or services purchased, their respective prices, any applicable taxes, and the total amount paid. This receipt is essential for both the buyer and seller, as it helps to maintain accurate financial records, assist in returns or exchanges, and provide proof of ownership. Types of Virgin Islands Sales Receipts: 1. Standard Sales Receipt: The standard sales receipt is commonly used for retail transactions where tangible goods are sold. It consists of relevant information, including the business name, address, contact details, and other required legal information such as the business license or permit number. 2. Service Sales Receipt: The service sales receipt is used when a business provides intangible services instead of selling physical goods. It includes information about the provided service(s), such as the nature of the service, the duration or quantity, the hourly or fixed rate, and any additional charges. 3. Online Sales Receipt: With the rise of e-commerce, online sales receipts have become increasingly common in the Virgin Islands. Online sales receipts are electronic documents generated after an online purchase. They contain all the necessary transaction details, including the customer's information, the product details, the payment method used, and any applicable taxes or shipping fees. 4. Point of Sale (POS) Receipt: POS receipts are generated through a point of sale system, typically used in brick-and-mortar stores. These receipts provide real-time information about the purchased items, prices, discounts, payment method, and any loyalty rewards or promotions. POS receipts are usually printed on thermal paper using a dedicated receipt printer. 5. Nonprofit Sales Receipt: Applicable to registered nonprofit organizations or charities based in the Virgin Islands, the nonprofit sales receipt fulfills the same purpose as a regular sales receipt. It confirms donations or sales made to support the organization's cause, including any tax-exempt status if applicable. In conclusion, a Virgin Islands Sales Receipt is a crucial document used to maintain transparency, record financial transactions, and provide proof of purchasing goods or services. Different types of receipts cater to various businesses and transaction types, such as standard receipts, service receipts, online receipts, POS receipts, and nonprofit receipts. Ensuring accurate and organized record-keeping through sales receipts contributes to efficient business operations and compliance with taxation laws in the Virgin Islands.

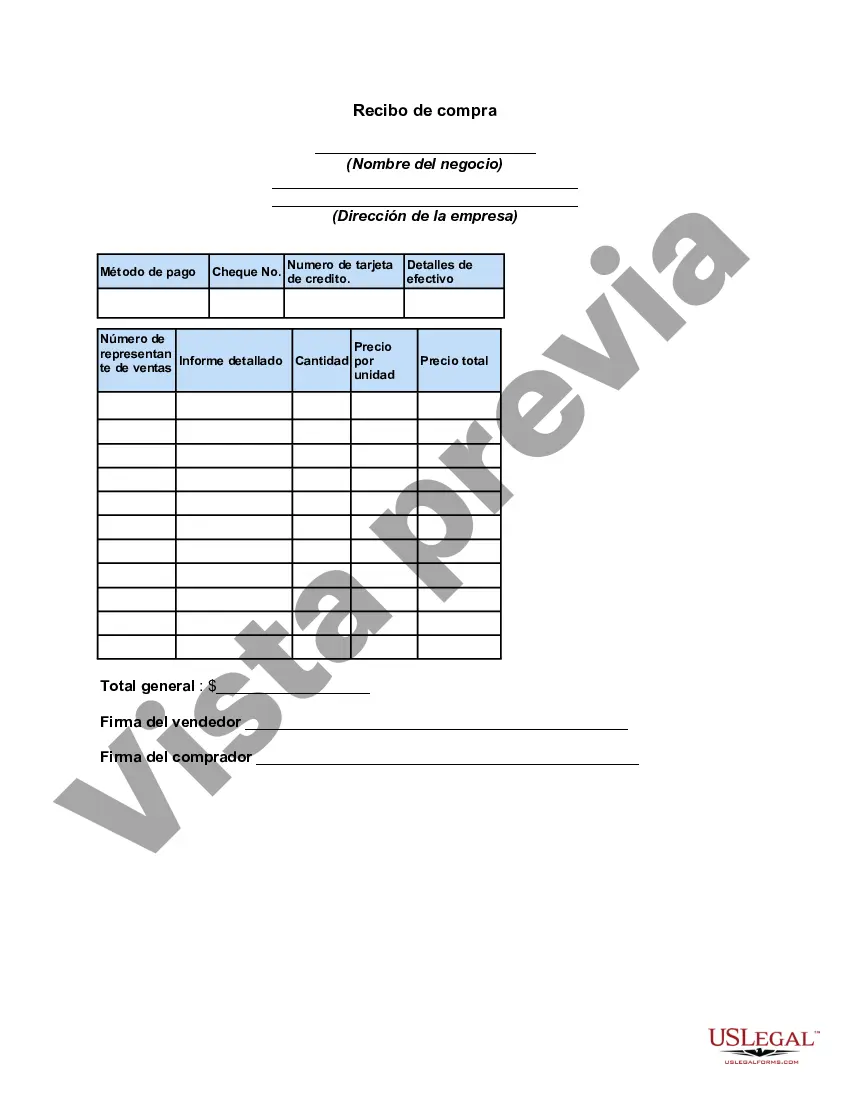

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Recibo de compra - Sales Receipt

Description

How to fill out Virgin Islands Recibo De Compra?

You can commit hours on the web searching for the lawful document design that meets the federal and state demands you want. US Legal Forms gives thousands of lawful kinds which are analyzed by pros. You can actually obtain or printing the Virgin Islands Sales Receipt from my services.

If you already possess a US Legal Forms accounts, you can log in and click on the Acquire option. Afterward, you can complete, revise, printing, or signal the Virgin Islands Sales Receipt. Each and every lawful document design you get is your own eternally. To obtain yet another copy associated with a acquired develop, visit the My Forms tab and click on the related option.

If you work with the US Legal Forms internet site initially, follow the simple recommendations under:

- Initial, make sure that you have selected the correct document design for your area/city of your choice. Look at the develop information to ensure you have selected the appropriate develop. If offered, use the Preview option to look with the document design as well.

- In order to get yet another model of your develop, use the Research field to get the design that suits you and demands.

- After you have located the design you want, click on Get now to carry on.

- Choose the pricing program you want, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal accounts to cover the lawful develop.

- Choose the format of your document and obtain it in your product.

- Make changes in your document if necessary. You can complete, revise and signal and printing Virgin Islands Sales Receipt.

Acquire and printing thousands of document templates making use of the US Legal Forms Internet site, which provides the largest variety of lawful kinds. Use expert and status-particular templates to deal with your company or specific demands.