Title: Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default — Detailed Description with Relevant Keywords Introduction: A Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal document issued by a creditor when a debtor fails to repay a loan or fulfill other obligations. This notice serves as an announcement to the public regarding the upcoming public sale of the debtor's collateral (consumer goods) to recover the outstanding debt. Multiple types of Virgin Islands Notices of Public Sale of Collateral (Consumer Goods) on Default may exist based on the nature of the loan or agreement. This comprehensive description provides insights into the process, purpose, and implications of these notices. Key Takeaways: — Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal notice issued to recover outstanding debts. — The notice alerts the public of an upcoming public sale for the debtor's consumer goods. — Different types of notices may be issued based on specific loan agreements. Types of Virgin Islands Notices of Public Sale of Collateral (Consumer Goods) on Default: 1. Vehicle Collateral Notice: If a debtor defaults on an auto loan or lease agreement, the creditor may issue a Virgin Islands Notice of Public Sale of Vehicle Collateral. This notice informs the public about the impending sale of the debtor's vehicle to recover the outstanding debt. 2. Electronics Collateral Notice: In cases where a debtor defaults on a loan related to consumer electronics, such as smartphones, laptops, or home appliances, the creditor issues a Virgin Islands Notice of Public Sale of Electronics Collateral. This notice ensures that the public is aware of the upcoming sale of these consumer goods to recuperate the unpaid debt. 3. Furniture and Household Goods Collateral Notice: If a debtor fails to repay a loan secured by furniture or household goods, the creditor will release a Virgin Islands Notice of Public Sale of Furniture and Household Goods Collateral. This notice discloses the intention to sell the debtor's furniture or household goods to fulfill the outstanding obligation. 4. Jewelry Collateral Notice: For loans backed by valuable jewelry items, the creditor issues a Virgin Islands Notice of Public Sale of Jewelry Collateral when the debtor defaults. This notice publicizes the upcoming sale of the jewelry in order to recover the unpaid debt. Process and Implications: — Once the creditor issues the Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default, it must be published in a local newspaper for a specific period, usually 30 days, prior to the sale. — The notice includes details about the debtor, the nature of the debt, the description of the collateral, and the date, time, and location of the public sale. — Interested buyers can attend the sale, bid on the collateral, and the highest bidder typically acquires ownership of the goods. — The funds generated from the sale are then used to satisfy the outstanding debt, with any excess being returned to the debtor if applicable. — In case the sale proceeds do not cover the entire debt, the creditor may pursue further legal actions to recover the remaining amount. Conclusion: A Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default is an essential legal notice that allows creditors to recover outstanding debts by selling a debtor's collateral. Different types of notices exist, depending on the nature of the consumer goods securing the loan. Debtors who receive such a notice should carefully review the documentation, understand the implications, and seek legal advice if necessary to protect their interests.

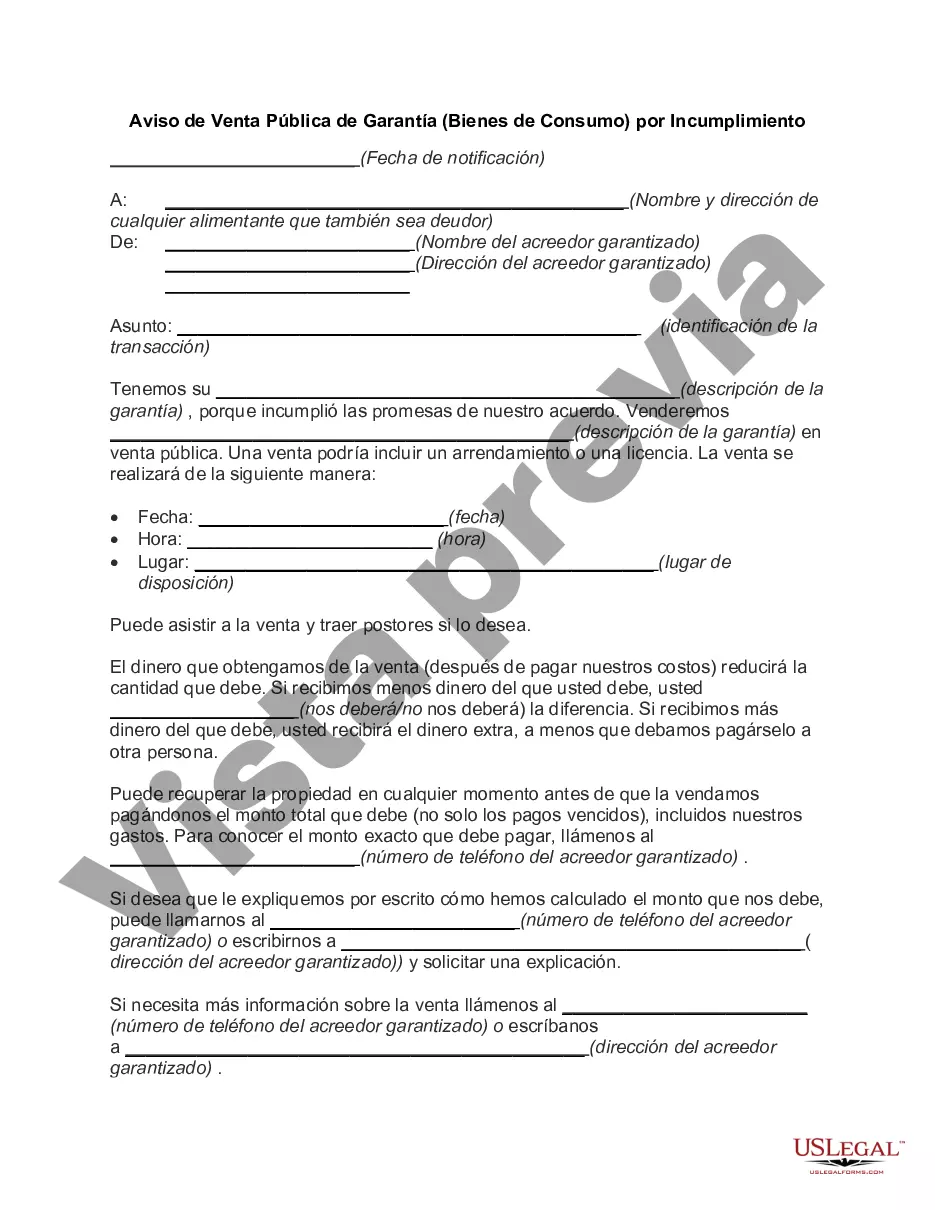

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Virgin Islands Aviso de Venta Pública de Garantía (Bienes de Consumo) por Incumplimiento - Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

How to fill out Virgin Islands Aviso De Venta Pública De Garantía (Bienes De Consumo) Por Incumplimiento?

You may commit hrs on the Internet attempting to find the authorized document web template that meets the federal and state requirements you want. US Legal Forms gives a huge number of authorized kinds that are evaluated by professionals. You can easily down load or printing the Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default from our services.

If you already have a US Legal Forms profile, you may log in and then click the Acquire option. Afterward, you may total, modify, printing, or sign the Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default. Every single authorized document web template you acquire is the one you have for a long time. To acquire an additional copy of any bought form, check out the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms web site initially, adhere to the easy guidelines under:

- Initial, make sure that you have selected the best document web template for your region/metropolis of your choice. Look at the form information to make sure you have selected the proper form. If offered, utilize the Preview option to check through the document web template too.

- If you would like find an additional variation of your form, utilize the Research industry to obtain the web template that meets your needs and requirements.

- Upon having found the web template you want, click on Acquire now to move forward.

- Select the costs prepare you want, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can utilize your Visa or Mastercard or PayPal profile to fund the authorized form.

- Select the structure of your document and down load it to your device.

- Make modifications to your document if needed. You may total, modify and sign and printing Virgin Islands Notice of Public Sale of Collateral (Consumer Goods) on Default.

Acquire and printing a huge number of document web templates while using US Legal Forms website, that offers the largest collection of authorized kinds. Use professional and status-distinct web templates to handle your business or individual needs.